Machine building sector in Ukraine is facing a difficult situation. Recent research showed that machine building is most heavily exposed to the Russian market in terms of the percentage of output exported to Russia. Apart from the fact that a large share of machine building facilities are located in the eastern oblasts of Ukraine, currently subject to political and military turmoil, there exists a pronounced risk that access to the Russian export market may be lost in future due to political decisions of Russia.

Beyond its aggregate economic significance and exposure to risks from the Russian market, the machine building sector of Ukraine is composed of different subsectors such as the car or aircraft building industry. These subsectors differ in terms of their size, productivity and exposure to the Russian market. As policy measures must respond to individual problem constellations, we first provide a more detailed overview of the machine building sector and its subsectors.

The machine building sector: aggregate view

The machine building sector is one of the largest sectors within Ukrainian manufacturing. In 2012, Gross Value Added (GVA) in machine building (or mechanical engineering) was USD 5.5 bn or UAH 44.6 bn, representing 3.5% of total GVA and 25% of GVA in manufacturing. Although this number may seem relatively small, one should bear in mind that the total importance of this sector for the GDP of Ukraine is still larger, as the sector utilises goods and services produced in other sectors of the Ukrainian economy. According to Ukrstat, total output of the sector amounted to USD 19.4 bn in 2012. Total employment in the sector was 585000 people (5.5% of the total labour force) in 2012.

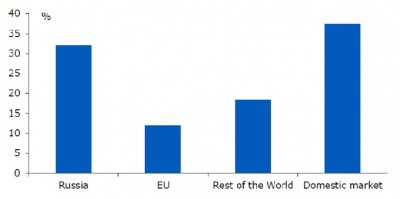

The exposure of the machine building sector to the Russian market and thus to the risk of losing market access is the highest among all industry sectors in Ukraine. In 2012, 32% of total output of the machine building sector was exported to Russia (see Figure 1).

Figure 1. Destinations of output of the Ukrainian machine building sector, 2012

Source: State Statistics Service of Ukraine, own calculations

Source: State Statistics Service of Ukraine, own calculations

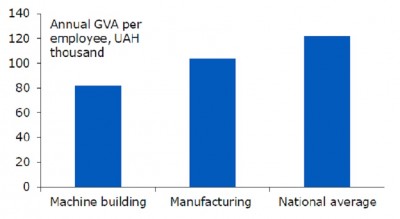

Apart from absolute size, the economic value of a sector to a country is determined by its ability to generate wealth. In a static view, this is best captured by the concept of (labour) productivity, the ratio of GVA to employees.

It is striking to see that the productivity of the machine building sector and indeed even of the next higher category, manufacturing, in Ukraine are below the national average and at very low rates. We find that, at roughly 82000 UAH per employee, productivity in machine building in 2012 was only 79% of productivity in manufacturing (103700 UAH per employee) and 67% of national average productivity (121700 UAH per employee). See Figure 2.

Figure 2. Comparing machine building productivity (annual GVA per employee, UAH thousand) to manufacturing and national averages

Source: State Statistics Service of Ukraine, own calculations

Source: State Statistics Service of Ukraine, own calculations

Size of the subsectors of machine building

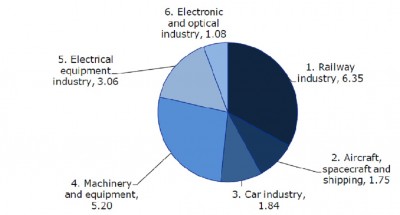

The Ukrainian machine building sector is composed of several subsectors, which constitute individual branches of industry, such as the car or aircraft industry. Six subsectors can be identified in official data, which we number for convenience.

1. Railway industry

2. Aircraft, spacecraft and shipping

3. Car industry

4. Machinery and equipment

5. Electrical equipment industry

6. Electronic and optical industry

To get an impression of the size of these six subsectors, we compare output volumes, for which more fine-grained data exists than for GVA (see Figure 3). One fact stands out: Subsectors 1-3, the transport-related industries together accounted for USD 10 bn of output, around 52% of total machine building output in 2012. The transport industry should be counted as one of the key strengths of Ukrainian machine building.

Figure 3. Output of the subsectors of machine building in Ukraine, USD bn, 2012

Source: State Statistics Service of Ukraine, own calculations

Source: State Statistics Service of Ukraine, own calculations

Exposure of the subsectors to the Russian market

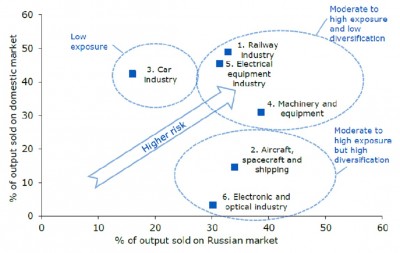

Due to the possibility of the loss of access to the Russian market, the vulnerability of the individual subsectors of machine building to this is of key importance for devising appropriate policy responses.

Most subsectors export around 30% of their total output to Russia, with subsector 4, machinery and equipment, exporting almost 39% of its output to Russia. The only notable exception is subsector 3, the car industry. The fact that only 17% of the output of the Ukrainian car industry is exported to Russia probably reflects that (final consumer-driven) demand for cars has significantly changed since the Soviet era, in which Ukrainian cars were popular throughout the Warsaw Pact countries. Russian demand has probably shifted towards Western European or Asian cars (often produced in factories within Russia set up by the makers). Ukrainian suppliers have apparently not become important parts of supply chains for car production in Russia.

As the two main indicators for the vulnerability of a subsector to the possibility of a loss of market access in Russia are the immediate exposure to the Russian market and the lack of market shares in other export markets, we can illustrate the vulnerability of subsectors by plotting them in a graph that measures exposure to the Russian market on the horizontal axis and lack of other export markets (measured as the share of output sold on the domestic market) on the vertical axis (see Figure 4).

Figure 4. Exposure to the Russian market and output share sold on the domestic market

Source: State Statistics Service of Ukraine, UN COMTRADE, own calculations

Source: State Statistics Service of Ukraine, UN COMTRADE, own calculations

The vulnerability of subsectors in the top right hand corner of this graph is the largest. These industries are highly exposed to the Russian market and lack significant market shares in other export markets that may be able to absorb some extra output. The three most vulnerable industries are therefore the railway, electrical equipment and machinery and equipment industries. These are also the biggest subsectors in terms of output in 2012, together accounting for USD 14.6 bn in output, 75% of total machine building output.

Risks of trade disruptions due to Russian policy

The large exposure of the Ukrainian machine building sector renders it vulnerable to shocks stemming from the Russian market. Apart from generally low growth of the Russian economy, which is expected to stagnate in 2014 and grow only 1% in 2015 after growth rates between 3% and 8% in previous years, there exists a risk that due to the political tensions, market access for Ukrainian companies may be severely restricted or even completely cut.

A complete loss of the machine building exports to Russia would directly reduce Ukrainian GDP by 1.1% compared to the baseline of 2012. No forecast can be made on whether Russia will implement such sanctions and for how long they would last.

Recommendations for short term policy measures

As the effects of the modernisation strategy cannot be expected to come about in the short run, policy action is required to preserve economic substance and potential.

1. Government-supported short-term work schemes. The instrument of government support to short-term work schemes has been highly popular and successful in the economic crisis that started in 2008. In light of the experiences from the use in previous years, the instrument should be updated to improve usability, reduce the potential for abuse of the instrument and streamline administrative procedures. Also, it should be considered to increase the maximum duration over the present 180 days to allow for longer transition phases. However, this should be done under consideration of the financial capability of Ukraine.

2. Public procurement schemes. Public procurement schemes serve a double goal: Improve the capacity or efficiency of the public body that receives the good and stabilise demand for the supplier of the good. Only where a real need for the goods exists should procurement schemes be set up, as regular tenders with a clear competitive element. This is to ensure an efficient use of public funds and competitive incentives for companies.

3. Increasing openness to FDI and joint ventures. Investments in capital and technology will be one key ingredient of improving the competitiveness of the machine building sector of Ukraine. As the financial market situation in Ukraine is highly problematic, FDI attraction will play a vital role in ensuring that the required investments are made. The process of increasing openness to FDI and joint ventures should also include a revision of the list of companies of “strategic importance” to Ukraine. This status prohibits the financial involvement of foreign investors in companies of “strategic importance”. A revision should ensure that all other measures to protect vital interests (such as legal safeguarding of intellectual property) are exhausted before employing this blunt instrument. An excessively broad definition of “strategic interests” should be avoided in order to prevent significantly negative economic effects to be suffered for uncertain political benefits.

Article by David Saha (German Advisory Group), Ricardo Giucci (German Advisory Group), Dmytro Naumenko (Institute for Economic Research and Policy Consulting – Kiev).

No comments

Be the first one to leave a comment.