In Spain it will be hot after the summer. Judgment day will be on September 12. Did you sell grandfather’s gold teeth in Italy? We are treating depression by delivering news about bad situation our neighbours are in.

The heat is slowing down the pace of society, but if you think it will slow down the pace of the crisis in the Eurozone, you’d better check if you don’t have sunstroke. Even though the news titles didn’t give much food for thought this week, we won’t devote this issue of Fiat Euro! to Slovak popstars.

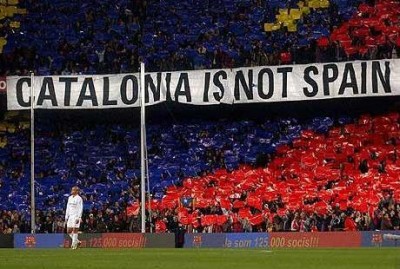

Spanish regions Valencia, Catalonia and Murcia one shortly after another asked for aid from the Spanish government. Catalonia, which produces a quarter of Spanish GDP and has to pay back EUR 13.5 billion of its debt, is asking for 5 billion from the government, but warned that it won’t accept any „political conditions“, i.e. cuts and savings. Valencia wants 4.5 billion and Murcia 700 million. What will say the Spanish government, which is trying to find any spare cent in the budget, remains to be seen. However, the bigger question is what the government will do when the next regions will have their turn. They have all together a debt of 145 billion, while in 2008 it was only a half of it. Perhaps they didn’t notice the crisis. Yields on Spanish bonds have been already for four months above the border of 6%. So what remains is either bailout or ECB.

Spanish banking sector is not doing any better, despite the guaranteed 100 billion help (just to remind you, a billion comes from Slovakia). Outflow of deposits from the Spanish banks reached record EUR 74 billion in July, which means a deposit decrease of 4.7%.

We don’t know yet if ECB will decide to purchase junk bonds from Spain and Italy with newly printed euros at the meeting in September. Mario Draghi is for it, he says to protect from irrational fears, non-standard solutions are needed. He even prepared an essay on the topic, full of peace-building and brighter tomorrows. Hollande is of course for it as well, a colleague from Bank of England also came to help. In this game of chess Germans are the opponents. President of the Bundesbanka Jens Weidmann compares financing countries through ECB to addiction to drugs. He already considered resigning because of this a couple of times, but the government managed every time to convince him to stay. These are not empty threats, it was proven by the example of his predecessor Axel Weber and German representative in the ECB Council Jurgen Stark, who both resigned due to persistent violation of the mandate of the ECB. Merkel’s advisor Lars Feld is more conciliatory; according to him ECB should purchase bonds, but piece by piece. Unfortunately the saying „both the wolves have eaten much and the sheep have not been touched“ can’t be applied to the Eurozone.

Finns would like such solution as well. Prime Minister Jyrki Katainen claims that they want to help, but as far as possible in a way not to increase common liabilities. Finns have respected the rule of 3% deficit for 16 years and they are the only Aaa state in the Eurozone, which maintained stable outlook according to Moody’s. It is very difficult to sell bailout mechanisms for the less responsible governments of the other countries to Finnish public opinion.

Bond purchasing program remains unclear, but the project of banking union, in which healthier Slovak banks would pay for the wrong steps of the banks in Spain or France, is progressing. On September 12 a detailed plan for European banking supervision is supposed to be ready. Mother ECB will have supervision over all the children in the Eurozone – and even some of those outside the Eurozone.

You should mark this date in the calendar. On this exact day German Constitutional Court is supposed to rule on the constitutionality of the permanent bailout mechanism. Shocking rule is not expected, but let’s not be surprised.

At regular intervals the legends about mythical saviour somewhere from far-away China, who will come and buy sovereign bonds of the white man, appear. Prime Minister Wen already mentioned many times that the Chinese are ready to help, but he would like to make the wolf a vegetarian, so they would like to buy a debt, but under certain conditions, which would lower its risk.

Not only money flows out of the troubled countries. If you are on holidays in Italy you probably noticed one of the 28 000 pawn shops titled “Compro Oro”. “Buing gold” business is experiencing real boom, when affected citizens are selling family jewels and even gold teeth. Majority of them are melted and then go to safes. Italian export of gold to Switzerland increased by 65%.

Not only money flows out of the troubled countries. If you are on holidays in Italy you probably noticed one of the 28 000 pawn shops titled “Compro Oro”. “Buing gold” business is experiencing real boom, when affected citizens are selling family jewels and even gold teeth. Majority of them are melted and then go to safes. Italian export of gold to Switzerland increased by 65%.

Not to envy our overseas friends too much, some bad news also from them. In the last couple of years China used $29 billion to support 35 new companies in the Australian mining sector. But today prices of iron reached record minimum and miners find it more and more difficult to get new loans from overblown Australian banks.

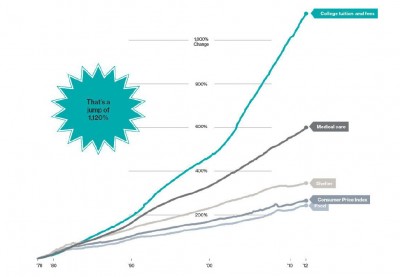

Some chatter about a new bubble emerged also in the USA. State-run scheme of federal student loans led to what a flood of cheap money causes – inflation. Tuition in American colleges has increased since 1978 by 1120%, far more than the costs of housing or health care. Total volume of the loans is approaching one trillion dollars and the delinquency rate reached 9%.

Positive ending? Neither Neil nor Lance Armstrong provide cheerful atmosphere at the moment, so let’s try with Louis.

371 Comments

Thanks for the sensible critique. Me & my neighbor were just preparing to do a little research about this. We got a grab a book from our area library but I think I learned more clear from this post. I am very glad to see such wonderful info being shared freely out there. edckbgcgcdak