Are there the first signs of banks‘ restructuring? Will Netherlands lose its AAA rating? Spain won a battle, but the war is not over yet. Sarko once again wants to reach for the treasure buried in ECB, Argentina is nationalizing, Italians are burning paintings, and ECB officials are afraid of inflation.

Following Germany, also Ireland will determine the constitutionality of the „fiscal pact“ and the new European Stabilization Mechanism. They were challenged by the Irish MP Thomas Pringle. According to polls on the Irish referendum concerning fiscal part that is to be held on May 31, 30% of the voters would vote in favour, 23% against and as many as 39% are undecided.

International Monetary Fund issued a report on global financial stability in which it warns that within following 18 months European banks might shrink their balance sheets by EUR 2 trillion (7% of their assets). According to IMF, it would lead to a decline in available credit for the economy by 1.7%. José Viñals, Financial Counsellor and Director of the IMF’s Monetary and Capital Markets Department thinks that “restructuring is crucial” and banks which are not “viable” should be closed down. Finally, there are voices heard calling for restructuring of insolvent banks, which have been untouchable. After two years of alleged „liquidity crisis“, it’s definitely high time. However, there is not much hope for quick and dynamic clearance of the banking sector , since there are still not many voices like this.

Even the core is not what it used to be. Rating agency Fitch issued a warning that Netherlands might lose its AAA rating if it doesn’t implement austerity measures to its budget. Dutch government in search of savings proposed cuts reaching EUR 10 billion from its contributions to the European Globalization Fund, which caused criticism from the European Commission President Jose Barroso: „ “I honestly don’t understand how it’s possible at this very difficult time for Europe that governments argue in favour of spending cuts in European programmes”..“ According to him Europe lacks solidarity. Dutch academics Harrie Verbon and David Hollanders see the essence of Dutch problems in a slightly different way: „cuts in public finances are a false solution. Netherlands guarantees debts of billions of euro for the Southern Europe…and this is the crucial problem“.

Spain’s auction of 10-year bonds, which was an important test for the mood on the markets, went quite smoothly on Thursday. Although revenues did go up slightly, the demand still exceeded the required volume of EUR 2.5 billion. So put your wallets back in your pockets, no bailout for Spain is needed yet. Mr. Euro – Jean Claude Juncker keeps convincing the world that it won’t happen: „I would like to invite financial markets to behave in a rational way. I don’t think Spain will need any kind of external support.“ he said. He is probably lying again.

http://www.youtube.com/watch?v=fxrd_jZJxkg

Spanish deposits guarantee fund doesn’t have enough resources and Spanish government doesn’t want to contribute any money as it keeps fighting the budget deficit. Authorities came to rescue with a creative solution. The banks themselves are going to lend the fund EUR 24 billion, with their individual contributions according to their market share. So the banks are lending the guarantee fund money for bailing out themselves. It is a beautiful illustration of the financial alchemy and magic realism, which the rescue mechanisms in the European crisis are based on.

Remember the European officials talking about the need for having an „independent“ European rating agency, which would pose a competition for the American Big Three? Roland Berger consultancy, responsible for setting up such agency, has problems with lack of investors’ interest to provide the resources for the project (EUR 300 billion). It seems that fulfilment of the European officials‘ dream has to be put off.

American banks, which were allegedly „too big to fail“, are even bigger today than before the crisis, also thanks to the aid financed by the taxpayers.

Recently mentioned Argentina, which is using monetary policy for fiscal aims and fights against inflation by putting economists in jail, announced that it will nationalize oil and gas company YPF, privatized by Spanish company Repsol in the year 1999. The European Commission has refused to take any retaliatory actions against Argentina so far.

Every time when presidential elections are coming, Nicolas Sarkozy pulls out his favourite topic – a redefinition of ECB tasks and use of euro’s depreciation as a way to boost economic growth. He promised to take such a step before the elections in May 2007 and he promises using ECB for supporting the growth also today. He wants to re-define tasks of the central banks in the Maastricht Treaty. „If the central bank doesn’t support the growth, there won’t be enough of it.“ This way he violated the agreement with German Chancellor Angela Merkel in which it was agreed that the role of ECB won’t be a subject of his presidential campaign. The campaign is already very tough, Sarko almost appeared in it with alost his watch which cost EUR 55 000.

http://www.youtube.com/watch?feature=player_embedded&v=yJ1AXNpYnc8

The employees of the European Central Bank demand their pensions to be linked to inflation. Do they want to secure themselves against their own failure or they just don’t believe in ability to fulfil their role – to ensure price stabilization in the EU?

Italy postpones its plan to balance the budget from the year 2013 to the year 2014. Italian art museum started burning paintings in protest against the budget cuts. First one was already burnt, and they plan to burn next three paintings following week. Wouldn’t it be better to sell these paintings? I don’t want to even imagine what will happen when the Italian drama starts protesting.

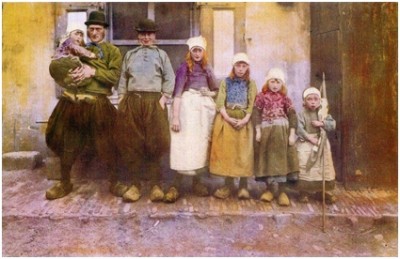

Have a picturesque weekend

Juraj Karpiš

46,178 Comments

Thanks for your post on the vacation industry. I will also like contribute that if you are one senior contemplating traveling, its absolutely vital that you buy traveling insurance for golden-agers. When traveling, senior citizens are at greatest risk of experiencing a health-related emergency. Obtaining right insurance policy package for the age group can protect your health and provide you with peace of mind.