Since the start of the war in Ukraine, the prices of energy sources have taken a central place in the dialogue surrounding economic policy in many European countries. The growing energy costs play an important role for the increase of the overall consumer price indices during the last couple months and threatens a maintenance of high inflation rates during the entire 2022.

For this reason, politicians focused their efforts on trying to compensate the households for the increasing prices of fuels. It is worthwhile to study the present condition of the prices of fuels after taking into account the condition of the household budgets in various parts of the EU. This can actually suggest whether there is a real need for an intervention in that field, and how big it should be.

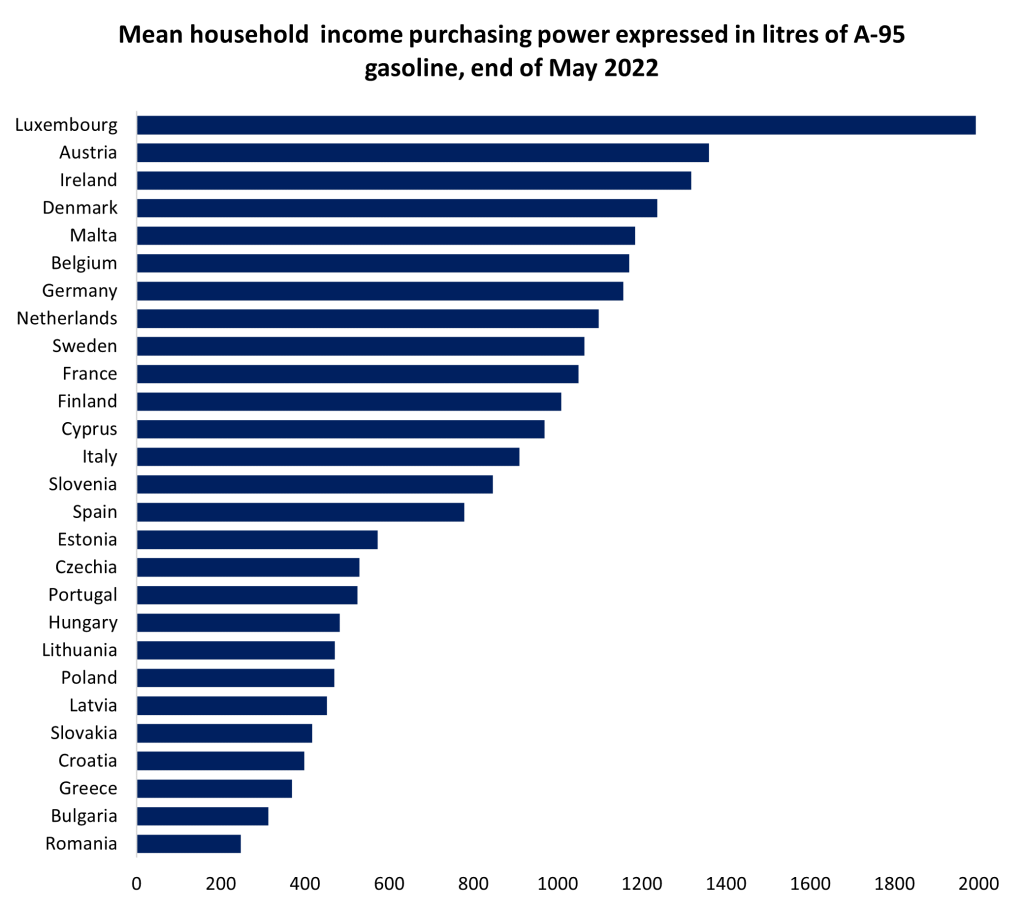

We compare the prices of the widely used A-95 petrol in the EU countries, delivered by the European Commission (EC) in the beginning of the fourth week of May 2022. We’ll also use the latest accessible data for the mean household income per individual. Combining the two indicators allows us to identify the purchasing power of incomes in different households expressed by the amount of fuel they can afford to buy in each country (assuming, of course that in this case we assume all household expenditures goes for fuel).

Source: Eurostat, European commission, authors’ calculations

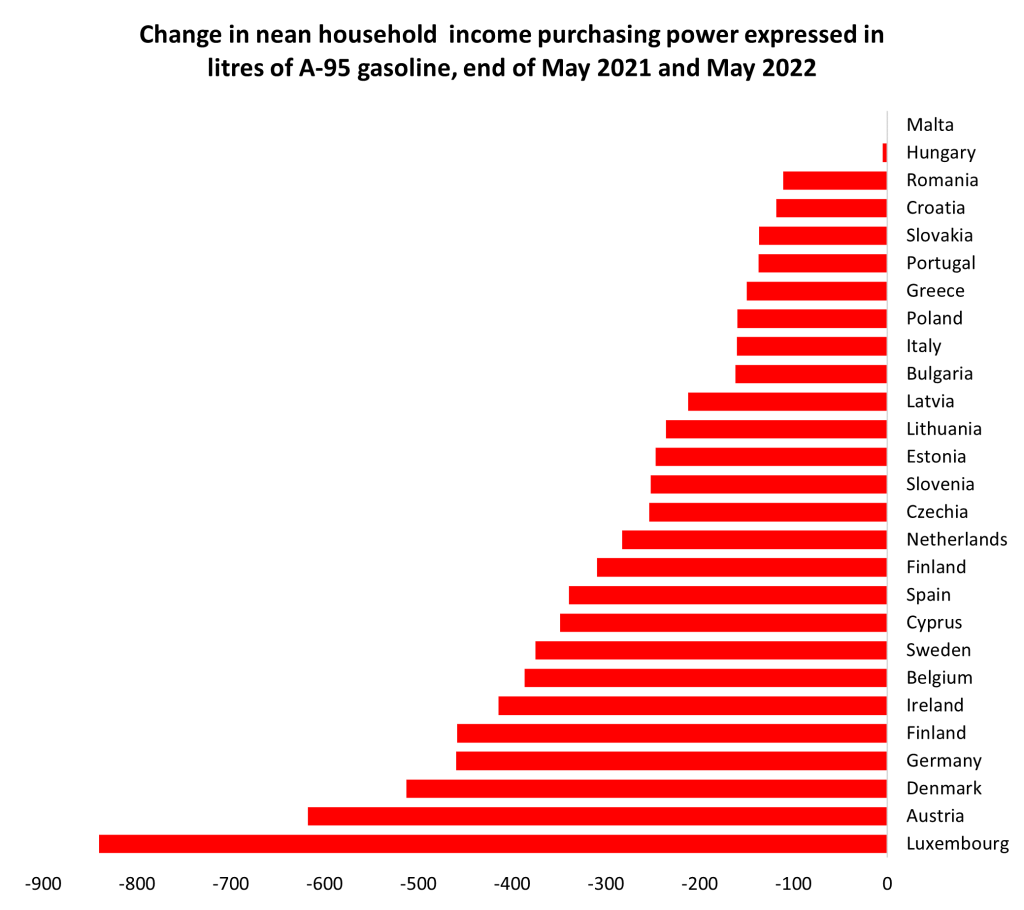

Source: Eurostat, European commission, authors’ calculations

The differences between the quantity of fuel which households can afford using the income of one member by the end of May 2022 are significant- from just 248 liters in Romania, all the way up to 1993 liters in Luxembourg, and in Bulgaria on average the volume is 313 liters.

In the upper part of the ranking are countries like Austria and Ireland, which stand out with relatively high incomes and low prices of fuels compared to the other EU countries. It is also notable that Greece is also fairly close to Bulgaria in terms of purchasing power expressed in liters of fuel. This is predominantly caused by the exceptionally high average cost of petrol in the country.

Between the EU states there are significant differences in the price levels of fuel despite the application of common excise policy and minimal tax rates. Atthe start of the week used in this article, the lowest prices were in Hungary (1.25 euro/liter) and Malta (1.34 euro/liter), however the two countries have incorporated special regimes by which the fuel prices for the final consumer are regulated. In the countries with the highest prices, they are almost double- 2.37 euro/liter in Finland and 2,32 euro/liter in Denmark.

Source: Eurostat, European commission, authors’ calculations

Source: Eurostat, European commission, authors’ calculations

While the debate is focused on the loss of purchasing power primarily due to inflation and in part due to the rise in fuel prices, it is also useful to review the changes on a yearly basis. Expressed again in liters of petrol, the highest decline in purchasing power was experienced by countries with relatively high incomes – Luxembourg (-841 liters/month), Austria (-618 liters/month), Denmark (-460 liters/month). In contrast, Hungary has the lowest decrease of only -5 liters per month and in Bulgaria the change is -162 liters/month.

The above explained comparison is most of all illustrative – mean incomes do not reflect neither the differences of the income structure of the separate EU countries, nor the propensity towards expenditure (and its shrinkage) for fuel of the various income groups in them.

Nevertheless, the incomes clearly demonstrate the major differences in the purchasing power of the various parts around the EU in spite the variance in the price levels (which sometimes could reach several times).

It is plainly obvious that the loss of purchasing power when it comes to buying fuel is universal- there is not a single EU country in which it increased throughout the year. Using only this comparison, we can hardly answer the question whether state interventions in the fuels have led to the desired results.

In the Hungarian case, even though the regulation looks successful for the consumers, it hides the consequences for the national budget and the market distortions. It is, however, a starting point to reflect on the impact of inflation, rising costs, and different regulation in the different parts of the EU.

Continue exploring:

Optimism Despite Uncertainty: Results of First Monthly Survey of Ukrainian Enterprises