The European Commission (EC) has proposed a Directive on adequate minimum wages in the European Union (hereinafter, the Directive)1 . The general objective of the Directive is to ensure that all EU workers are protected by minimum wages as a way to guarantee adequate working and living conditions regardless of the place of work or residence.

Under the Directive, Member States would maintain the discretion to keep their current minimum wage systems or to ensure access to minimum wage protection by collective agreements. The EC proposes that when setting the minimum wage certain criteria such as purchasing power, the general level and growth rate of gross wages or labor productivity should be taken into account.

Member States would be obliged to take necessary measures to ensure regular and timely updates of statutory minimum wages. In addition, the Directive proposes that Member States may allow deductions and variations of minimum wage, which may allow salaries below the set statutory minimum wage. Such deduction rules should considerably decrease the burden for enterprises operating in regions or sectors which create less value added.

When defining minimum wage policy, it is important to keep in mind that the adequacy of the minimum wage does not automatically imply its increase. It is essential to ensure that changes to the minimum wage should make as little distortion to the price of labor force as possible, and the minimum wage may be raised only when labor productivity increases.

According to the Organisation for Economic Co-operation and Development, if the minimum wage is set too high, it reduces the preconditions and incentives for rewarding employees for their productivity, and may lead to job losses, informal work or reduced working hours for some2 .

In the context of the COVID-19 epidemiological crisis and the related economic downturn, an untimely and ill-founded increase of minimum wage may have particularly detrimental effects on small and medium enterprises, not only for minimum wage earners. It should be kept in mind that minimum wage is typically used as a base rate for achieving other indicators. Therefore increasing the minimum wage has surplus effects to most sectors and workers.

For example, Lithuanian international freight carriers are subject to a minimal coefficient of 1.65 of the minimum wage. Unjustified and unsustainable increases of the minimum wages might further deteriorate the situation of the sectors where wages are dependent on the minimum wage, yet do not necessarily amount to it.

The following presents assessment of the specific elements which the Directive proposal lays down for calculating the minimum wage.

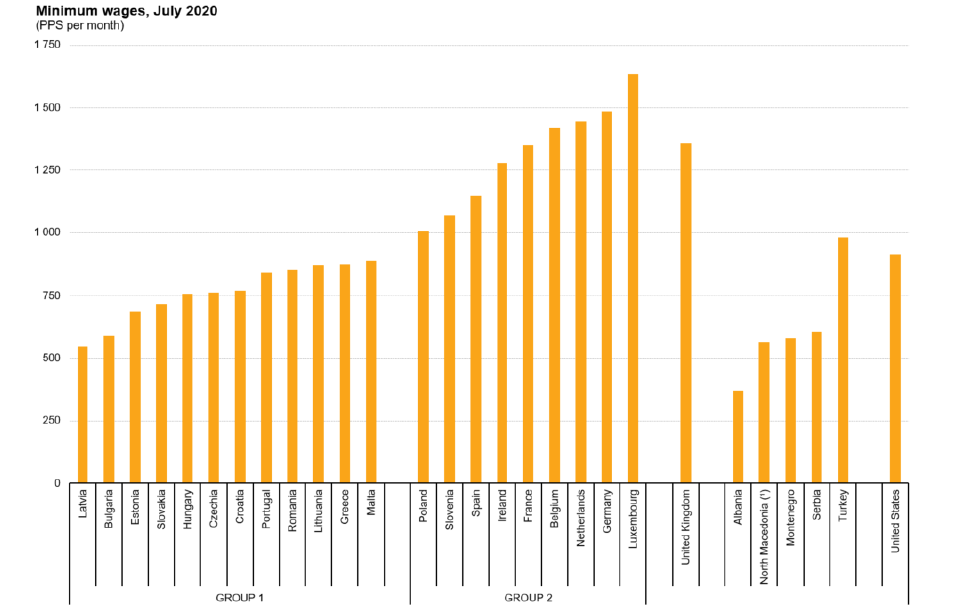

- The application of the purchasing power criterion when setting the minimum wage is reasonable and consistent with the Directive’s objectives. The purchasing power of statutory minimum wages is a more accurate indicator than the nominal minimum wage when it comes to reflecting living conditions of workers. Nominal minimum wage differs significantly: the lowest rate recorded in Bulgaria is seven times lower than the highest rate which is found in Luxembourg. Minimum wages expressed in purchasing power standards differ to a lesser degree: the lowest level found in Latvia is three times lower than the highest rate reported in Luxembourg. This significant difference provides a strong rationale for including the purchasing power into the calculation of the minimum wage.

- The Directive proposes linking the minimum wage to the general level of gross wage. It should be noted, however, that comparing the net minimum wage to the net average or median wage would provide a more accurate reflection of the level of workers’ welfare given that all Member States have different tax systems. Net salary therefore represents a better measure to promote the core objective of guaranteeing adequate working and living conditions than gross salary.

- The EC proposes that the minimum wage comprises 60% of the gross median wage or 50% of the gross average wage. However, it is important to note that linking the minimum wage with a higher percentage of the average or median wage increases the overall average or median wage. Most studies on the optimal level of minimum wage focus on the ratio of minimum wage to average wage. A joint report from ILO, OECD, IMF and the World Bank suggests that the minimum wage should correspond to around 30 to 40% of the median wage. It is important to note that due to the skewness of income distribution the median wage tends to be lower than the average wage in most January 5, 2021 countries. Thus, the EC’s proposed thresholds mean that minimum wages would constantly increase more than they would before being linked to the average or median wage. This would fuel inflation. It would also impose a disproportionate burden on SMEs which might result in higher unemployment.

- The Directive suggests that minimum wage growth may be linked to the growth rate of gross wages. Importantly though, in order to prevent negative effects on the economy, increases of the minimum wage should not be higher than increases of the average wage. This may act as a means of restricting unsustainable increase in the minimum wage. If minimum wage growth reflects the growth rate of the average wage, the same ratio between the minimum wage and the average wage is maintained. For example, in Lithuania during the COVID-19 pandemic the country’s average wage has grown while the economy has been shrinking. The growth of the minimum wage during economic downturns may result in an even greater decline due to the potential risk of job losses and SME bankruptcies and so higher budget spending and deficit.

- In order to keep the economy intact and foster competitiveness, wage growth should reflect the growth of productivity. As the economy’s labor productivity increases, more goods and services are produced for the same amount of work. Higher labor costs would discourage productivity growth and decrease competitiveness. What is more, minimum wage increases would lead to a higher level of unemployment among minimum wage earners and a higher level of inflation. Linking minimum wage growth to productivity growth would ensure the adequacy of minimum wage and benefit those EU Member States where labor productivity is growing faster. This would also incentivize more business investment into improving productivity.

- The EC suggests that wage deductions may be allowed by law. It should be noted that wage deductions may result in severe disruptions in the functioning of enterprises and increase legal uncertainty. According to the proposal and its travaux preparatoires the primary source of deduction justification could be a court ruling ordering such deductions. Such a requirement may lead to severe disruptions in the functioning of enterprises since adequate compensation could only be sought through long and expensive litigation procedures. This would increase legal uncertainty since the results of the litigation process are difficult to foresee and rulings may be appealed against a court of higher instance. In addition it deprives the enterprises from timely reimbursement of its expenses regarding allowance, equipment costs, etc. Instead it is advisable that the parties be allowed to clearly define in advance what expenses are covered by which party, and to determine the amount deductible between themselves. It would also be prudent to ensure an efficient functioning of pre-litigation councils.

- The Directive proposals suggests strengthening the controls and field inspections conducted by labor inspectorates. However, state inspections and other control mechanisms do not necessarily ensure that the rules on minimum wage are January 5, 2021 followed since such measures neglect the core reasons of the shadow economy in the labor market. Along with being proportionate and non-discriminatory the inspections must be founded on legitimate grounds and carried out at the highest degree of transparency. The expansion of inspections forces the market to return to the outdated approach to business control and deviates from the strategic goal of turning control authorities into advisers and consultants of enterprises. It must be emphasized that more inspections may only insignificantly reduce the incentives for undeclared work. The Directive’s proposed measures neglect the fundamental factors that precondition illegal work or undeclared income, such as the overall tax environment and rigid regulations. It would be more efficient to provide positive incentives such as tax reductions, tax amnesty, ensure optimization and simplification of the declaration and tax payment systems, etc.

Conclusions

- Due to the differences in prices and taxation across the EU, the purchasing power would provide a more accurate criterion for ensuring adequate living conditions of minimum wage earners.

- Linking the minimum wage as a higher percentage of average or median wage increases the overall average or median wage. Having this in mind, the EC’s proposed minimum wage thresholds of 60% of the gross median wage or 50% of the gross average wage are too high. The thresholds should be kept at 30 to 40% of the median wage, as suggested by ILO, OECD and IMF.

- Because of differences in the tax systems across the EU, the ratio of the net minimum wage and the net average wage would reflect the welfare of workers more accurately.

- Raising the minimum wage should not exceed productivity growth and the growth of average wages.

- In order to reduce the incentives for undeclared work, it would be most prudent to optimize the overall tax environment, to ensure more leeway in the regulatory framework and to introduce positive incentives such as tax reductions, tax amnesty, ensure optimization and simplification of the declaration and tax payment systems, etc.

1. The EC’s Proposal for a directive: https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12721- Initiative-on-adequate-minimum-wages

2. OECD (2015) Minimum wages after the crisis: Making them pay: http://www.oecd.org/social/Focus-on-MinimumWages-after-the-crisis-2015.pdf