Ukraine is unlikely to receive another installment of the IMF loan in 2017, as two planned disbursements were missed. The next tranche may come in the first quarter of 2018 if the Parliament and the Government deliver on their commitments. At the same time, the European Union delayed another tranche of the assistance under the MFA III. These delays are explained by the slow progress in the number of reforms, promised under the EFF and the MFA III. This may reduce investment attractiveness of Ukraine.

Close cooperation with international donors is necessary for Ukraine’s further economic recovery and growth for several major reasons. First, their support shows private investors that reforms are ongoing and are likely to continue.

Close cooperation with international donors is necessary for Ukraine’s further economic recovery and growth for several major reasons. First, their support shows private investors that reforms are ongoing and are likely to continue.

Second, international donors create additional pressure to the Government and the Parliament to implement necessary reforms as they meet with political opposition. A number of important legislative measures approved over the recent years were supported by international organizations through technical aid and/or by their inclusion in conditionality for financial assistance. This relates to the fiscal consolidation measures, creation of anti-corruption institutions, technical regulation reform, education and healthcare reforms.

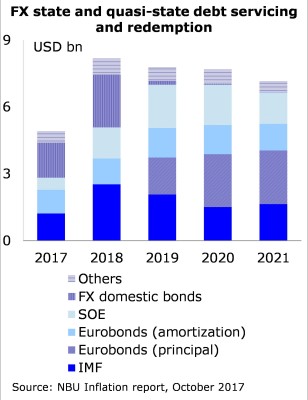

Third, NBU international reserves in the end of October reached USD 18.7 bn, which is much larger than in 2014-2015 but may be still insufficient to cover potential capital outflows especially taking into account Ukraine’s future debt payments. According to the NBU, FX state and quasi-state debt servicing and redemption will be equal to about USD 8.2 bn in 2018 and USD 7.8 bn in 2019. Therefore, inflow of assistance from international donors will help Ukraine to keep reserves at adequate level.

Recently, the reforms slowed down with little progress in such areas as property rights protection and judicial reform. However, the improvements in these spheres are key to boost both domestic and external investments.

New anti-corruption institutions are important part of judicial reform. The National Anti-Corruption Bureau of Ukraine (NABU), the Specialized Anti-Corruption Prosecutor’s Office (SAP) and the National Agency on Prevention of Corruption (NAPC) were created in 2015 but so far had limited success in fighting corruption. The NABU was able to secure few convictions as court cases it pursues frequently face significant delay. To ensure faster and more professional trials the creation of the specialized Anti-Corruption court is suggested by local experts. It is also envisaged in the IMF Program. At the same time, the NAPC amassed several millions of asset and income declarations but so far it has done little with this mountain of data. Automatic verification of e-declarations to flag inconsistencies was not yet introduced, but it is one of the most essential conditions for the next tranche of assistance under the MFA III.

The land market reform is a measure that can boost investment in agriculture. According to the World Bank, the elimination of agricultural land moratorium might stimulate additional 1.5% of economic growth each year. However, the Government still has not approved the land market model and, thus, it remains unclear when and how the owners of agricultural land could start selling their plots officially. Meanwhile, the moratorium results in losses of land owners, unofficial transfers of land, inefficiency of land use, and fraud. The approval of the land market reform is one of the benchmarks defined in the EFF with the IMF.

The announced privatization might become another instrument for attracting FDI if the Government ensures transparent auctions. The Parliament approved in the first reading the Draft law on privatization, which foresees the “triage” of state-owned enterprises (SOE). The SOEs are to be divided onto three groups: to remain in state ownership, to be sold, or to be liquidated. Improvement in corporate governance of the remaining SOEs is also foreseen in the IMF program. The Draft State Budget for 2018 envisages privatization receipts at UAH 22 bn, which would be realistic only if the Government finally sells several blue chip companies (e.g. Odessa portside plant and Centroenergo). The FDI could also be stimulated by improved legislation on concessions and public private partnership.

Ukraine needs at the very least 5% annual GDP growth to catch up with neighboring countries in economic development. One option for this would be improved investment climate for higher FDI and domestic-sourced capital investment. Other options are limited given lack of fiscal space and aging capital assets. Improvement of investment climate requires tangible progress in the property rights protection and the commercial dispute resolution. The privatization, land market reform, and improved legislation on concession are also necessary to bring FDI to the country. The international donors might further support economic growth through good advice, knowledge sharing, and financial aid.