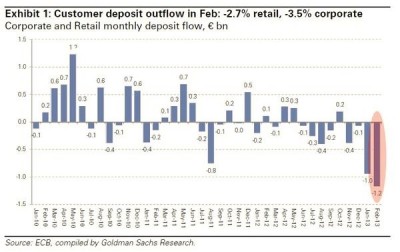

The rescue package for Cyprus finally consists of a 10 billion euro bailout from the ESM and it has one crucial condition, namely taxation of all deposits larger than 100,000 euros, which inflicts significant losses on depositors — possibly up to 40 percent. EU officials have stressed that this measure was a “unique step” in Cyprus. But, really, who knows? The Dutch Finance Minister and chief of the euro group, Jeroen Dijsselbloeman, stated that “If there is a risk in a bank, our first question should be ‘Okay, what are you in the bank going to do about it? What can you do to recapitalize yourself?’ If the bank can’t do it, we’ll talk to the shareholders and the bondholders then, we’ll ask them to contribute to recapitalizing the bank, and if necessary, we’ll talk to the uninsured deposit holders.” How many times in history did absolute unique measures become the standard ones? Please, answer yourself. The Cypriot central bank is accused of not doing enough to control the movement of capital. Many are furious that the bank allowed “special payments,” which means that a lot of the money was withdrawn from overseas. Lawmakers in Nicosia who probably did not have the opportunity to withdraw money prior to the closure of the country’s financial institutions have demanded a list of those customers who did so. In particular, parliamentarians want to know if central bank employees or members of the government received early warning and were able to quickly rescue their assets. The fact is that February outflows (just a month ago) hit a new two-year record in Cyprus, as is described in the chart below:

Russian businesses and banks are starting to consider some legal action against Cyprus or individual banks, but some lawyers predict that they may have a hard time winning their case. “It’s worth trying. It’s not going to be easy. It’s not going to be a one-off, 24-hour court case, but the nature of the action itself sounds like expropriation.” There will be a lot of consequences of Cypriot decision and one of them is fear. Luxembourg is for example afraid that Germany and the EU Commission are going to force also other countries to change their business models once they face any problems. It is a logical fear because Luxembourg has a large financial sector, which is markedly similar to the Cypriot one and regulatory regime has long irked its much bigger neighbors Germany and France. And we can speculate now about who will be the next in the queue. Italy? The truth is that Bersani is unable to form a new government which could cause panic among investors. Spain? The Spanish government for example said that its 2012 budget deficit will be bigger than primarily estimated. I would bet on Slovenia (another small member of the Eurozone). The country is struggling with its own banking problems and will need to recapitalize its three largest banks this year. How much will it cost? As usual – billions of euros. The country is already having some trouble selling sovereign bonds on the market. So, will they need a bailout? Politicians say that it’s not going to happen and, as usual, we cannot or need not believe them.

French towns and municipalities are calling on the French government to save them from 10 billion euros in Dexia loans. Dexia pegged loans to foreign interest rates or currencies and now many municipalities are struggling to service their loans and asking for help from the state. And why not; their counterparts from Spain have done the same many times.

And in the meantime, Egan Jones rating agency downgraded the UK from AA- to A+. The major problems for the UK are the impact of Europe’s banking crisis on the country and the deficit to GDP, which has declined but it was the result of increased taxes. The real concerns are whether the country will be able to continue to cut its deficit in the face of weaker economic conditions and a possible deterioration in the country’s financial sector.

The biggest Asian investment bank Nomura is warning that debt levels in China are at unsustainable levels. Their analysts believe that gross debt level of public sector in China is in reality somewhere between 150 and 200 per cent of GDP, which means that China could repeat what happened in the US and Europe. Governor of the BoJ Kuroda confirmed that the BoJ is prepared to buy government bonds and he also said there may be room to boost purchases of riskier assets.

US banks wrote off $3 billion of student loan debt in the first two months of 2013. The main reason behind is that many graduates remain jobless in a slow U.S. economic recovery. Delinquency rate have spiked in the last eight years. Right now about 6.8 million borrowers of 40 million students delay their repayment more than 90 days. The student loan market is in total more than $ 1 trillion; put into perspective, the whole debt of U.S is $ 16 billion. Does it seem to you similar to housing bubble? If yes, you are right.