Along with the increase of inflation in Poland and in the whole world, the discussion about its causes intensifies. There are many voices that the main reason is an external supply shock – the prices of energy and food.

An example may be the statement by the Governor of the National Bank of Poland, Adam Glapiński, on the 8th of September 2022 – “at least 3/4 of the inflation comes from the outside, from energy shocks. From the extremely high price increases of gas, electricity, heat, etc.“[1] This statement is not true.

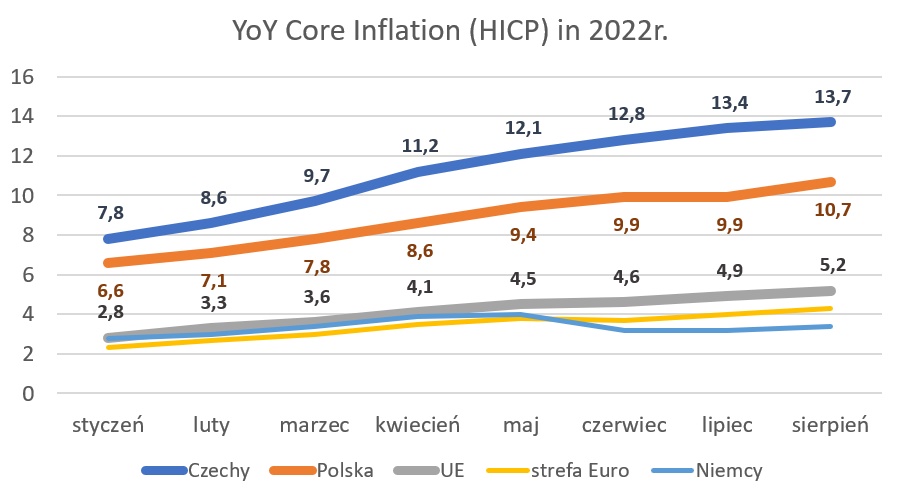

It is useful, in the analysis, to distinguish within CPI inflation, a core inflation and the rest of it. Core inflation is an inflation rate that is devoid of the most unstable components such as food and energy prices.[2] This indicator is used to present inflation, limiting the impact of supply shocks.

By definition, core inflation does not account for increases in energy and food prices. Therefore, it reflects the influence of domestic monetary policy managed by central banks and fiscal policy of governments.

Eurostat has the best data available for comparison between countries.

In August 2022, the YoY core inflation (HICP) in Poland was 10.7%[3], which was one of the highest results in the European Union.

- across the EU, it was 5.2%;

- in the Euro zone – 4.3%;

- in Germany – 3.4%;

- in the Czech Republic, 13.7% (this was by far the worst result in the EU).

Source: Eurostat

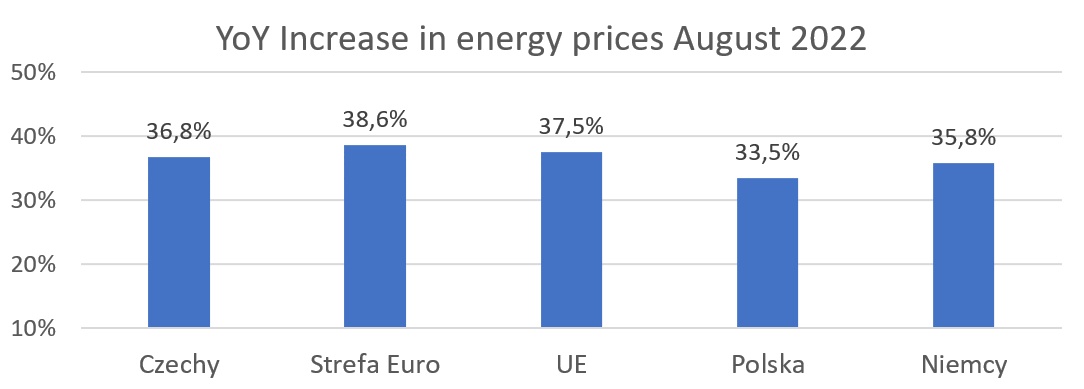

The rest of inflation, i.e., energy and food prices, also needs to be observed. The importance of the rise in core inflation in the CPI growth in Poland is shown by the fact that the aforementioned energy prices increased significantly less than the EU average.

The chart below shows only the year-on-year increase in energy prices in August 2022. Energy prices in Poland increased by 4 pp. less than in the entire European Union and by 5.1 pp. less than in the Euro zone.

Source: Eurostat

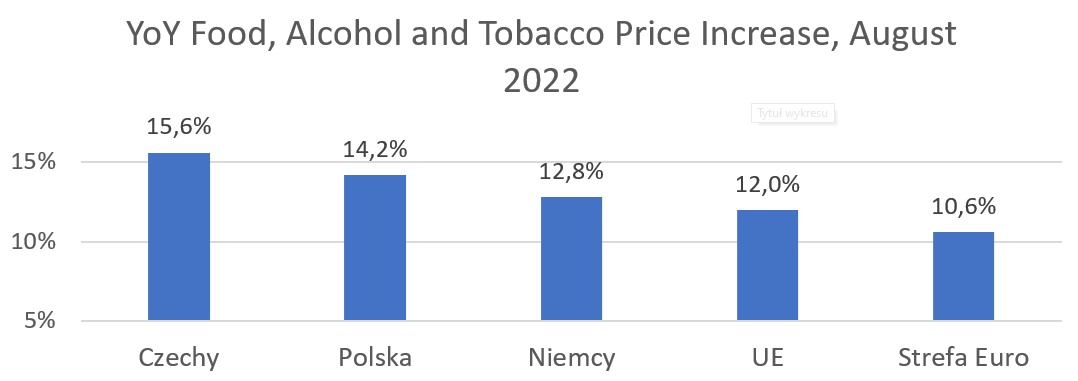

Poland’s situation is similar to other EU countries in the case of food prices, although worse than the above-mentioned increase in energy prices. The increase in food, alcohol and tobacco prices in Poland in August 2022 was higher than in the entire European Union by 2.2 pp. and was 14.2%.

Source: Eurostat

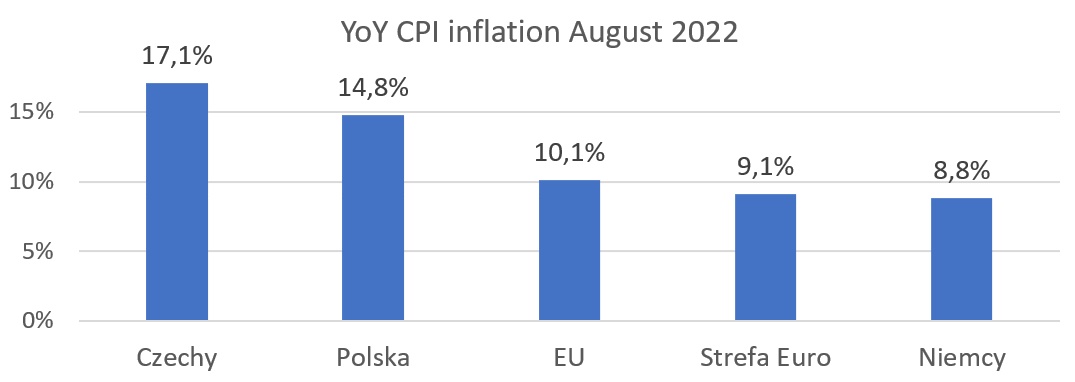

For comparison, below is the CPI inflation, i.e., the full consumer price index, year-on-year in August 2022, the inflation difference between Poland and the EU average is 4.7 pp. In the Euro zone, it was 5.7 pp.

Source: Eurostat

There are countries where core inflation is higher than in Poland, for example, Czech Republic, Baltic states and Hungary, but most EU countries have core inflation much lower. Monetary and fiscal policy errors in other countries cannot be an excuse for poor management of budgetary expenditures in our country.

Large transfers of funds under the COVID aid programs are one of the reasons for the rising core inflation in the Czech Republic. This country, which has been conducting a rational fiscal policy for the last 30 years, started a pro-inflationary mix of increasing consumption expenditures from the budget and reduced revenues by lowering taxes during the pandemic.

For this reason, the debt-to-GDP ratio is projected to increase by more than 24% in 2019-2024, which will be the highest increase in the EU[4]. Until January 2022, inflation in Czech Republic was much lower than in Poland. The interest rates of the Czech central bank were and are slightly higher than the rates of the National Bank of Poland, it should also be noted that the Czech koruna has appreciated over the last two years against the zloty by over 15%.

In Poland, domestic monetary and fiscal policy is responsible for the majority of inflation.

In this context, one should look at the government’s announcements of introducing next social programs, as well as “thirteen”, “fourteen”, and possibly even “fifteen” extra pensions[5] in 2023 and already existing ones, such as subsidies to coal and similar, often financed from extra-budgetary funds. The budget deficit quickly increased to 4.4% of GDP in 2022 compared to 1.8% in 2021.

As for monetary policy, it should be noted that the response of European central banks, including the NBP, to the recovery after the pandemic was delayed. The National Bank of Poland, in particular, kept interest rates very low in the face of inflation, which since April 2021 has significantly exceeded the target.

The bank reacted late and with too small increases, starting the cycle of rate hikes at the end of 2021. Before the pandemic, the Polish economy already showed symptoms of overheating (a combination of low unemployment, inflation rising above the target and economic growth), which persisted after the pandemic ended.

Price and supply shocks do not distinguish Poland from other European countries, and yet inflation is one of the highest. Despite the uncertain international situation and high prices of energy (Russian oil, gas and coal) and food (limited production of fertilizers and significantly reduced exports from Ukraine), the key to stopping runaway prices in Poland lies mainly in Warsaw.

Written by: Bartłomiej Jabrzyk

References:

[1] https://biznes.interia.pl/gospodarka/news-glapinski-nbp-mamy-wysoka-inflacje-ale-nie-widac-kryzysu-pol,nId,6272795

[2] P. Samuelson, W. Nordhaus, Ekonomia, wyd. XIX, Wydawnictwo Rebis, s.626;

[3]https://ec.europa.eu/eurostat/databrowser/view/TEICP200/default/table?lang=en&category=shorties.teieuro_cp

[4] https://www.gisreportsonline.com/r/czech-finances/#toc-pos-factsfigures

[5] https://www.pap.pl/aktualnosci/news%2C1409873%2C15-emerytura-jezeli-bedzie-potrzebna-trzeba-ja-rozwazyc.html

Continue exploring:

206 Billion PLN – Real Budget Deficit at the End of 2023

Law and Justice Continues to Deprive Poles of Money from EU Recovery and Cohesion Funds