In September 2024, the business climate in Ukraine shows positive changes. In recent months, companies’ production and financial performance have increased, and expectations for further development remain optimistic. Despite the challenges posed by the war, businesses demonstrate the ability to adapt and look for new development opportunities.

The article is based on the findings of a New Rapid Enterprises Survey (NRES) conducted monthly by the IER since May 2022. The survey covers 500 manufacturing enterprises of different sizes and industries in 21 out of 27 regions of Ukraine.

General Indicators of Business Activity

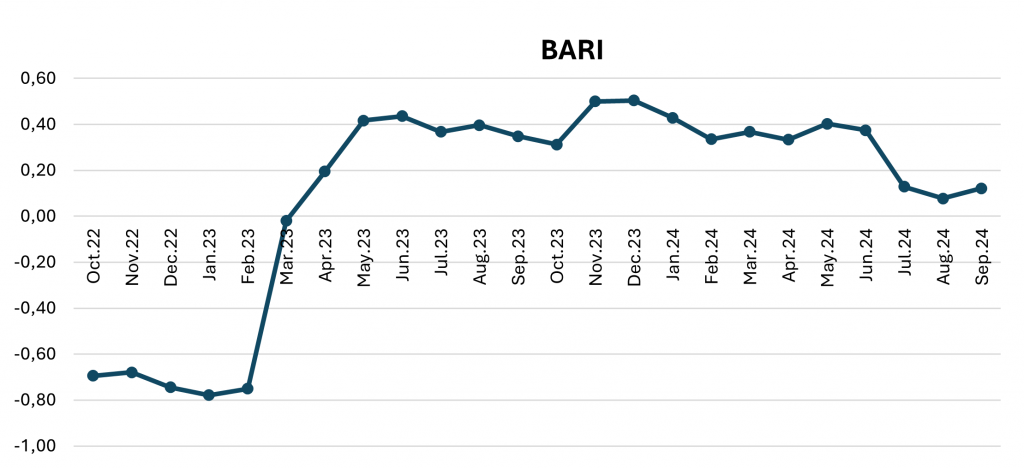

The pace of recovery in business activity improved in September 2024. The business recovery index increased from 0.08 in August to 0.12, indicating that the market has stabilized, and business performance has improved. The index of the current financial and economic situation remained almost unchanged at 0.10 (against 0.09 in August), demonstrating a gradual improvement in the financial position of enterprises. Expectations for changes in the financial and economic environment over the next six months remain positive, with an index of 0.31, underlining business optimism.

Figure 1: The Business Activity Recovery Index (BARI)*

Source: IER Business Surveys 2022-2024, NRES presentation 14.10.2024

Source: IER Business Surveys 2022-2024, NRES presentation 14.10.2024

**BARI is based on the difference between the share of enterprises’ reported improvement and the share of the firm’s reported deterioration of the situation at enterprises “how it is now” vs. “how it was a year ago.”

Production: Maintaining a Steady Growth Rate

In September 2024, the growth rate of production showed improvement. The index of changes in production increased from 0.12 to 0.18, partly due to a decrease in the share of enterprises that reduced production volumes. Despite the war risks, businesses’ production expectations for the next three months remain positive, with the Index of Production Expectations of 0.38. The share of enterprises that plan to increase production is 38.5%, while 55.9% do not expect any changes. Only 5.5% of companies plan to reduce production volumes, almost the same as in the previous month.

- The size of the enterprise significantly impacts production expectations. Large enterprises show the highest level of optimism, with an index of 0.51. The indicators of medium (0.40) and small (0.21) enterprises are much lower, and micro-enterprises have the lowest level of optimism—only 0.10.

- Regional specificities are also important. The Poltava (1.00), Rivne (0.87), and Cherkasy (0.86) regions show the most optimistic plans for production growth. At the same time, Kharkiv (-0.10), Lviv (-0.07), and Sumy (-0.05) regions have the lowest indicators.

- The industry distribution shows that the woodworking (0.50) and light (0.44) industries are the leaders in production expectations for the next three months. At the same time, the production of building materials has the lowest level of optimism, with an index of -0.11.

Demand and Sales

September 2024 showed signs of stabilization in the growth rate of sales and new orders. The Sales Change Index increased from 0.12 to 0.17, and the New Order Change Index increased from 0.05 to 0.12. These improvements indicate increased demand for products and services from Ukrainian companies, which may result from increased consumer confidence and market stabilization.

The orders booked also indicate positive trends. In September 2024, the average period for providing enterprises with new orders was 8 months, the highest value in the last year and a month more than in August. The share of businesses with orders for a year or more increased in September to 22% (since 6% in June 2024) , while 48% have orders for up to two months.

Problems with Prices and Debt

Prices for raw materials and supplies showed a downward trend in September, the price change index decreased from 0.29 to 0.26. However, businesses’ expectations for future prices for raw materials and supplies have increased, with the Index of Expected Changes reaching 0.44, indicating fears of a price rise shortly.

The debt situation also continues to deteriorate. Accounts receivable and payable increased, and the tax liability ratio increased from -0.19 to -0.12. These indicators are expected to grow upwards in the next three months, which may negatively affect enterprises’ liquidity.

Employment: Labor Shortages and Difficulties in Finding Workers

The labor shortage has become one of the main obstacles to doing business in Ukraine. Businesses continue to experience difficulties in finding qualified employees. The index of challenges in finding skilled workers increased from 0.49 to 0.56. The shortage of unskilled workers has remained almost unchanged, but the problem of staff shortage is a severe threat to the stable development of the business. At the same time, enterprises were forced to reduce staff; the employment change index decreased from -0.02 to -0.05. This may be due to economic uncertainty and a lack of qualified personnel.

Capacity Utilization

In September, only 10% of enterprises were operating at total capacity compared to before Russia’s full-scale invasion of Ukraine, the lowest figure in the last year. The reasons for this are both hostilities and power outages, which seriously affect business activities. Micro and small enterprises suffer the most significant losses in working time, reducing their efficiency.

Export During the War

Despite all the difficulties, exports remain an important part of Ukrainian companies’ activities. In September, 63% of enterprises continued or started exporting during the war. However, the share of active exporters decreased slightly compared to previous months, indicating difficulties in entering foreign markets.

Public Policy: Support or Obstacle?

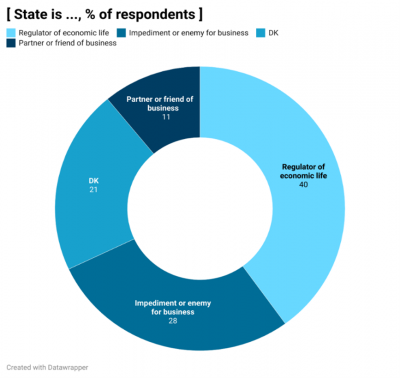

Despite the war, economic policy remains important for regulating the business environment. The attitude of business to public policy in Ukraine remains ambiguous. Only 5% of companies have a favorable view of the government’s policies, while 61% of respondents expressed a neutral attitude and 24% a negative one. At the same time, 40% of businesses see the state as a regulator (as it should be), 28% as an obstacle or even an enemy, and only 11% as a partner or friend. This shows the need to reform state support to make it more efficient and valuable for enterprises.

Figure 2: State is .., % of respondents

Source: IER Business Surveys, NRES, 2022-2024, author’s visualization

Source: IER Business Surveys, NRES, 2022-2024, author’s visualization

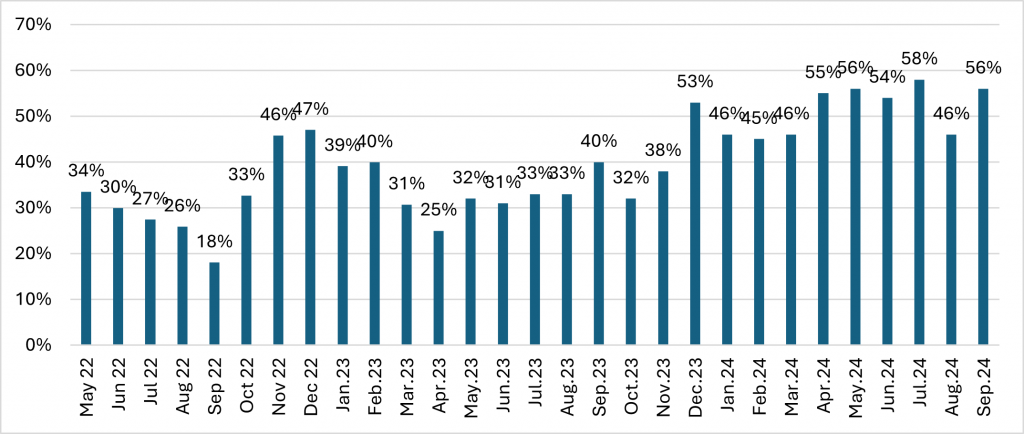

Danger as a Result of War: Essential Factor in the Business Environment

However, against the backdrop of improved economic indicators, the danger to the operation of enterprises caused by the full-scale Russian invasion has increased significantly. This factor, having risen from 3rd to 2nd place among the main obstacles to business, increased from 46% to 56%, indicating increased security risks for companies. Also, the level of uncertainty has increased slightly over the two-year perspective, which means businesses are concerned about long-term risks and challenges.

Figure 3: “It is dangerous to work” an impediment to doing business in Ukraine % of respondents.

Source: IER Business Surveys 2022-2024, NRES presentation 14.10.2024

Source: IER Business Surveys 2022-2024, NRES presentation 14.10.2024

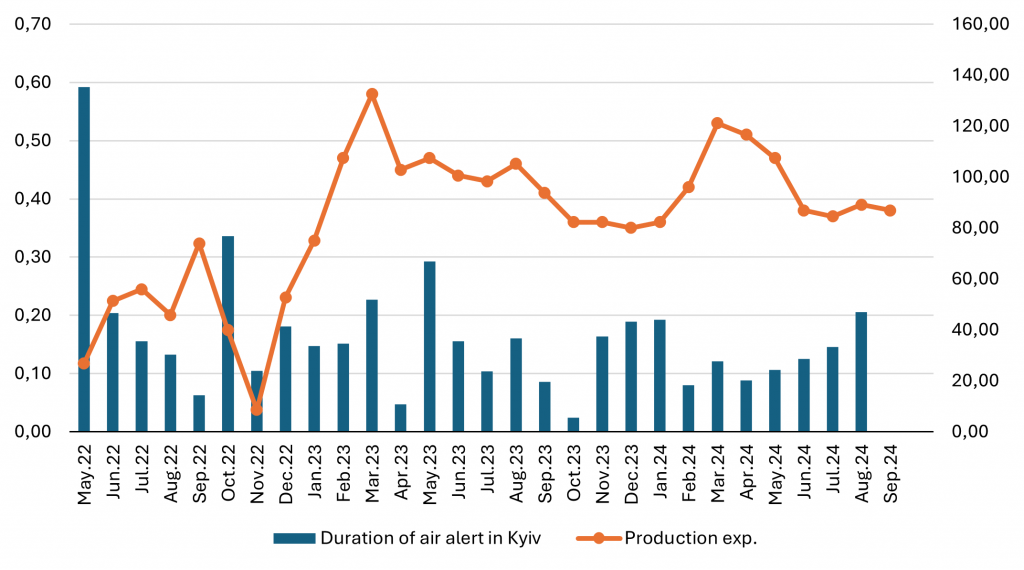

We compared the duration of air alarms in Kyiv (as an external indicator of danger) and expectations. The graph shows the relationship has strengthened in the last 12 months (correlation coefficient -0.37 for the entire period and 0.60 for 2024). This means that the risk negatively affects the short-term business’ expectations.

Figure 4: Production output expectation and duration of air alert signal in Kyiv ( index, hours)

Source: IER Business Surveys, NRES, 2022-2024, author calculation

Source: IER Business Surveys, NRES, 2022-2024, author calculation

Conclusion

Ukrainian businesses continue to adapt to challenging conditions, demonstrating resilience. The main obstacles remain labor shortages and security risks such as a full-scale invasion, which rose to second place among threats to business, market instability, and rising commodity prices.

The growing risks to businesses caused by the war highlight the importance of adaptation strategies, such as stable export supplies (as a source of funds for businesses) and effective resource management. At the same time, with proper government support and further regulatory reforms, companies can make significant strides in improving the business climate and stimulating economic growth in Ukraine.

Continue exploring:

Pensions: Balancing Present Freedom with Tomorrow’s Responsibility

Fighting Back against Populist Scaremongering on Immigration and Gender