AI in Schools: Between Promise of Progress and Educational Reality

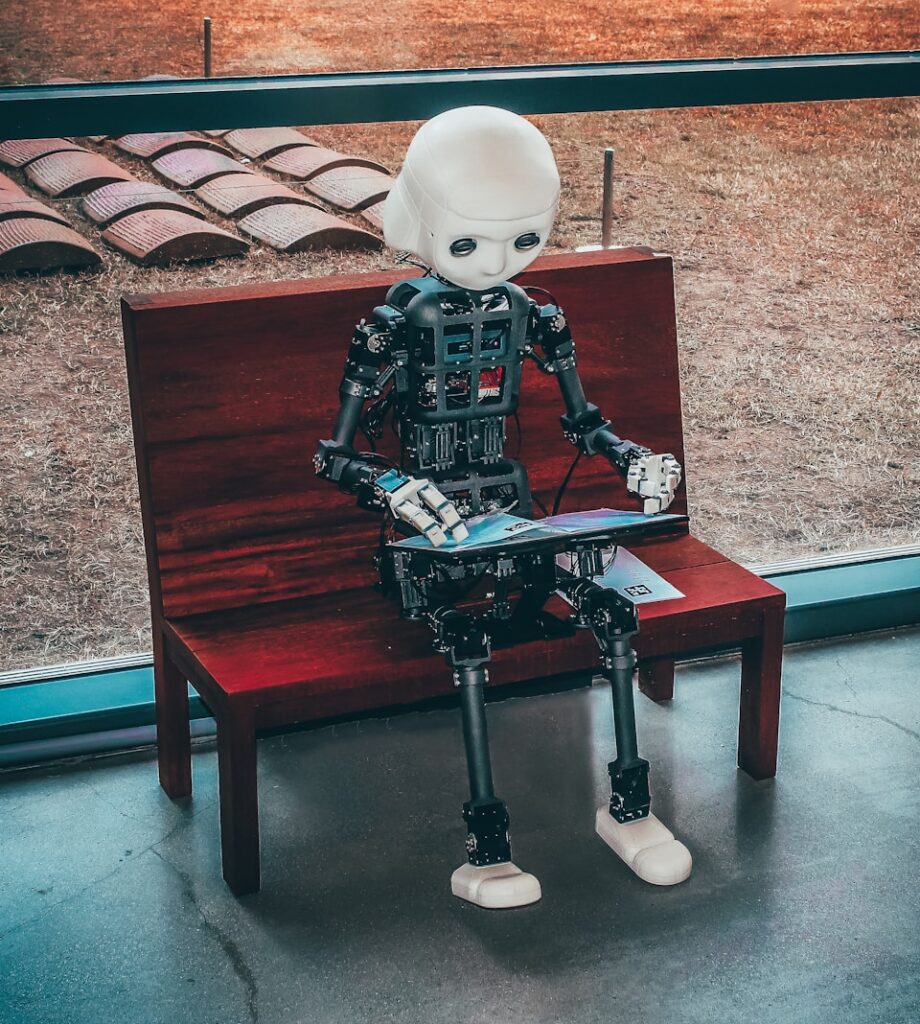

Artificial intelligence is here — and it has arrived in the classroom. What was once considered science fiction has become a reality. Students use tools like ChatGPT, DeepL, or other resources to gather information, complete assignments, or revise texts. But how is AI changing everyday school life? What is needed to turn technological hype into meaningful educational progress?

![Learning to Be: Does School Dare to Ask Why? [4liberty.eu Newsletter] Learning to Be: Does School Dare to Ask Why? [4liberty.eu Newsletter]](http://4liberty.eu/phidroav/2025/02/newsletterfin-1024x1024.png)