The term “wage” and its size are very important in national discussions about labor markets, taxes and insurance payments, but also part of international comparisons for investors deciding to build a factory or to place investments in a specific country. A lot of confusion has been created by the introduction of gross wage with arbitrary distinction between “employee paid” and “employer paid” taxes and contributions. However, this is countered by introduction of total wage cost in international statistics.

Yet, total wage cost does not provide complete picture about labor cost at all. It does not count paid holiday, sick leave, or employee related costs like obligatory meal vouchers and other benefits. Furthermore, it does not count various surcharges required by national law (night time work, holiday work, etc.).

In 2019, INESS created Employee Price methodology and calculator. The calculator takes numerous inputs from a user (wage, amount of overtime or night time hours, etc.), calculates all monetary costs and discounts, as well as time spent out for work (holiday, state holiday, sick leave, etc.) and returns the price of the employee – the total cost of man-hour and man-month spent working.

Two years later, three more countries (Bulgaria, Czechia and Poland) joined the project and created their national versions of the calculator. In 2022, INESS (Slovakia), IME (Bulgaria), and Liberal Institute (Czechia) with the generous support of the Friedrich Naumann Foundation updated the calculators according to the current legislation.

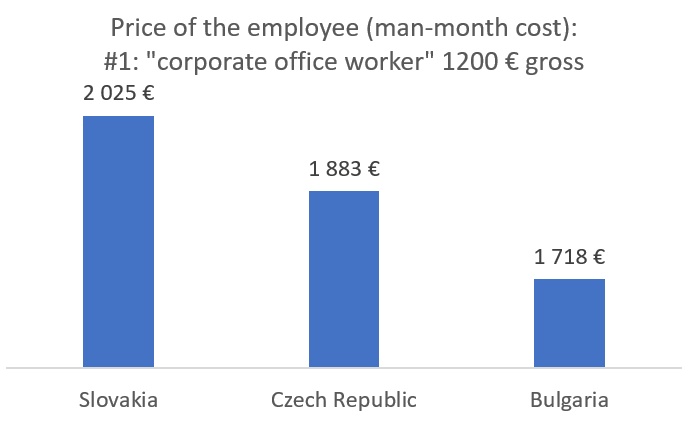

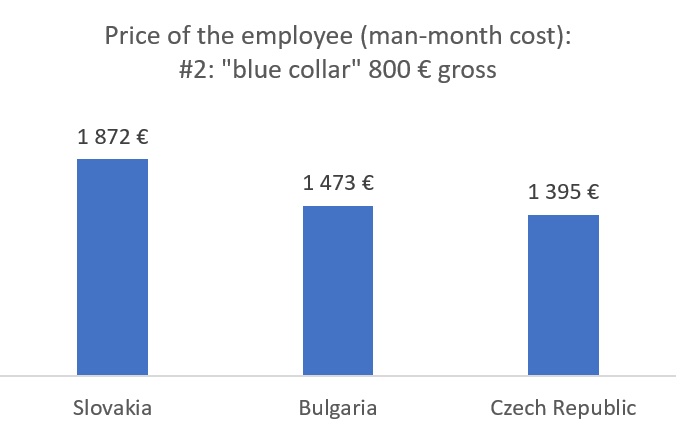

A comparison among the three countries can be seen below.

Model 1

“Corporate office worker” – 1200 euros equivalent gross wage per month, standard working time, no overtimes, no weekends etc., 30 years old, no kids, company with 100 employees.

Model 2

“Blue collar” – 800 euros equivalent gross wage per month, works in 3-shifts, 12h paid overtimes per month, 48h in nightshifts per month, 12h Saturday, 12h Sunday and 12h state holiday worked per month, 2 kids, 45 years, company with 500 employees no 13th, no 14th wage and no benefits in both cases for simplification.

Continue exploring:

Average Employee Has to Earn 163% of Their Contractual Wage

Universal Basic Income: When Everything Is Enough, Everything Starts Missing