Although Bulgaria has officially been in a budgetary consolidation phase during the entire 2013-2015 period, public expenditure went out of control on several occasions. Yet again the newly presented medium-term budget framework provides for decreasing deficits, while current expenditures (and thus deficits) are being hiked.

Here we will show four charts from IME’s 2016 Alternative Budget. They demonstrate the fiscal position deterioration in Bulgaria and the ongoing tendency for adopting new expenditure that makes higher deficits inevitable and that tries to change the public attitude by planting fiscal illusions.

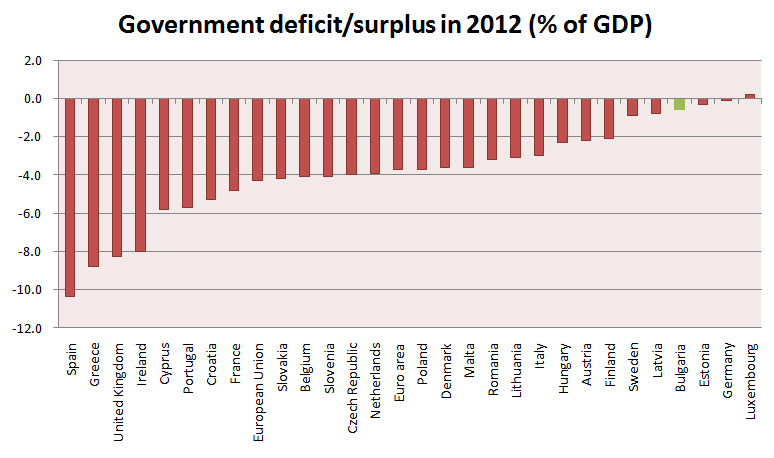

The 2012 Deficit: Bulgaria Among the Best Performing EU Countries

The first two charts compare the fiscal position of Bulgaria with the other countries in the EU. The 2012 chart clearly demonstrates that Europe as a whole practically faced deficits, while Bulgaria was among the small number of countries featuring almost zero deficit in terms of the general government budget. In 2012, the deficit was almost zero and the country ranked next to Estonia and Germany as one of the best examples of fiscal discipline.

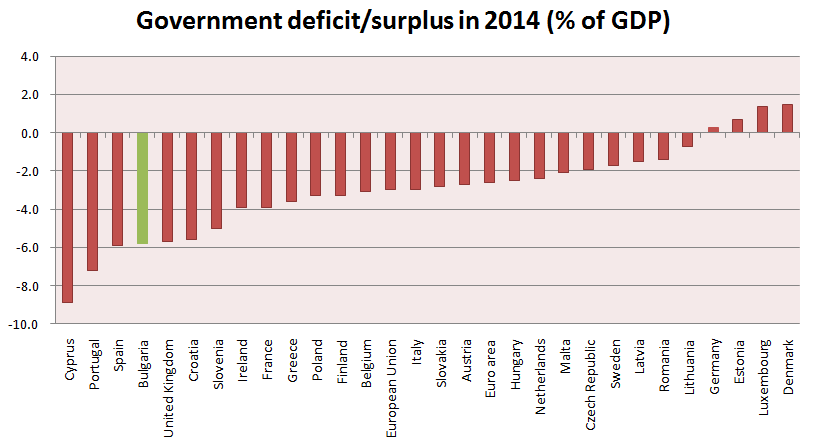

The 2014 Deficit: Bulgaria Joins Portugal and Spain

The same chart shows quite a different picture in 2014. While EU countries shrank their deficits, and there were even countries reporting surpluses, Bulgaria headed to the bottom, joining Portugal and Spain. That was the price of the 2013–2014 political crisis, namely: losing control over the budget and the transition from a good to a bad example in Europe.

The differences between the European and the Bulgarian methodology regarding the calculation of the deficit and the impact of what happened at CCB on the data reported, could be detailed here, but the truth cannot be changed by methodological issues. Regardless of the methodology used, even if all effects resulting from the CCB case are excluded, the budget was out of control in 2013 and 2014, and Bulgaria surely ranks amongst the fiscally irresponsible EU countries.

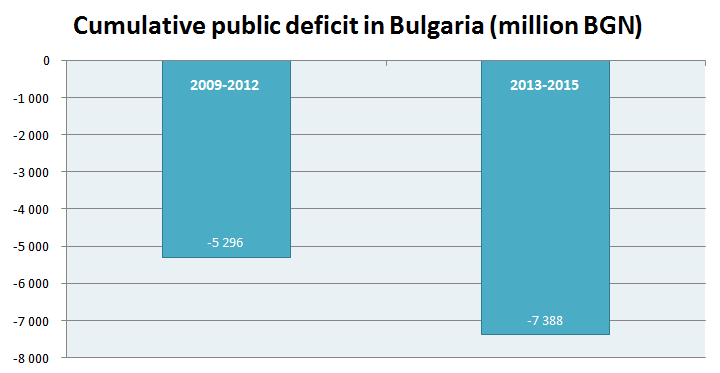

Political Instability Entails a Huge Deficit

The third chart demonstrates the cumulative deficit from 2009 to 2012 (recession and recovery) and from 2013 to 2015 (political instability). The effect of the severe recession was a deficit of almost BGN 5.3 billion, which was mainly financed by the fiscal reserve. The effect of the political instability, however, was much bigger and it reached almost BGN 7.4 billion, which mainly impacted the sovereign debt. Without being in a recession, and given the recovering labor market, expenditure went out of control in successive budget updates during 2013, 2014 and now in 2015, which raised Bulgaria’s debt and worsened its credit rating.

Budget Actualizations — New Trick for Hiding Consolidation Failures

Budget Actualizations — New Trick for Hiding Consolidation Failures

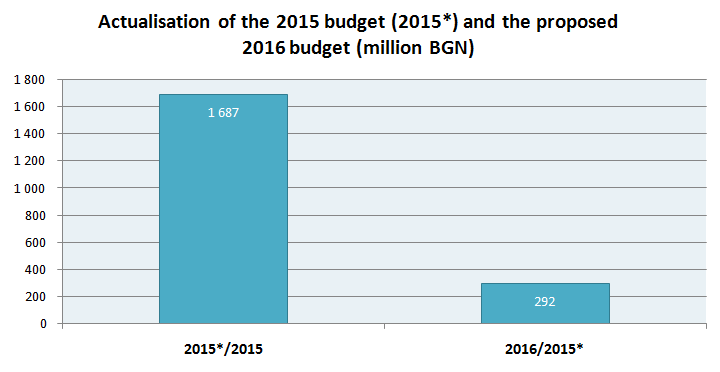

The last chart reveals the method that presents new expenditure as inevitable. For the past three years raising the expenditure has been done not via adopting the budget for the next year, but rather via updating the current one and using it as a basis for the following one. The increase in expenditures, in absolute terms, is demonstrated on the chart — first, this year’s budget update compared to the initially adopted budget expenditure, and then the 2016 budget compared to the updated expenditure pertaining to this year. The total growth in terms of the consolidated framework (proposed for 2016 relative to the initially adopted one regarding 2015) is almost BGN 2 billion, but the big increase is implemented in this year’s budget update.

If the 2016 budget is to be compared with the updated 2015 budget, a surge in costs and expenses will not be visible, and it would be hard to explain the deficit. This constitutes replacement of public expectations with fiscal tricks.

If the 2016 budget is to be compared with the updated 2015 budget, a surge in costs and expenses will not be visible, and it would be hard to explain the deficit. This constitutes replacement of public expectations with fiscal tricks.

We may draw at least three conclusions from the charts presented above:

-

The political instability in Bulgaria caused a much bigger burden for the budget than the one caused by the 2009 recession;

-

After 2013 governments use fiscal tricks to raise expenditure, mostly via successive budget updates;

-

The deficit can not be overcome without reforms of the ineffective public sectors, and it will always be presented as some kind of inevitability.

Such reforms are not specified in the medium-term framework up to 2018.