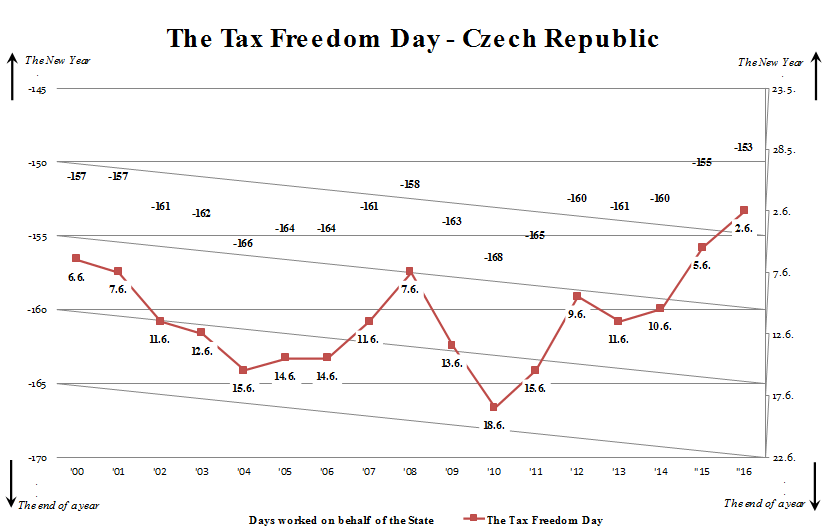

After 153 days of work on the account of public institutions, the expenditures of which had to be covered by taxpayers, Liberal Institute together with the Czech society commemorated the Tax Freedom Day on June 2, 2016. The Tax Freedom Day is the first day in a year when we make decisions about our earned money after meeting an obligation of our state tax liability. The Liberal Institute has celebrated the Tax Freedom Day since 2000.

This year’s result is two days better than in 2015. “We have spent record-breaking short time to work for the state this year, 153 days. However, this result is not brought about by the government, unfortunately! Many fathers claim merits for this positive development, among whom politicians are (with all due respect to their work) the loudest group. Nevertheless, the development has been caused mainly by economic activity and GDP growth, not by fiscal liability of politicians”, Petr Koblovský, director of the Liberální Institut, says about the results. “Expenditures of public institutions increase continuously, the number of state employees increases as well and the government, with its endless regulatory effort, has created demand for thousands of new public servants and for public sector growth”, he adds.

Source: Liberální institut (www.dendanovesvobody.cz)

When focusing on international comparison, the Czech Republic shows quite good performance among EU states – 02/06 is significantly below the Eurozone average (26/06). However, in comparison to developed OECD economies (average 29/05), we still have some public expenditures to cut. The best result was achieved by South Korea, as every year, where taxpayers celebrated the Tax Freedom Day on April 28 – 59 days earlier than the Eurozone average and 35 days earlier than the Czech Republic. “It is generally accepted that there is a high rate of correlation between economic freedom and economic growth. The more of freedom and lower taxes, the higher economic growth”, Petr Koblovský emphasises.

The macroeconomic prognoses of respected institutions indicate good times for the Czech economy. However, we had the experience with irresponsible fiscal behaviour of the government between 2000 and 2006, when both the Czech economy and the Czech public debt were boosting. The economic growth creates the scope for government to lower governmental expenditures – politicians should use these years for implementing a conceptual solution to the fiscal balance problem.

A fiscal balance is a result of the stable tax environment, which itself is the reputable value for domestic companies, investors as well as for taxpayers. Jiří Schwarz, chairman of the Academic Board of the Liberální Institut, warns: “You won’t create economically competitive environment by restrictive regulatory measures or by excessive legislative activity. The effort of entrepreneurs and managers of companies to do tax optimization is authentic and economically advantageous. Although it often doesn’t go only for tax rate but also for administrative burden against the state authority. The overall entrepreneurial conditions, with law enforcement as their integral part, are important for the economic growth of the country and for the growth of welfare of its inhabitants. From this point of view, the tax competition, and also institutional and administration competition, is not a threat, but a challenge”.

Liberální Institut is a non-governmental, non-partisan, non-profit think-tank founded in February 1990. The aim of LI is to promote development, dissemination and application of classical liberal ideas and programmes by publishing papers, conducting educational projects and releasing publications in the Czech Republic and abroad. The director of Liberal Institute is Petr Koblovský.