On June 6, the demolition of the Kakhovka dam by russians led to the flooding of a large area. In addition, there were problems with access to water for the population and enterprises of several regions. Metallurgical enterprises in the Dnipropetrovsk oblast, particularly in Kryvyi Rih, were forced to suspend production and only later in June resumed their activities. As a result, metallurgy and iron ore extraction output worsened compared to May.

The government urgently allocated UAH 1.5 bn from the budget to construct a water pipeline designed to solve the problem of water access in the country’s South. Otherwise, according to official estimates, some cities may run out of water at the end of July.

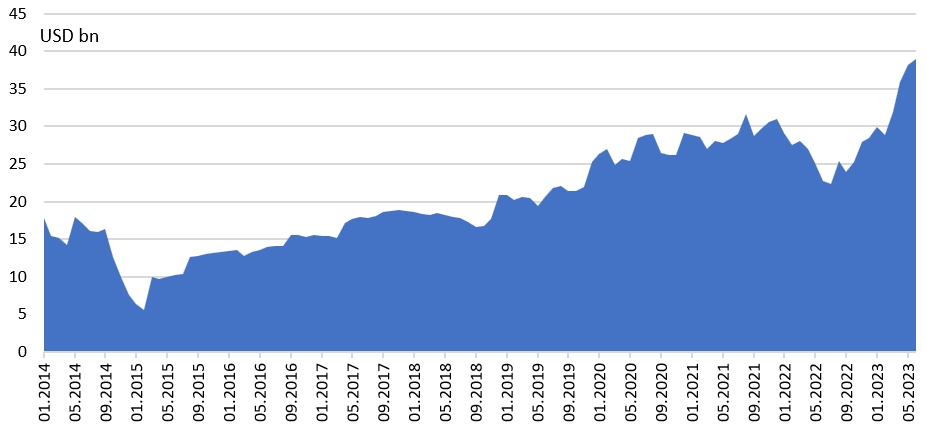

According to the IER estimate, real GDP grew in June by 15.3% yoy (year-on-year) after increasing by 20.9% yoy in May. Please note that we have revised our previous estimates for the first five months of 2023 to take into account new data from the State Statistics Service on the state of the economy in January-March 2023: flash estimate of the real GDP drop by 10.5% yoy in the first quarter (according to our assessment, the decline was about 13% yoy) and indicators of industrial and construction output.

In June, in contrast to January-May, agriculture covers crop production: according to our estimate, real GVA in agriculture increased by 3.4% yoy. Further recovery in several manufacturing sectors, in particular machine building and food production, from a low statistical base last year kept the growth in this sector at about 20% yoy. At the same time, the GVA in manufacturing remained significantly lower than the 2021 level. The real GVA in the extracting industry was estimated to be close to last year’s. At the same time, the energy sector showed worse results than last year due to repairs of blocks on nuclear power plants. Real GVA in trade and transport is estimated to continue fast growth from a low base.

Figure 1: Contributions to real GDP, p.p.

Source: IER assessment, made with the support of the USAID Program “Competitive Economy of Ukraine.”

Energy: Power Grids Repair Campaign Is Ongoing

Electricity

According to the Ministry of Energy, Ukraine is undergoing the most extensive repair campaign in the energy sector since independence to prepare for the new heating season. Many power units are shut down for repairs, so the system does not have enough power to meet the needs of consumers in the evening hours.

In June, Ukrenergo called on Ukrainians to limit electricity use from 19:00 to 22:00, but this did not happen. In the first days of July, evening consumption increased by 9% compared to June, and the evening peak shifted to 16:00 – 23:00. In “Ukrenergo,” such a jump is explained by the increase in air temperature and the use of air conditioners. Emergency imports cover the deficit of electricity. Cases of accidents in the network have become more frequent.

In mid-June, Energoatom reconnected after repairing a 1,000 MW power unit of one of the Ukrainian nuclear power plants to the grid, which allowed the nuclear generation to produce almost half of the electricity (46%) in June. Thermal generation supplied about 32% of all electricity, RES – 11%, and hydro generation – 10%. Due to the Russians’ destruction of the Kakhovska HPP, hydro generation produced less electricity than planned: Dniproges-1 and Dniproges-2 HPPs were forced to work with restrictions.

Tariffs

On June 30, the National Commission for State Regulation in the Energy and Utilities Sectors (NERC) set new maximum prices for electricity for businesses. In the evening consumption peak, from 19:00 to 23:00, the upper limit price increased by 80% to UAH 7,200/MWh. Electricity prices on the day-ahead market and the intraday market also rose.

Producers of “green” electricity do not receive funds for their products. In June, the level of payment by the SE “Guaranteed Buyer” with producers was only 42.3%, the lowest indicator since August last year. Generally, during the first six months of the year, “green” investors did not receive about 50% of the funds for the produced “green” electricity. This level of underpayments also existed in 2022. At the same time, the indebtedness of Ukrenergo to Guaranteed Buyer amounted to UAH 21.5 bn and increased by 15% compared to the previous month. Non-payments on the energy market threaten the stability of the entire energy system.

Figure 2: Level of payments for electricity with producers according to the “green” tariff, %

Gas

The gas transfer point “Oleksiivka” became operational for inflow on the interstate connection with Moldova. NERC approved a tariff of USD 4.45 per 1 thousand cubic m, which is standard for transmission points on the western border of Ukraine. The new gas point will expand Moldova’s ability to store gas in Ukrainian underground storage facilities and provide access to the EU market for further import through Ukraine. In the new gas season, Ukraine offers more than ten bcm of underground gas storage facilities and a flexible gas transportation system that provides more than 100 transportation routes between gas storage facilities and European borders.

In June, Ukrgazvydobuvannya (UGV) launched three wells with a total output of 425,000 cubic meters of gas per day. Two are new, and the third was revitalised after a significant renovation. In the first half of 2023, the company put into operation 11 highly productive wells with an output of more than 100,000 cubic meters per day each. For comparison, UGV produced 12.5 bcm of gas in 2022 or about 34 mn cubic meters per day.

Transport: Railway Is Increasing Volume of Transport

Sea transport

Russia refuses to inspect ships heading to Ukrainian ports for loading. From June 1 to July 10, out of the planned 150 inspections of vessels (both inbound and outbound fleet), only 70 occurred due to the refusal of the Russians to carry out checks. Since the beginning of July, six ships have left Black Sea ports. In total, only 215,000 tons of agricultural products were loaded onto them. The Pivdenny port has been closed for over two months because Russian inspectors do not approve ships heading there.

During June, 3.9 mn tons of agricultural products were exported, of which 2.0 mn tons came through Odesa ports and 1.9 mn tons through Danube ports. According to preliminary news, on July 14, Russia agreed to extend the grain agreement. At the same time, as June figures show, the agreement’s effectiveness for grain exports remains in question.

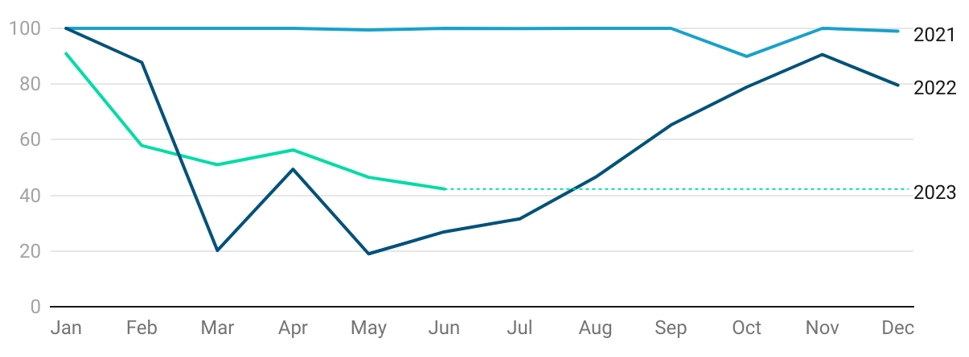

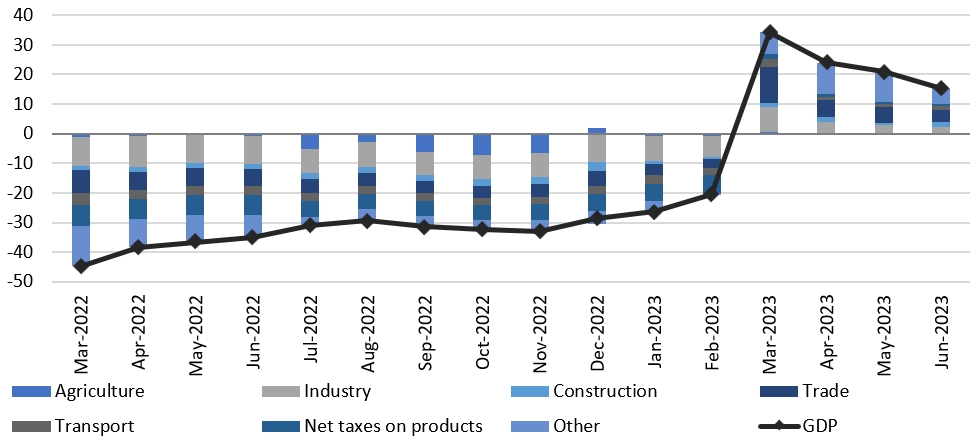

Figure 3: Number of inspections of vessels passing through the “grain corridor” (moving average for 7 days)

Source: Black Sea Grain Initiative Vessel Movements https://data.humd a ta.org/dataset/black-sea-grain-initiative-vessel-movements

Railway Transport

During June 2023, the railway transported 12.4 mn tons of cargo. This amount is 8% more than in May and 32% more than in June 2022. Domestic cargo transportation in June 2023 increased by 41% yoy to 7.9 mn tons, and export transportation increased by 24% yoy to 4 mn tons. Grain and ore were the most popular goods exported by rail (36% each of the total rail export volumes).

In the structure of general cargo transportation in June 2023, the leaders are construction materials, coal, cereals, iron, and manganese ore. Thus, transportation of building materials in June increased by 87% yoy, coal by 16% yoy, cereals by 48% yoy, iron and manganese ore by 3% yoy.

As of June 2023, queues of freight cars at the western border crossings were reduced to 6,600 wagons, including 1,000 wagons with grain. This queue is for several days, although the waiting time varies depending on the load of the crossing point. Among the ports, the situation is the most difficult in the direction of the Izmail port, where the queue is more than 6,500 wagons, including 2,000 grain wagons. Instead, the number of wagons with grain moving in the direction of the ports of Greater Odesa decreased to 819 units. This reshuffle happened because Russia has blocked inspections of the incoming fleet within the “grain corridor” since June 29.

Automobile Transport

As of June 30, about 3,800 trucks are waiting in the electronic queue to cross the border at 16 international automobile checkpoints. Last month, this figure was 15,000-16,000 trucks. During June, 190,000 tons of agricultural products were exported by road transport. This is the lowest figure since April last year.

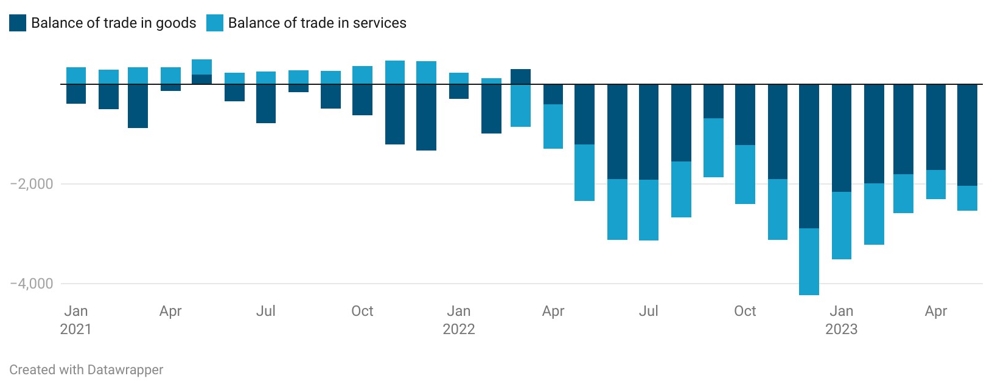

International Trade: Deficit in Trade in Services is Gradually Decreasing

In the first five months of 2023, Ukraine exported goods and services worth USD 22.4 bn, 9% less than in the first five months of 2022. The reduction occurred primarily in goods exports, which fell by 12% yoy, while the decline in services exports was only 2% yoy. The pace of export recovery after March 2022 low is languid in 2023. That happens due, in particular, to the instability of the Black Sea Grain Initiative and restrictions on food exports to Poland and several other Western neighbours of Ukraine. The restrictions were introduced in April and are still in place for several essential goods.

Imports of goods and services in January-May 2023 amounted to USD 36.6 bn, 23% higher than in January-May 2022. The increase was ensured by a 24% yoy increase in the imports of goods and a 19% yoy increase in services.

Figure 4: Trade in goods and services of Ukraine, 2021-2023, USD bn

Accordingly, the deficit in trade in goods and services for the first five months of the year amounted to USD 14.2 bn, which by USD 9 bn exceeds the deficit for the same period last year, while it differs only slightly from the amount of the last five months of 2022.

Starting from March 2023, there is a noticeable reduction in the deficit of trade in services, which became a defining feature of trade in services in 2022 against the background of multi-million emigration and, accordingly, a rapid increase in the imports of services related to living abroad (expenditures of Ukrainians abroad are counted as imports of travel services). If in January 2023, the deficit in service trade peaked at USD 1.4 bn, in May, it decreased to USD 0.5 bn thanks to the gradual recovery of exports of services, particularly transport, against the background of a reduction in imports, particularly “travel” expenses.

Figure 5: Deficit in trade in goods and services, 2021-2023, USD m

In January-May 2023, the deficit of the current account of the balance of payments amounted to USD 1.4 bn. A significant deficit in trade in goods and services, as well as income payments from foreign investments, were compensated by the receipts of grants from international donors (USD 7.0 bn) and wages of Ukrainians working abroad (USD 4.9 bn), which allowed to form a surplus of primary and secondary incomes.

State Budget: Continued Dependence on International Aid

Budget

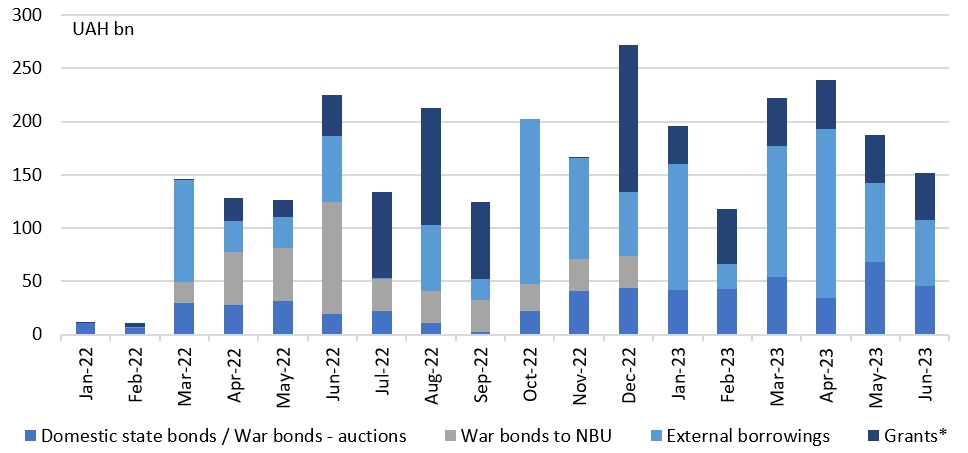

In June, budget revenues were lower than in May, when they were supported by dividends from the Privatbank and the payment of corporate income tax. At the same time, Ukraine received a grant from the USA at USD 1.2 bn and from Finland (USD 15 m), which are included in budget revenues. According to the preliminary data of the Ministry of Finance, tax revenues were over-executed by 1.1% of the plan. The pace of income growth compared to the corresponding period of 2022 slowed down due to the statistical base effect.

Gross revenues from VAT increased by 31.2% yoy due to both consumption recovery and inflation. The government continued refunding VAT, while no information on refund arrears is publicly available. The recovery of imports, the hryvnia devaluation, and inflation explain the surge of VAT revenues from imports by 2.4 times. Further financing of the military and some, albeit fragile, recovery of the labour market contributed to income growth from personal income tax.

Traditionally, the most extensive funding has been for defence and security expenditures. At the same time, the government continues to pay social obligations, such as pensions and various social benefits, on time and in full. At the same time, the Ministry of Social Policy emphasises the need to change approaches to providing social assistance: transition from support through a lifetime to stimulation of active participation of vulnerable population groups in society in general and the labour market.

As in previous months, social spending and salaries were primarily financed by international grants and soft loans. In June, the EU provided another tranche of concessional loans for EUR 1.5 bn. At the same time, the placement of domestic government bonds decreased. In total, the government attracted UAH 45.4 bn from bonds in June compared to UAH 68.6 bn in May due to lower placements of securities denominated in foreign currency.

Figure 6: Funding and grants received in the state budget, UAH bn

Note: * grants are part of budget revenues, which are accounted for under the code 42000000 “From the European Union, foreign governments, international organisations, donor institutions.”

International Support: Lots of Support Has Been Promised in London

London

During the Ukraine Recovery Conference, which took place in London on June 21-22, various donors announced their intentions to support Ukraine in the future. The President of the European Commission announced an aid package of EUR 50 bn. Such large numbers were not heard from other donors.

But, after a long delay, the USA came close to paying USD 1.3 bn in support for the reconstruction of infrastructure allocated in December 2022 by Congress. The UK promised to provide USD 3 bn in guarantees for World Bank financing. Funds will also come from the EIB (EUR 840 m) and the EBRD (EUR 600 m): funds from the banks will not likely go to the state budget but to the private sector and municipal projects. Also, at the end of June, the World Bank announced its readiness to provide USD 1.5 bn under the guarantee of the Government of Japan.

The EU

Several days before the Ukraine Recovery Conference in London, the European Commission announced an extensive support package for Ukraine for EUR 50 bn for the next four years. It is important to note that this is an initiative that the European Parliament and EU countries are still to approve. The EU countries should unanimously vote for the proposed changes to the multi-year EU budget. At the same time, if approved without significant changes, the predictability of Ukraine’s support will increase since, so far, the macro-financial assistance program provides regular monthly loan tranches only until the end of 2023.

78% of the total amount will be budget support through grants and concessional loans. Another 16% is investment support, including war-risk insurance for investors. The other 5% should be allocated for international technical assistance and other purposes.

At the same time, funding will be provided based on the results of implementing the Economic Development Plan of Ukraine for the next four years. Its draft Ukraine plans to prepare in September, most likely, before the EU decides on the support package. The plan should include detailed steps for rebuilding and recovery and a list of reforms to be implemented. The basis for the reform package should be the Association Agreement with the EU and other actions within the scope of Ukraine’s acquisition of EU membership. Therefore, after 2023, when the loan conditionalities are pretty mild, the government will have to fulfil a broader range of obligations in the following years.

The IMF

In June, the Executive Board of the IMF approved the first review of the IMF program, as a result of which, on July 3, Ukraine received the second tranche of a loan within the framework of the EFF program in the equivalent of USD 890 m. So, a total of USD 3.59 bn has already been received from the total amount of the program of USD 15.6 bn. The review report states that Ukraine met all quantitative indicators and structural benchmarks at the end of May. In particular, it refers to the submission or adoption of amendments to the Budget Code of Ukraine on the restoration of medium-term budget planning, better management of the public debt, and adoption of the Strategy for Easing Currency Restrictions.

The deadline for adopting amendments to the Tax Code to restore the tax legislation to the changes introduced in the first months of the full-scale war was postponed to the end of July. This draft law was adopted in the parliament and sent to the President for signature. Also, the deadline for adopting the Mid-Year Strategy for State Debt Management has been postponed by one month − until the end of October 2023.

Four new structural benchmarks have been added to the IMF program, three of which relate to fiscal policy. By the end of September, the provisions of the Budget Code on the restoration of medium-term budget planning and the reduction of risks from the state-guaranteed debt should enter into force.

Also, by the same deadline, the government must develop a concept for changes in the “5-7-9” affordable credit program, which should then focus on supporting SMEs with gradual phasing out of support for large companies, and include effective monitoring. By the end of October, the Ministry of Finance, the State Tax Service, and the State Customs Service should adopt reform action plans, which will become the basis for developing the National Revenue Strategy. The only additional non-fiscal structural benchmark envisages appointing the Supervisory Board of the GTS Operator by the end of October 2023.

The next review of the program should take place in mid-October 2023. Its success will mean that Ukraine will be able to receive another USD 890 m to the budget. By then, Ukraine promised to complete nine structural benchmarks and be in the final stages of implementing four more.

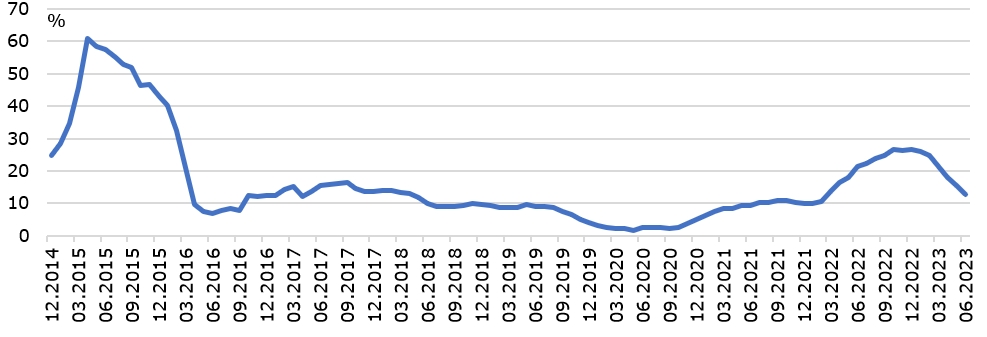

Inflation: Prices in June Remained at Level of May without Taking into Account the Increase in Electricity Tariff

In June, inflation slowed to 12.8% yoy (compared to June 2022), the lowest rate since the start of the full-scale war. 12-month inflation finally stopped taking the rapid rise in prices in the first months of the full-scale war in the calculation. At that time, the consumer price index increased by 3-4% monthly.

In contrast, the CPI rose by an average of 1% each month over the past 12 months. The slower price increases were due to the limited purchasing power of consumers and the stable exchange rate of the hryvnia, which restrained the growth of import prices and contributed to the reduction of inflationary expectations.

Figure 7: Consumer price inflation

In June, the CPI increased by 0.8% mom (to the previous month). However, this included an 83% increase in the electricity tariff for most households and 57% for those consuming more than 250 kWh. After deducting the change in the price of electricity, consumer prices in June remained unchanged on average, i.e., the decrease in price for some goods and services offset the increase in the price of others.

In June, fuel prices continued to fall in line with global trends, although the resumption of pre-war fuel taxation from July 1 is likely to reverse this trend. Among food products, the prices of cereals and oil continued to decrease on the back of large stocks, but the prices of meat and meat products continued to grow at high rates. There was also a seasonal decrease in the prices of clothes and shoes and a seasonal increase in the prices of potatoes.

Monetary Policy: NBU Maintains Strategic Ambiguity Regarding Return to Floating Exchange Rate

To fulfil its obligations under the IMF program, the National Bank of Ukraine approved the Strategy for Easing Currency Restrictions, transitioning to greater exchange rate flexibility, and returning to inflation targeting. On July 7, the NBU released a “public version” of this Strategy, which explains some details of the NBU’s plans for currency liberalisation, but generally remains unclear about how this process will occur. This uncertainty was probably introduced to avoid speculation, but it also limited the information content of the released document.

However, several interesting points can be highlighted in the NBU document. The NBU plans to eliminate the multiplicity of exchange rates, i.e., the significant discrepancy between the card, cash, and non-cash hryvnia rates, before the fixed exchange rate on the interbank foreign exchange market is abolished. The gap between different exchange rates of the hryvnia against foreign currencies has narrowed.

Nevertheless, it still exceeds the threshold of 2%, which defines multiple currency practices under the IMF definition. The document also indicates that the flexibility of the exchange rate will not be restored in one go but gradually. That points to the likely introduction of an exchange rate corridor before the complete abandonment of the hryvnia peg to the dollar.

The document also specifies that the remaining restrictions on trade operations will be removed first, then the rest of the limits on current operations, and finally, the liberalisation of the financial account of the balance of payments will take place. According to the NBU, the transition to new liberalisation stages will depend on achieving the NBU’s predetermined goals for macroeconomic stabilisation. These goals include reducing inflation, increasing international reserves, sufficiently high-interest rates in the hryvnia, and maintaining financial stability.

However, the specific values of macroeconomic indicators are not announced, and the NBU also emphasises that, if necessary, the order of measures may change, and liberalisation may be suspended or partially cancelled in the case of a worsening economic situation.

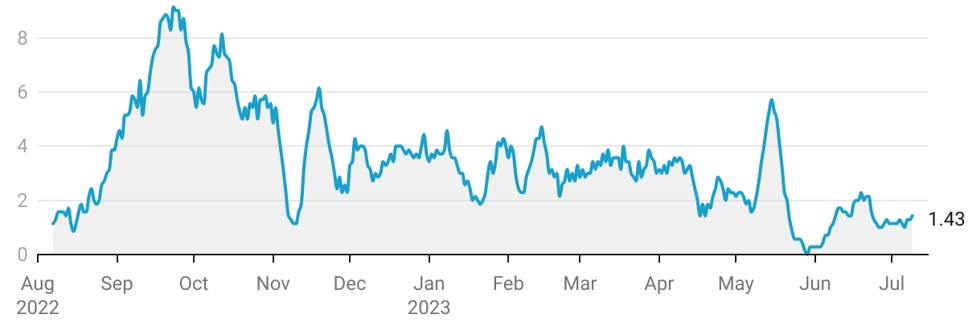

Against the background of planning future steps to liberalise the hryvnia exchange rate, the NBU’s international reserves set a new maximum of USD 39.0 bn at the end of June in nominal terms. They reached the highest value in 10 years if adjusted for the change in the purchasing power of the US dollar. As a result, reserves can finance more than five months of imports. This result became possible thanks to the regular receipts of aid from the EU, the US, and other donors, which exceed the costs of maintaining a fixed exchange rate. In the first half of 2023, the NBU spent more than USD 12 bn on interventions in the foreign exchange market.

Figure 8: International reserves

This publication was prepared by the Institute for Economic Research and Policy Consulting with the financial support of the European Union. Its contents are the sole responsibility of the Institute for Economic Research and Policy Consulting and do not necessarily reflect the views of the European Union. The MEMU is for informational purposes only. The judgments presented in this publication reflect our point of view at the time of publication and are subject to change without notice. Although we have made the most thorough efforts to prepare the most accurate publication, we do not take any responsibility for possible errors. The Institute shall not be liable for any damages or other problems that have arisen, directly or indirectly, due to the use of any of the indicators of this publication. In the case of a citation, a reference to the Institute for Economic Research and Policy Consulting is mandatory.

Written by: Oleksandra Betliy, Iryna Kosse, Vitaliy Kravchuk, Veronika Movchan

Continue reading:

Keep Your Chin Up: Economic Trends in Ukraine from Business Point Of View