Last July, the European Commission presented a proposal for a directive aimed at reforming the taxation of energy products and electricity. This proposal is part of the European Union’s (EU) efforts to reduce emissions and air pollution.

In its official position, the EU argues that the current taxation set-up favors the use of fossil fuels and that the current state of taxation “does not take into account their environmental impact”. The increase in the tax burden is intended to ensure that negative environmental impacts are financially compensated for and to make fossil fuels a less attractive source of energy.

Is It Really the Case That Fossil Fuels Are Being Favored?

Fossil fuels are already burdened by excise duty on mineral oils. Historically, this tax has been perceived as motorists paying for the transport infrastructure they use. Later, the rationale was added that this tax pays for the negative externalities caused by the operation of cars.

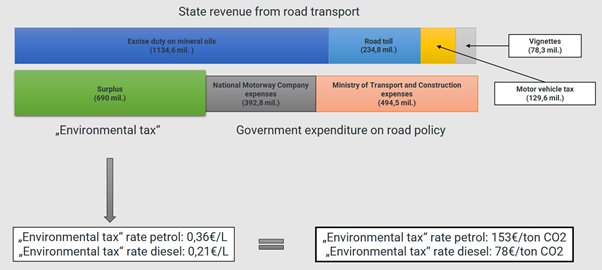

In this study we look at the actual own expenditure of the state budget and the National Motorway Company on building and maintaining transport infrastructure. New infrastructure financed from EU funds has been excluded, as these resources are prepaid by membership fees paid by each country and partially funded from cohesion and solidarity of richer countries.

If we consider all payments by motorists (tolls, motorway tolls, stamps, etc.), only one third of the excise duty is used to finance roads.

Almost two thirds of the excise duty can be considered as a tax that meets all the characteristics of an environmental tax.

If we convert this part of the excise duty into the CO2 emissions caused by the burning of petrol and diesel, we find that a rate of EUR 78 per ton of CO2 is imposed on diesel and a rate of EUR 153 per ton of CO2 is imposed on petrol. This is considerably higher than the current CO2 permit market price of €70-78.

It is therefore not true that motor fuels are being favored. The high excise duty is already significantly reducing fuel consumption, because, when added to the VAT, diesel is already taxed at 42% and petrol at 50% of the total price.

There is currently a debate in the EU on whether the current system of emission permits should be extended to motor fuels. Emissions trading aims to put a price on the social cost of burning motor fuels.

If emission permits (a form of emission tax) were to be introduced for fuels, the excise duty on motor fuels should be adequately reduced from an economic point of view. There is no reason why the same CO2 emissions from fuels should be taxed twice, both by excise duty and emission permits.

New INESS publication titled A new tax we’ve had for a long time is available in Slovak for free download here

Continue exploring:

Let’s Not Be Intimidated by Private Schools but Take Them as Opportunity

[PUBLICATION] Teachers’ Pay with Sober Head