Tax Freedom Day that is calculated and promoted by Liberalni Institut every year in the Czech Republic, was celebrated on Saturday, 9th June 2012. This result indicates six-day improvement compared to the last year, i.e. the Czech taxpayers must work 160 days to cover expenditures of the general government. In 2011, the obligation was 165 days (one day difference is due to leap-year).

Tax Freedom Day is an indicator that divides the year into two parts: the one when tax-payers work on coverage of public expenditures, and the second one when working for them. This interpretation is possible if we accept the following assumption: The state has no own money, only those from taxes and those from borrowing (these money will have to be repaid in the future, with interest). Acceptance of this assumption could not be big issue – this is reality.

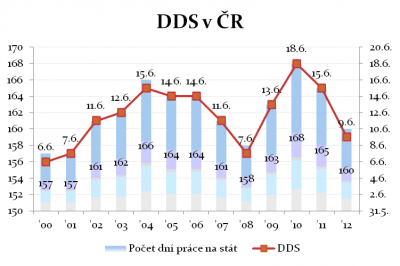

Graph: Tax Freedom Day in the Czech Republic (2000 – 2012)

Note: The left axis (blue columns) shows a number of days that must be worked for covering all government expenditures. The right axis (curve) indicates a date of the DFD.

Source: Own calculations.

As shown in the graph above, the difference between last year and this year’s Tax Freedom Day is 6 calendar days (as mentioned: leap-year explains one from that 6 days). Anyway, Tax Freedom Day shift toward the New Year is unambiguously positive because it indicates the appetite of public institutions to spend taxpayers’ funds is relatively smaller. The shift of the TFD confirms cuts made by recent government in the fiscal area resulted in greater freedom of domestic taxpayers. But, immediately after saying this, it must be noted we still have many examples to catch up. The tax freest OECD country is, as regularly, South Korea. The Tax Freedom Day was celebrated on 23rd April, i.e. 47 days earlier than in the Czech Republic. In early May, the TFDs were welcomed in Australia (May 4th) and in Switzerland (May 6th). Taxpayers in our traditional benchmark country, Slovakia, have also more reasons to celebrate (1st June). So we can safely say there is still a space for real system fiscal adjustments, which, important to say, must be distinguished from improvements via accounting tricks.

To be complete, let‘s focus on the other end of the scale of tax free, or rather unfree countries. Denmark, as usual, closes the ranking with the Tax Freedom Day in August (on 12th Aug 2012). Taxpayers have to work 224 days to cover government outlays there. From the end of the ranking, we should mention even France (the second unfree country – 24th July) and Sweden (the third unfree country – 13th July).

More information is available on the brand new website www.dendanovesvobody.cz. (Note: all content is in Czech)

3 Comments

Nice collection about Tax Freedom Day 2012 in the Czech Republic – 6 days earlier than in 2011.

about Tax Freedom Day 2012 in the Czech Republic – 6 days earlier than in 2011.

Unfortunately Tax Freedom Day in Hungary is two weeks later than in 2011

Tax Freedom Days in EU : http://borcsok.tumblr.com/post/26337521303/mennyit-is-adozunk-es-az-eu-hoz-kepest-az