Right from the start of the Great Recession the current account deficit shrunk with 62% in 2009, got to the relatively low level of 376 million euro in 2010 (around 1% of GDP) and turned into surplus of 361 million euro (close to 1% of GDP) in 2011. By doing so, all experts, who continuously scared the people with this “huge current account deficit”, which we were suppose to believe was extremely dangerous for our economy, have been proven wrong (at least in their reasoning). These warnings were frequent, although our balance of payment was positive and our currency reserves grew rapidly.

It is now clear, that the one-time adjustment of the external balance to a new equilibrium, which included a positive balance on the current account, was achieved extremely fast and harmless with the sudden decline in the capital inflow and the demise of the economic growth. It is also clear, that in the Bulgarian case, what we should worry about is not the current account deficit, but quite the opposite – its absence. The periods without deficit are exactly those in which our economy is in recession or grows very slow at best.

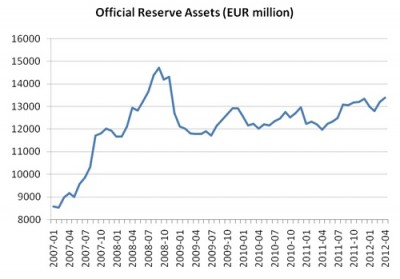

What’s more interesting is how the “new realities” in the balance of payment affected the other elements of the external balance – the currency reserves and the external debt. Contrary to the expectations, the disappearance of the current account deficit did not lead to a sharp increase in the currency reserves, but quite the opposite. The reason was that the current account deficit was caused in the first place by the inflow of foreign capital, which supported the currency reserves.

Source: Bulgarian National Bank

If we look at the dynamics of the currency reserves before and after the crisis, a visible trend emerges of serious decline by almost 2 billion euro in the period between the last quarter of 2008 and the middle of 2009. This is exactly the moment in which the crisis hit Bulgaria. After that, the foreign reserves are relatively stable between 12 and 13 billion euro, and even more so in the last several months as the reserves go above 13 billion euro.

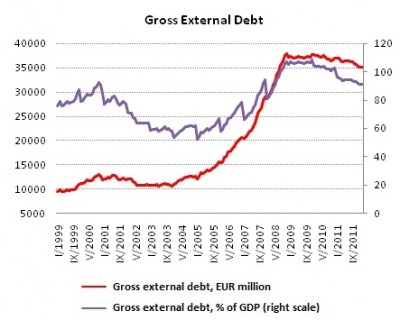

Source: Bulgarian National Bank, IME estimations

On the other side, the external debt, which is a result of the external balances, shows stable declining tendency from the beginning of the crisis, i.e. the Bulgarian economy goes through a process of freeing itself from the debt (the so called “deleveraging”). The foreign debt reached its peak of 37,9 billion euro (107% of GDP) in November 2008. From this point onwards a slow and uneven process of declining began, which continued in the beginning of 2012. As in the end of March 2012, the debt is little above 35 billion euro or approximately 91% of 2011’s GDP.

It deserves mentioning that the decline of the debt comes from the short-term debt in the banking sector. This means that with the end of the credit boom, which was financed with loans from sources outside the local banks, these loans had to be paid off, which leads to their net decrease. Despite all that, the total debt, as well as the debt of the banks is still far away from the levels before the crisis.

As an example, the total gross external debt at the moment is the same as the one from the summer of 2008. The decline from the beginning of the crisis until now has managed to erase debt, which was accumulated for a period of only 4-5 months. Considering these rates of debt deleveraging (around 3 billion for 3 years), Bulgaria must stay in recession/stagnation at least two and a half decades in order to reach the levels of debt before the boom. It is clear, that this is unrealistic and the levels of the external debt will go back to 100% in the long run.

If we have to summarize, our external balances went through a logical and expected adaptation from the beginning of the crisis to the present moment. The deficit on the current account turned into surplus and the gross external debt of the economy decrease by around 16% of GDP compared to its peak value. Taking into account our insufficient internal savings, swift growth of the economy is unlikely scenario, without the inflow of foreign capital – FDI and loans. What’s left is to hope for new worsening of our external balances.

No comments

Be the first one to leave a comment.