20 April 2012 is the day when Bulgarians, figuratively speaking, stop working for the government and start working for themselves. This day is called Tax Freedom Day. In 2012 Bulgarians will need to work nearly four months only to pay their taxes and fees to the Government, thus reaching the budget’s revenue target for the year.

In Bulgaria, this day traditionally is somewhere in May and its early appearance in the last 3-4 years is largely due to the emergence of budget deficits. In other words, the state seems to confiscate less, but it still spends as before – at the expense of accumulated reserves and new debts. If we continue with the symbolic calculation, then from 20th of April to 25th of April are the days when taxpayers will have to work extra for the state if the budget was due to be balanced – thus, five additional days to cover the deficit for 2012. In reality these 5 days will be worked out in state’s favor sooner or later.

Methodology

The estimation methodology of this symbolic date is relatively simple – the consolidated revenues in the state budget are compared to country’s GDP, using only official data or government forecasts. We exclude from the revenues all the grants, which are mainly money from the EU – thus from the European taxpayer. The revenues rather than expenses are used because they show what is actually taken from citizens or business during the year. In 2012 Bulgarians will averagely produce 223 million levs everyday, measured by projected GDP (as estimated in Budget 2012). Therefore, around 111 days will be needed to reach the expected 24.8 billion revenues in the budget.

The use of official government forecasts is the most correct way to make this calculation, which does not mean that reality will be exactly the same. For example, when calculating the date for 2010 we also used official estimates, but they seriously clashed with the reality – the collapse of the revenues and the emergence of deficit moved the day much earlier.

Early Celebration?

The focus on revenues gives somehow false sense of more freedom. In the course of the crisis the revenues from VAT, excise duties and corporate tax were severely affected, which additionally moved the date earlier. Only revenues from labor taxes (income tax and social contributions) remained relatively stable.

If we ignore the revenues, closer look at tax rates reveals that the picture is quite different – preserving the basic taxes such as VAT, corporate and income tax, but increased social contributions and minimum thresholds, increased excise duties and property taxes, as well as high quasi tax burden. All this comes to show that conscientious taxpayers lose their freedom, often at the expense of others who are “distracted” and not paying.

And yet, every Bulgarian citizen pays to the treasury in one way or another. Most days from 2012 we will spend to fill in VAT revenues – 32 days. Revenues from excise duties would take us 19 days. For social contributions we will need 25 days – 17 days for social security (pension mostly) and 8 days for health contributions. Revenues from income taxes we will fill in for 10 days and those from corporate taxes in 7 days. Property taxes would cost us 3 days. Fees also need to be considered – more than 7 days will be needed to match the revenues from national and local fees.

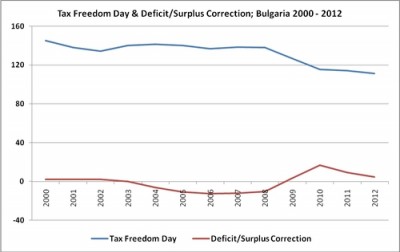

The chart above shows the day of freedom from government down the years (in blue) as well as the so-called deficit/surplus correction – the effect on the day if the budget was balanced. If there is a surplus, then taxpayers would have worked extra for the state, thus they have paid taxes, the revenues from which were not spend by the government – these days are represented by the red line in negative values.

If there is a deficit, then taxpayers will sooner or later work out what was already spent; these are the positive values of the red line. Placing the lines one over another, they indicate that the picture in recent years has not changed significantly, i.e. we are not getting more freedom from the government, despite the shift of the day earlier.

No comments

Be the first one to leave a comment.