We’ve been walled up. Greece has government but money is still missing. Which German team will win the European Championship? FED playing games, another package is postponed. How many Olympic medals will the EU-funded United Nations of Europe get?

Let’s start from the end, namely from what happened last week. Eurozone is on fire and Europe instead of putting it down, sets up a bailout firewall. Slovak MPs just placed us on the wrong side of this wall. We won’t escape easily (cheaply) anymore.

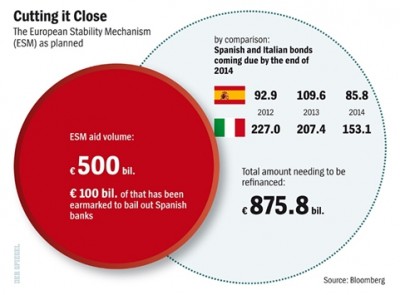

And the firewall is too small anyway.

We can still be saved by the German Constitutional Court, which is investigating ESM, or by the German parliament which will vote on the bailout mechanism at the beginning of July.

We learnt last week that the winning party of the Greek elections, „pro-bailout“ New Democracy, will rule in coalition with PASOK and Demoratic Left. Leader of New Democracy Antonis Samaras was appointed Prime Minister. New government will ask European leaders to postpone the public finance deficit target at the level of 3% by two years; such a step will require additional 20 billion of European taxpayers‘ money. One worry vanished from Eurozone’s mind. It would be really difficult to send “rescue” money to one’s own banks through a country, whose political representatives are openly against Europe. Another default with the possibility of Grexit is postponed. What was not postponed was the match between Germany and Greece. Apparenly Angela had to come to see it.

Whatever the result was, the game was to be won by a team sponsored by German taxpayers. Here you can see a trailer from the game:

http://www.youtube.com/watch?v=ur5fGSBsfq8

There were elections also in France. Socialists gained the absolute majority. The Minister of Finance Pierre Moscovici said: „now President Hollande and Prime Minister have necessary support to carry out project of radical change.“ We will soon know how much this project will cost us when the French banking sector gets a loan from ESM or another instrument of mass solidarity.

Poor Europeans. Everyone judges them, criticizes, and advises what and how. At the G20 meeting in Mexico President of the European Commission, former Maoist Jose Manuel Barroso, couldn’t take it anymore. After he called for other countries of G20 to contribute more money to the common cash box of the International Monetary Fund to save Europe, Canadian journalist asked him why North Americans should risk their money to help Europe. Barroso exploded: “Frankly, we are not coming here to receive lessons in terms of democracy or in terms of how to handle the economy because the European Union has a model that we may be very proud of.” Well-being and security at somebody else’s cost? Barroso reminded the journalist that crisis came to Europe from America, European banking sector was contaminated by “unorthodox practices from some sectors of the financial market.” Who knows why European bankers were so eager to buy on US market and why American FED in its saving operations in the year 2008 was saving to a big extent European banks.

Maybe somebody could brief Mr. President and explain him the basic rule of successful fundraising: when asking somebody for money, don’t insult him right in the face, regardless of what you think about him.

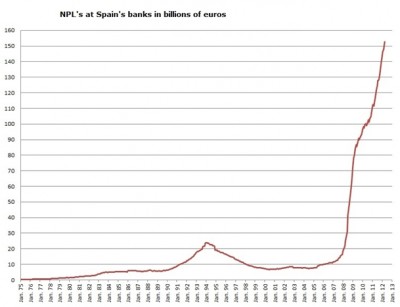

Spanish Minister of Finance Cristobel Montoro calls ECB to act „decisively and reliably“ on the increasing interest rates of the Spanish debt. Spanish bad loans reached 8.72% out of whole amount of loans of commercial banks, which is the highest percentage since 1994. If you are still breathing, look at the total numbers of delinquent loans. The euro-blown megabubble is easy to see.

Italians are smirking at the treasure chest as well. They are suggesting semi-automatic bailout mechanism – when the interest rates on their public debt reaches a previously defined level, they would automatically receive aid from ECB ( bonds purchase) or from ESM without any conditions. What do Germans say to that? „Nein!“

ECB is discussing possible emergency measures to fight against the crisis. Among the proposals there is an idea that central bank should ignore rating of other agencies and rate state bonds on its own. At the same time it is discussed to lower the requirements for quality of the collateral required against loans for commercial banks, which are using as a collateral for the loans from ECB basically anything, including even football players (Ronaldo sent Czechs home from the EURO championships, that will be reflected in the quality of collateral).

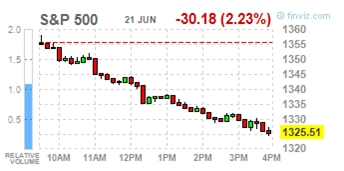

American central bank FED lied to the markets. At the last week’s meeting it didn’t approve QE3, only prolonging of the programme TWIST (sale of short-term American bonds and purchase of the long-term ones), which after all doesn’t increase the total supply of money by close to $100 billion. Reaction of the bonds‘ market „day after“ to the fact that the main dealer refused to provide monetary drug to keep the illusion, was straightforward.

The International Monetary Fund warns that the euro crisis reached „critical stadium“ and calls for deeper integration and centralization of Europe. These are crucial news. As if it wasn’t clear to anyone just looking at Spanish or Italian bonds interest rates. Why they didn’t warn against these problems when introducing euro in Europe?

It has been clear for two years already that Europe faces radical changes. How they will be? It seems that there will be double investments into wrong idea of forcing against the will of the people integration of something that cannot be integrated. Transformation into United European States is discussed in Europe.

We don’t have good news. At least we have a cute animal. Doesn’t it remind you of Slovak foreign policy?

http://www.youtube.com/watch?v=CWgbmgIzoT8&feature=player_embedded

Do not let your weekend to be spoilt! Juraj Karpiš

No comments

Be the first one to leave a comment.