This week about how FED doesn’t want to leave alone the “Print” button and what you can go to jail in Argentina for. In Europe, we will have a look at the biggest default in the history, hope that German Luftwaffe won’t take off, we mention Iron Lady and make fun of the new title Kill Bill Saving EU.

Only a few days of falling stock markets after the press conference, when the governor of the American central bank FED announced no need for further round of quantitative easing (QE), were enough to have QE back on the table. FED announced possibility of further QE, this time a “sterilized” one. FED considers using newly printed dollars to buy American long-term bonds and then to withdraw the new money via short-term borrowing. Its aim is to reduce long-term interest rates. Jim Grant describes impact of further QE in this interview. Among other things, he mentions that capitalism would be a good alternative to the system which we have today.

Only a few days of falling stock markets after the press conference, when the governor of the American central bank FED announced no need for further round of quantitative easing (QE), were enough to have QE back on the table. FED announced possibility of further QE, this time a “sterilized” one. FED considers using newly printed dollars to buy American long-term bonds and then to withdraw the new money via short-term borrowing. Its aim is to reduce long-term interest rates. Jim Grant describes impact of further QE in this interview. Among other things, he mentions that capitalism would be a good alternative to the system which we have today.

Not market supply and demand, but central banks have been the driving force shaping prices on capital and financial markets in last couple of years. That’s not all. “Central banks were created not only to maintain the stability of the currency but to finance the state…” said Argentina Central Bank Chief Mercedes Marco del Pont. If you use currency monopoly to finance the state, then before you realize it, you have to falsify the official economic numbers and to charge economists, who point out real increase in price inflation. It seems that Argentina, thanks to its monetary policy abuse, is about to repeat the economic catastrophe from 10 years ago.

Iceland surprised again last week. After a wild ride of Icelandic króna Iceland considers outsourcing its own monetary policy by introduction of a foreign currency – dollar. No, not American dollar, but a dollar from a country with solid AAA rating – Canada (first sign of a twilight for American dollar as a reserve currency?). Sounds like a good idea. Monetary nationalism creates unnecessary economic costs and there is certainly no need to teach Icelanders about that. Super-inflationary monetary policy of their central bank led to monetary illusion and then to tough disillusionment, which consequences will cause headache for Icelanders for a long time more.

Let’s get back home, to Europe. ECB’s meeting didn’t surprise anyone when it left the key interest rate at the level of 1%. However, there is growing concern in the German Bundesbank about the size of ECB balance sheet and particularly about the risk of assets held by the central bank after the second round of LTRO. Former member of the ECB Executive Board Juergen Stark described the balance sheet as “gigantic”, and the quality of securities lending as “alarming”. Jens Weidmann, governor of the Bundesbank, requires specific safeguards for German claims within Eurozone’s plumbing system TARGET 2, which keep rising with the accelerating deposits outflow from periphery states to Germany. Such safeguards would mean German control over assets in Greece and Spain, which would serve as collateral on these claims.

Financial Times’ commentator Wolfgang Muenchau says that Germany could “send in the Luftwaffe to solve the Eurozone crisis”. The planes are not flying yet, but according to these signals it seems that Germany doesn’t consider the scenario of Eurozone’s dissolution to be impossible. Claims arising from TARGET 2 may become a problem only when Eurozone falls apart. If Bundesbank wants to insure itself, you should do the same.

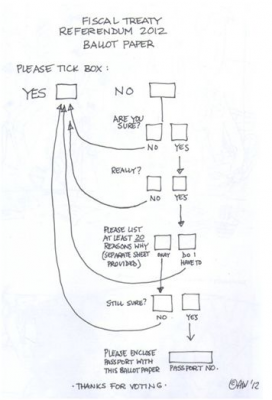

German opposition in exchange for support for the Fiscal Pact in the German parliament wants to introduce a financial transaction tax. So it’s not only that we will sign unnecessary international agreement (Do you know that the Stability and Growth Pact is still valid? And do you remember the “Six Pack” from December 2011?), which is a further step towards more intensive centralization, but we will also pay meaningless general tax, which will punish future pensioners instead of banks?

The Irish also want treats for YES in the referendum – writing off part of their  bank’s debt.

bank’s debt.

First major political party in the Eurozone, Dutch Party for Freedom, led by well-known populist Geert Wilders, called for a referendum in Netherlands about leaving the Eurozone.

The major event of the week was the ongoing default of Greece. Tender to exchange bonds ended with 85,8% of bond holders voluntary accepting the swap. It is less than expected 95% participation. Others will be therefore forced to exchange. This means default and a year of EU efforts to turn the whole matter into voluntary exchange will be vanished.

Greece bought over 1 bln euro worth of arms from EU countries in 2010, just when it was negotiating the first aid package.

People in Greece, who have been receiving pensions illegally, are asked to return the money, said Greek Labour Minister Giorgos Koutroumanis. 40,000 pensions were illegally claimed, in some cases people have been receiving the money for 20 years. Annual savings from cutting down the illegal pensions are said to reach 405 million euro.

Did you know that Greek default is the biggest default in history? Not the Greek history – the history of the world. Details of the second aid package are described here. Troika is already aware of the need for the third aid package for Greece, amounting to cca. 50 bln euro.

It proved right the former Slovak Prime Minister Iveta Radicova, who said in Brussels that another pot of money won’t solve the situation of indebted Greece. “This money didn’t help them, didn’t help at all. Everyone knows it. Neither will help these (loans) that are provided now. Let’s say it openly.” According to her, Greece will receive only a fraction of the money, majority will go to the banks, which provided loans to Greece. Money will go mainly to the countries, which agreed to help Greece. “These countries are making deals with themselves”. Isn’t pulling yourself out of water with your own hand by your own hair an exact definition of EFSF, for which approval she was ready to give up power?

Czech Republic (which was criticized by Radicova) and Great Britain said NO to the Fiscal Pact. “No, no, no!” was already said to EU by UK some years ago by a certain strong lady.

There are no toxic assets, only toxic prices, we wrote lately. The Irish market is already cleaning. This coastal hotel with 55 rooms was sold on an auction for 650 000 euro last week.

There are no toxic assets, only toxic prices, we wrote lately. The Irish market is already cleaning. This coastal hotel with 55 rooms was sold on an auction for 650 000 euro last week.

In June, „Mister Euro” Jean-Claude Juncker, “for the reason of time constraint” will give up the function of the Euro Group (ministers of finance of the Eurozone countries) head, which he has been leading since the year 2005. Together with the re-elected president Herman Van Rompuy they are now looking for a suitable successor. Maybe then there will be less lies in the European politics…

Deputy chairman of the European Commision Maroš Šefčovič is surprised how much disinformation concerning EFSF was in Slovakia before the March parliamentary elections. According to him, the whole deal was presented as an unnecessary charitable assistance to a member country, without realizing what bankruptcy of one country would mean for the whole European system…” In hardly any other country this discussion took such a grotesque shape as it happened in the discussion in Slovakia, said Šefčovič. The EU is not about charity, according to Slovak President Ivan Gašparovič it is about bargain: “If people knew how much money we could have had and how much more we can get, they wouldn’t find this EFSF so repulsive” answered Gašparovič. Here are exact numbers so that “people know”.

Popularity of the European Union among its citizens is gradually decreasing,  given the current problems and the way to tackle them. We can say that Brussels has a PR problem.

given the current problems and the way to tackle them. We can say that Brussels has a PR problem.

The European Commission agreed to improve the public picture of the Union. It launched a video popularizing the idea of Union enlargement with methods utilizing fear. In the video, a white woman is surrounded by three men: skew-eyed, bearded, and a black one. There were objections raised that the video has a racist undertone, so the Commission withdrew the video for 127 000 euros.

Have a calm weekend!

Juraj Karpiš

No comments

Be the first one to leave a comment.