Aleksander Laszek in cooperation with Dominika Pawlowska and Michal Goszczycki.

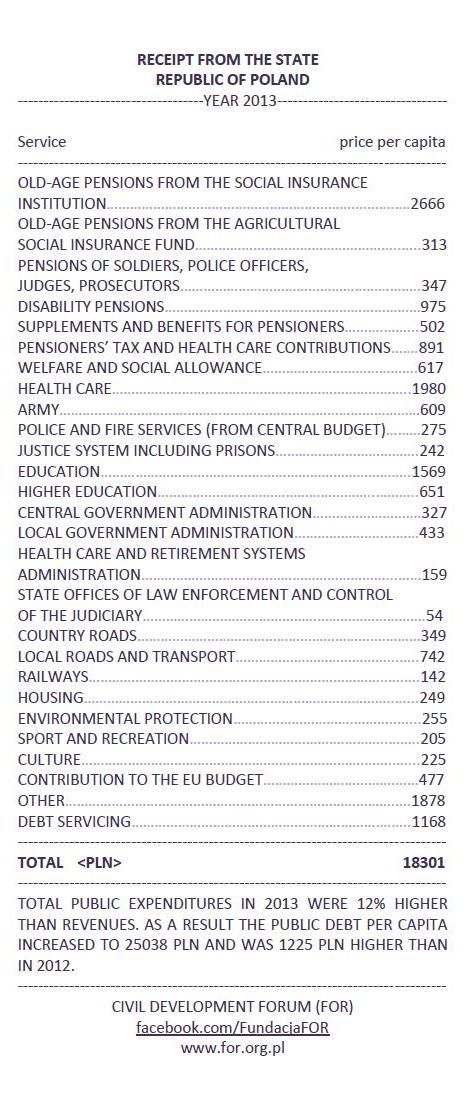

Having a tax statement in our hand, we can see how much income tax we have to pay for the year 2013. If we than come to a conclusion that this tax is too high it would be interesting to find out how this money is spent by the government. Many politicians talk eagerly about lowering the taxes, but only a few are eager to discuss lowering the government spending, even though that these are in fact both sides of the same coin. According to preliminary estimates in 2013 the government spending amounted to 682 billion PLN, which can be also portrayed as 18301 PLN for every citizen of Poland. The third issue of the Receipt from the state, prepared by the Civil Development Forum shows how this amount was spent.

It is important to asociate public spending not only with central government, but also with local government, National Healthcare Found (NFZ), public retirement funds and other public institutions. By the end of April some of the public institutions still have not published their detailed financial reports for the year 2013, and therefore our calculation should be treated as approximate. They are designed to present the scale of particular spending per capita. The idea of the Receipt from the state came from Slovakia, where it is prepared by INESS think-tank (In Poland similar calculations are carried out also by the Globalization Institute).

According to the initial calculations the receipt in 2013 was 207 PLN (1.1%) higher than in the year 2012. However, taking into consideration the high inflation rate (0,9%) it can be stated that there was just a slight increase of 0,2% (44 PLN). What is more, if we take into account the economic growth, we will see that the real level of public spending went down from 42.8% to 41.8% of the GDP. Such developments should be welcomed, because excessive public spending harm economic growth Despite the decline we cannot forget that the level of 41.8% of the GDP is still quite high, given the level of development of Poland.

Despite the common believe, the highest spending are not connected with the administration, but with the retirement system. In the year 2013 every Polish citizen spent on average 5694 PLN on pensions, including 2666 PLN on old age pensions from the Social Insurance Institution (ZUS – general system) and further 313 PLN from Agricultural Social Insurance Fund (KRUS). Disability pensions from both institutions add up to further 975 PLN and further 502 PLN is spent on various supplements and benefits. Pensions of judges, prosecutors, policemen, soldiers, who are excluded from general system cost additional 347 PLN. These amounts are on net basis and represent money that is received by the pensioners. The true expenses are in fact higher, however 891 PLN returns instantly to the government in form of healthcare contributions and income taxes paid by the pensioners.

After pensions the three biggest positions in the Receipt are education (2220 PLN), health care (1980 PLN), transportation (1233 PLN). The costs associated with education can be subdivided into primary and secondary education (1569 PLN) and higher education (651 PLN). It can be noted that overall the cost of pensions, education and health care are quite stable and eventual changes are to small to comment (as data are preliminary, such small changes can be due to estimation errors), but in case of costs of the road and highway system a huge decline is visible – from 607 PLN in 2012 to 349 PLN in 2013. This decrease can be linked with the conclusion of preparations for the EURO 2012 and the ending of 2007-2013 EU financial perspective.

The fifth highest expenditure on the bill is the spending on national security, both internal and external, which is 1126 PLN. It consists of spending on military (609 PLN), police and fire departments (275 PLN, the given amount applies only to the state budget) and on judiciary and penitentiary system (242 PLN).

Costs of public debt servicing come sixth amounting to 1168 PLN. During 2013 the public debt per capita increased by 1225 PLN to 25 038 PLN. The debt servicing is the most visible cost of high public debt as the money spent on interest cannot be invested or used to reduce taxes Public debt holds also other negative effects – it reduces trust in the state and also makes it harder to obtain investment loans for enterprises (as banks prefer to borrow the state rather than companies). As a result, companies have smaller investments and the whole economy slows down.

The seventh largest expenditure is administration, which is 973 PLN. Nearly half of the amount is directed to local government administration (433 PLN), followed by central government administration (327 PLN), administration of ZUS, KRUS and NFZ (159 PLN) and other head organs of state authorities (54 PLN). It’s worth mentioning, that the expenses on administration amount to slightly more than 5% of the whole public expenditure. Therefore, one should not trust politicians, who claim, that “firing unnecessary bureaucrats” alone will solve all the problems of Polish public finances. Of course there are savings that can be made in administration, but they must go along with other reforms as well.

What follows are expenses related to social aid including welfare benefits (617 PLN), contribution to the EU budget (477 PLN), protection of the environment (255 PLN), housing (249 PLN), culture (225 PLN), sport and recreation (205 PLN). The Polish State spends public money also in many other fields, from science to tourism. Even though these expenses are individually relatively small, all together they sum up to 1878 PLN. This amount is a result of various discrepancies – the “Receipt from the state” bases on forecasts and estimations coming from not always consistent sources.

Public spending is financed from our taxes. Therefore, saying that the state should spend more in some area (for example on healthcare or highway constructions), one should consider, whether it should be covered by higher taxes, or maybe by a reduction of other public expenses (if so, than which?). Similarly, when suggesting lower taxes, one should immediately point to the expenditures, that can be symmetrically reduced.

No comments

Be the first one to leave a comment.