Reacting to significant decreases in GNP, countries of the region temporarily suspended or reduced the pension contributions to the fully-funded pillar of their pension systems, at the same time verifying the eventual level of the contributions. Polish government, in spite of Polish economy not falling into recession (“the green island”), decided to cut the contribution drastically, too.

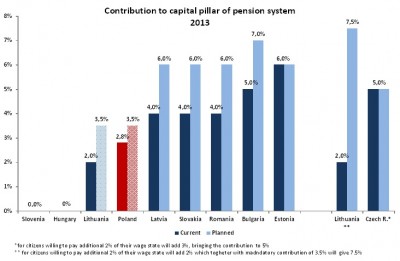

In Poland, current level of contribution that supply the fully-funded pillar (2.8 %) is one of the lowest in the region. The planned eventual level of contribution (3.5 %) also counts among the lowest in the region.

Among the ten countries of Central Eastern Europe, only Slovenia and Hungary do not have a fully‑funded part of their pension systems. In Slovenia, such a pillar has never been created, whereas in Hungary citizens’ savings in the fully-funded pillar were de facto nationalised by the short-sighted government.

*a condition for transferring 3 % of the contribution to the fully-funded pillar is an additional contribution amounting to 2 % and covered by the employee; **target part of the contribution transferred to the fully-funded pillar may by higher by 2 percentage points for those paying an additional contribution as high as 2 %, which gives a total increase by 4 percentage points. Planned level of contribution mirrors the current legislation and/or the declaration of the governments.

Sources: INES (Slovakia), LFMI (Lithuania), IME (Bulgaria), Liberalismi Akadeemia (Estonia), Liberalni Institut (Czech Republic), OECD (Slovenia), press materials (Hungary and Romania), consultation with government representatives (Latvia)

By the end of 1990s, the countries of Central-Eastern Europe implemented a number of pension reforms, a vital part of which was establishing the fully-funded pillar of the pension system. That path was not followed only by Slovenia (apart from specific professions/sectors, fully-funded pillar is not mandatory) and Czech Republic, which started to build fully-funded pillar only a year ago (due to political uncertainty its future is unsecured).

The addition of the fully-funded pillar to the pre-existent PAYG pension systems increases the security of a pension (one part of it is subject to political risk, another part to market risk, which diminishes the total risk for “not all eggs are put in one basket”); simultaneously, owing to investments in capital market, it increases the expected value of the pension. Subsequent advantages of fully-funded pillar were stimuli for the local financial markets and a decrease in future budget expenditure.

When faced with deep recession of 2009 and public finance tensions connected with it, the countries of the region temporarily decreased the level of the contributions transferred to the fully-funded pillar. In some countries, the target level of the contribution was decreased as well, at the same time changing the agenda of reaching them. However, the most radical steps were taken by the Hungarian government which decided to actually nationalise the savings Hungarian citizens had accumulated in the pension funds. Among these countries, Poland is distinguished as the only one which, although not experiencing a recession (“the green island”), decided to reduce the level of the contributions transferred to the second pillar.

With an exception of Hungary, none of the countries resigned from building the fully-funded part of their pension system. As the economic situation was recovering, they began once again to increase the level of the contributions transferred to the fully-funded pillar. Czech Republic, which did not implement such a pillar earlier, began to build it in 2013. It is not mandatory; people willing to participate in it will transfer 2 % of their salary, which, in addition to 3 % transferred from the pension contribution, will give 5 %. Nevertheless, its development is now curbed by political uncertainty and the opposition’s announcements with regard to its liquidation after the upcoming elections.

Both, the current level of contributions that are transferred to the fully-funded pillar in Poland (2.8 %) and their planned level (3.5 %), are among the lowest in the region. Eventually, so low a level of the planned contribution is implemented only by Lithuania, however, for those willing to transfer another 2 % from the salary as an annuity contribution, the Lithuanian state will increase the contribution that is transferred to the fully-funded pillar up to 5.5 %, which gives a contribution amounting to 7.5 % in total. The rest of the countries of the region established the target level of contribution to be 5 % (Czech Republic), 6 % (Latvia, Slovakia, Romania, Estonia), or 7 % (Bulgaria). When comparing the levels of the contributions, it is crucial to remember that reaching the target level can last till 2020 in some countries, with a risk of political changes along the way.

No comments

Be the first one to leave a comment.