Voters decided if they still want to live on others‘ money. Savings or growth? A false dilemma with irresistible sex appeal to politicians. The Golden Dawn in Greece. Why Hugh Hendry is concerned about his assets in Europe? In Spain thr nationalization of banks‘ debts is launched – will they manage to break record annual deficit of Ireland (32% of GDP)?

French and Greeks were voting during the weekend. Results of both elections will lead to worsening of the crisis.

In France, the elections were won by career-oriented socialist Francois Hollande (52%), who promised 75% tax on high income and to spen even more money which France doesn’t have on „support growth“. Voters still want to believe that their form of socialism paid by others‘ money works (this country didn’t have a single budget surplus in the last 34 years) and the crisis is a result of us intensively ignoring this fact. Hollande is going to renegotiate recently agreed „fiscal compact“ and it seems that the harmonious relations between Germany and France are over. Merkozy is dead. Long live…hm…Horkel…no…Merllande….hmm…..Merde!

Remember the maid from the New York’s hotel falsely accusing the former President of the International Monetary Fund and potential candidate for French president Dominique Strauss-Kahn of rape? The whole case stinks, or at least it is not usual that hotel’s employees celebrate reporting a crime to the police with spontanous dance (second video). According to one of the versions, Sarkozy used secret service here, for fear of his opponent’s success in elections. If that’s true, Sarkozy has to be banging his head against the table now. His attack came too soon and went in the wrong direction.

Remember the maid from the New York’s hotel falsely accusing the former President of the International Monetary Fund and potential candidate for French president Dominique Strauss-Kahn of rape? The whole case stinks, or at least it is not usual that hotel’s employees celebrate reporting a crime to the police with spontanous dance (second video). According to one of the versions, Sarkozy used secret service here, for fear of his opponent’s success in elections. If that’s true, Sarkozy has to be banging his head against the table now. His attack came too soon and went in the wrong direction.

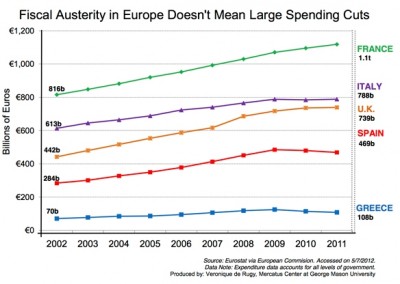

With Hollande coming to power there will be inevitable escalation of the already big pressure on austerity measures relaxation in Europe. Allegedly in order to „support economic growth“. But it’s basically the same- if you don’t want to save, you are willing to believe any exotic theory that will justify your inability to take rational but unpopular steps. Europe is balncing at the edge of another recession and is tired of austerity. That‘s strange because according to the available data, austerity hasn’t started yet. Deficit of the EU member state’s finances in the year 2011 constituted 4.5% of GDP, namely 50% more than famous Maastricht criteria. Or else, point out a country on the following chart depicting public spending which started radically saving.

However, the debate savings vs. economic growth is accelerating. But it is a false dilemma. Not only because the right cuts in ineffective public spending in the medium term lead to economic growth, but mainly because we pretend that Europe has any other choice than to save. It does not. If there was more fiscal relief and free hands for spending, bond markets would slap Europe in face again.The newest report by Carmen Reinhart, Vincent Reihart, and Kenneth Rogoff confirms that it is worth stabilizing the debt situation with savings. This publication has also proven again the notion that a high debt decreases economic growth of a country for decades.

In discussion about consolidation a fact is often missed that the problem for economy is not only existing deficits, but mostly the too high public spending – and reducing deficits by raising taxes is not saving. Even worse than deficits are high taxes, which suffocate the producers, who are the only ones to pay back debts. Consolidation through raising taxes is a way to economic hell. Then neither new Marshall’s plans nor future bonds of the European Bank for Reconstruction and Development or building empty highways by cronies will help.

Cries about the need to „support“ growth come mainly from America. USA can talk big because they are lucky to have privileged position of the producer of world reserve currency (economist Barry Eichengreen isn’t worried about dollar losing this position in close future). Worldwide demand for dollar helps to reduce the costs of refinancing their mega debt, despite having deficits of Greek proportions. When it comes to their fiscal responsibility, it is worse than in Europe, but as the main economist of Citigroup Willem Buiter says (34 min. 30 sec): „US can pretend that austerity and fiscal stability are an option, that you could ignore. But this is a temporary privilege that is being eroded fast, bond market vigilants are rolling up the sleeves to take on the US treasuries. They are waiting for the outcome of the elections to see whether the Congress actually grows up. If it doesn’t then I think renminbi looks like a good idea.“ But let’s have a look also at the other elections. Those in Greece were obviously a real blockbuster. In other parliaments you would look in vain for such a group of strange parties – from communist stalinnists to neonazis. Two years of „rescue work“ of Troika brought the results.

Post-elections press conference of the neonazi party Golden Dawn (7% of votes). We are not used to such a tense atmosphere at the press conference in Slovakia. Slovak journalists don’t need to stand up in honor of the Chairman when he enters the room:

http://www.youtube.com/watch?v=E4AXJx3IzdY&feature=player_embedded

Real problems in Greece have only started with the elections. Parties which agreed a few months ago on the further aid package didn’t get enough votes to set up government. Other relevant political parties, which are against meeting the conditions of Memorandum can’t create government either. It looks like there will be another round of elections in June as a result of inability and lack of willingness of the country to fulfill the agreement, under which there is a flow of European taxpayers‘ money.

Greeks without government stopped paying taxes. Regardless of the elections‘ result, Europe approved paying another tranche of the aid reaching EUR 4.2 billion. The warning boils down to the fact that after strong opposition from Germany and Finland (where was Slovakia?) the amount was decreased from planned 5.2 billion by one billion. 3.3. billion will go to paying back Greek debt in ECB due next week. Despite this, European officials already talk openly about possibility of Greece leaving the monetary union (eurozone would survive if Greece left it, says German finance minister Wolfgang Schauble). It’s about time, after two years, complete disruption of the „rescued“ country and hundreds of billions of public money spent. This time a real default (onthe money of the European taxpayers, who own the majority of the Greek debt) seems to be on the doorstep. Citi estimates the probability of Greece leaving eurozone within 12-18 months at 75%, Credit Suisse at 15% up to one year, other analytic think tank believes Greek withdrawal this summer „is very likely“.

“The thing that I fear (in Europe) is confiscation. Confiscation of my assets, confiscation of my clients’ assets. I fear that this thing could get out of [control]. I think we’re a year away from the French fully nationalizing their banking system. It is a break point in economic history We have reached a profound point in economic history where the truth is unpalatable to the political class — and that truth is that the scale and magnitude of the problem is larger than their ability to respond — and it terrifies them..“ If hedge fund manager Hugh Hendry is worried about his investments in Europe, you should be worried too. Because of continuing problems of the eurozone the biggest Chinese state fund stopped buying European bonds. China’s position is difficult to read but there are speculations that China supports the euro exchange rate at 1.3 against dollar.

Nationalization of banks in Spain is starting.The takeover of the third biggest Spanish bank Bankia will cost taxpayers according to the first estimations EUR 10 billion. 10 billion here, 10 billion there and Spain will be begging EFSF soon. But what they can do if even their own citizens don’t want to pay? For example the 20 top football clubs owe state in taxes and levies together EUR 1.4 billion. The European Commission is reportedly preparing relaxing of the consolidation aims for Spain. So much for saving in Europe and the efficiency of the new fiscal rules. Anyway, did you know that in Spain there is the biggest number of houses per capita in the world (1.7)? But they are happy to continue building them.

We’ve mentioned that Spain re-introduced border controls with France „because of the concern for security of the ECB summit in Barcelona“. These violent protests which posed a threat to bankers looked like this:

Have a weekend without any protests.

Juraj Karpiš

No comments

Be the first one to leave a comment.