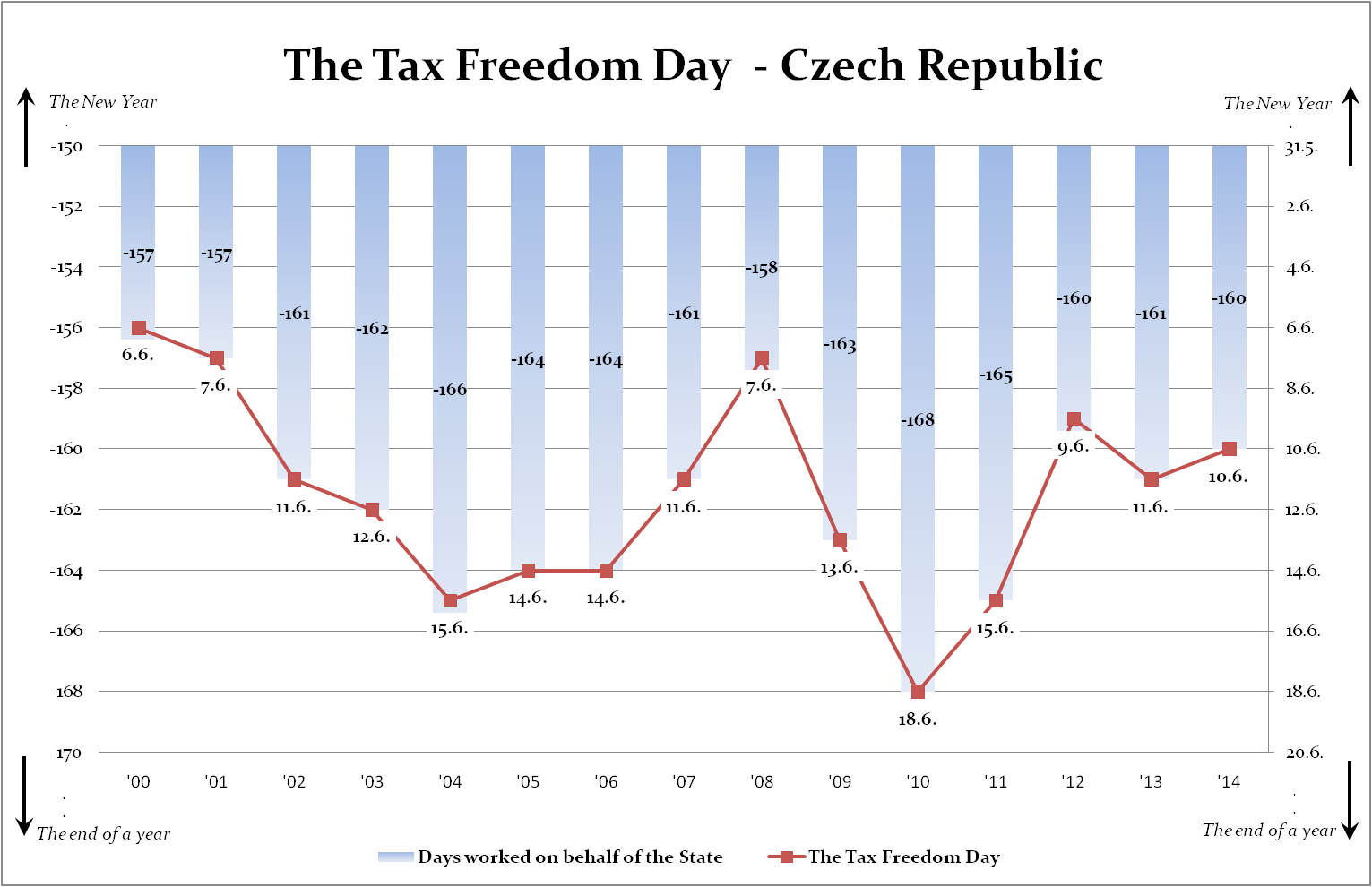

Tuesday, 10th of June, 2014 – did you feel some change in comparison with days before? No? If you live in the Czech Republic, you should. The Tax Freedom Day has arrived! The last Tuesday was the first day when people have started to earn on their own and not for the State and needs of public finances. The Tax Freedom Day 2014 has arrived one calendar day earlier than last year.

„Public finances in the Czech Republic reach the volume that conforms to a work of 160 calendar days for an average taxpayer. A day on, Tuesday 10th of June, the Tax Freedom Day is arriving,” Aleš Rod, the director of the Centre for Economic and Market Analyses, said. “Compared to especially some countries, especially South European ones, the Czech Republic had survived the post-crisis period and associated enormous pressure on public finances relatively well. However, we should compare ourselves with the best. And, for example, there is a gap of 49 days between us and the freest country South Korea,” Aleš Rod, who cooperates with the Liberal Institute on the TFD calculations, added to the topic.

However, not only comparisons mentioned above were being presented during the international seminar on the occasion of the Tax Freedom Day 2014, organized by the Liberal Institute and the 4Liberty.eu at the CEVRO University in Prague, Czech Republic on Tuesday. Three other speakers presented topics related to public finances and (in)efficiencies of public institutions.

In his contribution, economist Jan Dinga from the Institute of Economic and Social Studies (INESS SK) highlighted a continuous pressure on tax increasing in Slovakia. “In Slovakia, inefficiencies are quite common in the public sector. For example, in a social system – parental benefits are paid to families with very high incomes. We propose a long-term and detailed audit of hundreds of state institutions, in which cases of inefficiency and wasting were revealed,“ Jan Dinga said.

Jonas Rais, analyst from the Centre for Economic and Market Analyses (CETA), introduced a new methodology for evaluation of activities of Czech MPs. “Members of the Czech Parliament often misuse that nobody is watching their performance in the parliamentary benches. For example, the absence at important meetings in parliamentary committees and subcommittees is striking – it is worse than high school students’ absences,” Jonas Rais mentioned in his speech.

An interesting example to follow was introduced by Mihkel Lees from the Ministry of Social Affairs, Estonia. The Estonian perfectly sophisticated system of electronic communication between public institutions and residents saves costs everywhere you look. “It’s a bureaucracy without paper. Healthcare and efficiently managed medical prescriptions, simple tax returns, e- voting and more; savings are observable every day. The undisputed plus of this approach is that it also saves time. There is no waiting in lines at offices in Estonia,” Lees presented to shocked audience and added that this also limits a space for government outlays and bureaucracy extending.

Let’s hopes the Czech Republic will continue with steps led in a positive direction. But this won’t happen without our interest and systematically created pressure to politicians. “We realize that the Tax Freedom Day is a simplified indicator. Nevertheless, this is also its strength. It has popularized a fact that there is no free lunch and that a taste of public institutions to spend and redistribute taxpayers’ money is endless. International comparisons of economic indicators show that residents in countries with lower taxes economically grow faster, create more jobs and become more competitive,” said Jiří Schwarz, Chairman of the Academic Board of Liberal Institute.

Photos from the event (by Václav Holič):

No comments

Be the first one to leave a comment.