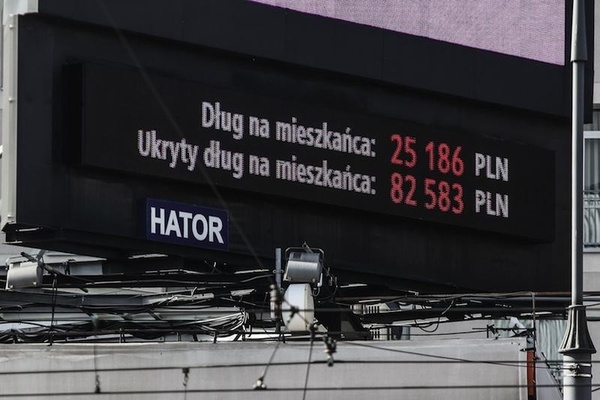

In 2013, Civil Development Forum added estimates of implicit public debt to the Public Debt Clock, which was launched three years ago. Our decision to display the value of implicit public debt was induced by the introduction of the European System of National and Regional Accounts (ESA 2010), which obliged the EU countries to publish their implicit public debt. Instead of waiting for the official numbers, which are due in 2017, we have come up with our first estimates. The idea behind the decision is that implicit public liabilities are also an important factor influencing public sector sustainability and economic growth.

Implicit public debt is a broad concept. While explicit public debt is defined as liabilities that are government loans and bonds, implicit public debt includes all other government liabilities – i.e. obligations for future expenditures that are written in the current law, like pensions and health insurance. Although there are controversies around the range of flows that should be counted as implicit debt, they all have one characteristic in common: such obligations are usually less binding than contracts with creditors and bondholders. It is easier for the government to back up such liabilities (e.g. by changing pension indexation rules) than to refuse to pay bondholders or creditors, which would be considered a default.

Our estimates of implicit debt are based on ESA 2010 methodology, which obliges EU countries to estimate their pension system obligations based on accrued rights. By paying pension contributions, we acquire a right to be paid a pension of a certain value in the future. At the same time, our right becomes the government’s future liability.

The most sizeable part of implicit public debt is the public pension pillar (in Polish: ZUS) liabilities, that is why we decided to draw our attention to public pensions when calculating implicit debt. As a consequence, the number displayed on the public debt clock is the minimal value of Polish implicit public debt, yet due to data limitations, we calculated only government retirement pension liabilities, excluding disability pensions. Our estimation was based on ESA 2010 methodology.

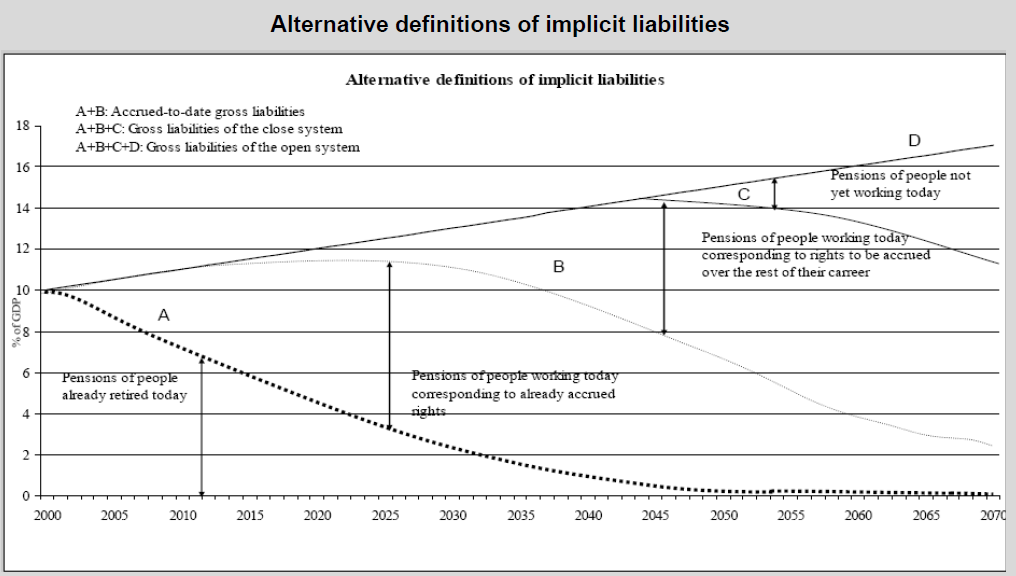

Government pension liabilities can be estimated in at least four ways, which is illustrated by the graph below:

Source: Eurostat 2011 Technical Compilation Guide for Pension Data in National Accounts

The four methodologies of implicit liabilities calculation shown above differ with respect to time horizon. By the first definition (curve A in the graph above), the only future expenditures taken into account are pensions of people who have already retired and have been granted pensions. Curve B illustrates expenditure on pensions of people working today corresponding to already accrued rights. This means that we calculate their pensions only on the basis of the sum of already paid contributions, without making any projections on how much they are going to pay until they are retired. Curve C shows the expenditure on pensions of people working today corresponding to rights to be accrued over the rest of their career. Finally, curve D describes pensions of people not yet working today. It increases uniformly because there are always new people entering the system.

Disclosure of implicit public debt value has also fueled public debate over the recent plans of the Polish government for changes in the second pension pillar. According to governmental plans, all government bonds held by pension funds will be nationalized, and their value will be added to the notional account in the public pillar of the pension system. Furthermore, private pension funds will be prohibited from investing in governmental bonds, making them aggressive, high-risk investment funds. In the medium term, such changes (after the first severe slump in the stock market) will lead to the extinction of the private pension pillar. Such a reform will reduce explicit public debt in the short term; however, it will also increase the implicit debt, affecting public sector sustainability in the long term. Furthermore, lower explicit debt today might encourage politicians to spend more now. As a result, the burden of the total public debt (explicit and implicit) for future generations of tax payers will increase.

Our new, upgraded Public Debt Clock and the disclosure of implicit public debt have been widely discussed in all leading newspapers, which emphasizes that extensive implicit debt might be a threat to the economy. Not surprisingly, it was criticized by the authors of the proposed overhaul of the pension system, the Minister of Labor and Social Policy and the Minister of Finance, who argued that implicit debt is not an accurate indicator of the state of public finance since it does not include future government income. The government has a vital interest in playing down the economic consequences of implicit debt, as the Polish explicit debt is approaching the constitutional limit of 60% of the GDP. By shifting part of the liabilities from explicit to implicit debt, the government would gain some fiscal space to spend more for a few years at the cost of making the Polish pension system less diversified and less safe.

No comments

Be the first one to leave a comment.