Jánošík wasn’t Polish, he was Spanish! Two registered transactions at the commercial real estate markets in Italy in the second quarter. Did Angela soften after holidays? How Danica invests. Do you have peas in the freezer? And euros? When the children don’t want to leave home…

New hero in Spain is emerging. Spanish Jánošík. Juan Manuel Sanchez Gordillo, mayor of Marinaleda – a town in southern Andalusia, is stealing in the supermarkets together with trade unions. Then they give the stolen goods to the „families affected the worst by the crisis“. Police have already arrested seven people, who filled their shopping carts with goods and left without paying last week. Mayor was waiting for them outside. As a member of the local parliament he has political immunity but reportedly he is willing to give it up if they want to arrest him. Now he is going for a tour around the country, during which he wants to set people against government’s austerity measures and layoffs. Interesting way to solve the crisis. Wouldn’t it help to do exactly the opposite? Stop taking resources from other people? Including the state and banks?

According to the sources from the Spanish Ministry of Economy, Spain will probably ask for faster transfer of the first tranche of 30 billion to save the Spanish banks already at the end of this week. At the same time there are speculations that the Spanish government is negotiating with Europe an agreement that out of this aid package of 100 billion intended originally for banks they would be allowed to purchase also Spanish state bonds in order to reduce the high interest rates, which the country has to pay. According to the Spanish Ministry of Economy’s estimations, 60 billion would be enough for the banks, 40 billion could therefore help the Spanish government without any annoying conditions from Troika, which now apply to any help granted to the countries using the bailout mechanism.

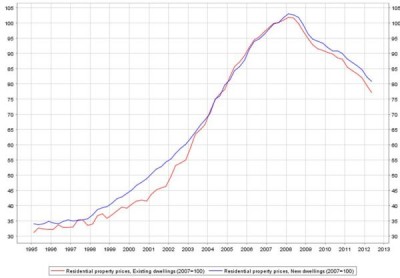

At the same time commercial real estate markets in Italy and Spain collapse, the number of realized registered transactions decreased in the second quarter of 2012 by 90%. In Spain during this period there were only three big transactions in comparison to 58 from the last quarter, in Italy only two vs. 58. Prices of real estate in Spain haven’t reached their bottom yet and therefore not 60, but even 100 billion for Spanish banks will be very little and the need for recapitalizing that banking sector will reach hundreds of billions of euro.

Residential real estate in Spain (red line indicating existing properties, blue one – new constructions)

Speaking of banks, PWC issued a report concerning the volume of defaulted loans in the balance sheets of the European banks. Since 2008 it has increased by over 100% and reached trillion euro. One third of this volume is in Ireland, Italy and Spain. Economy of the Eurozone in the second quarter of 2012 shrank by 0.2%.

Not that much can be heard about Greece in the media nowadays, probably it’s just a calm before the storm. Maybe a catharsis is approaching finally. Greece is running out of money again, due to lack of cash, the government announced unofficial moratorium for any public spending excluding salaries of the civil servants and the payment of pensions. Next week Greek Prime Minister Antonis Samaras is going to meet rested Angela Merkel and French President Francois Hollande. He will reportedly ask for further EUR 20 billion, but judging by the recent hard and suspiciously numerous comments – not only by the representatives of the German trade unions, concerning „manageability“ of Grexit, it is not clear yet if Europe won’t make a scapegoat out of Greece. On the other hand temptation to brush the „Greek problem“ under the carpet with promise of next dozens of billions of our money will be huge for the European politicians.

Uncertainty concerning the future of the Greek currency led Greek citizens to come up with innovative ways of hiding their money from the tax office, the New Drachma, and other thieves of their purchasing power. Are you inspired?

According to the chief economist of Deutsche bank Thomas Mayer, the pro-reform attitude of the Italian Prime Minister Mario Monti, a technocrat appointed by Europe, is disappointing. „Liberalization of the licensed professions came to a halt and reform of the labour market was so massively limited that it is impossible to expect any positive effect concerning employment.“ These details clearly don’t bother Danish pension fund Danica that in pursuit of returns eagerly purchases Italian bonds. Maybe they will have more luck with timing then the broker MF Global whose neck was almost broken with speculations with Italian bonds. Bold yields on PIIGS‘ bonds were apparently irresistible temptation also for some Slovak speculators.

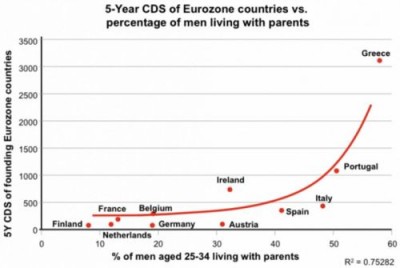

At the end an interesting chart comparing the cost of insuring state debt and proportion of men aged 25-34 years old living at home with their parents in different countries.

So dear youth, in order to reduce probability of Slovak default and costs of Slovak debt, hop hop out to the world!

Have a worldly weekend!

Juraj Karpiš

No comments

Be the first one to leave a comment.