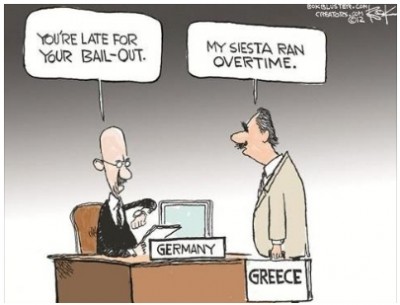

Who wants to be Minister of Finance of Greece should report to the director. Everyone in ECB was following football, players used as a collateral were playing. Will ESM turn into European zombie banks hedge fund? Will ESM run out of resources even before it is set up?

Troika still hasn’t gone to Greece to assess the situation there. Local leaders are affected by health problems – both Prime Minister and Minister of Finance were hospitalized. Rumor has it that resignation of the newly appointed Minister of Finance was caused not only by his health problems, but also by disastrous economic program of the new government. Yannis Stournaras, who used to serve as an advisor of the government that introduced euro, is supposed to be the new Minister. So perhaps he already knows what went wrong. Greek Prime Minister, who will appoint Sourmaras, has constant problems with sight. At the European summit, missing Greek Prime Minister and Minister of Finance will be replaced by the President Karolos Papoulias. However, they will send a letter, in which they want to point out tough economic situation in the country and underline need for negotiating conditions of the second aid package. („Dear Angela. It’s difficult here. Send money. With kind regards….“).

For example, they want to give up the plans of letting 150 000 civil servants go or halting the minimum wage. According to the documents of Troika and Greek Ministry, which were obtained by the newspaper Vima, Greece violated the agreement with creditors and in the years 2010 and 2011 employed additional 70 000 civil servants.

ECB sent congratulations to semi-finalists of the football championships. Central bank is obviously happy that it sponsors 3 out of the 4 best teams.

Apart from football, in ECB they deal a bit also with monetary policy of course. ECB reduced requirements for the acceptable collateral in refinancing operations with commercial banks. They take really everything, including leasing agreements and loans for cars. There are talks about reducing basic interest rates or even introducing fees for the banks which keep excessive reserves at ECB. These unorthodox monetary measures are supposed to help to introduce newly printed euros to economy, so the predictions of inflationary prophets are fulfilled.

EU’s summit brought further promises and important step towards dividing debts and losses of banking systems of individual countries between all the member states of the Eurozone. This way they indirectly raised our future taxes.

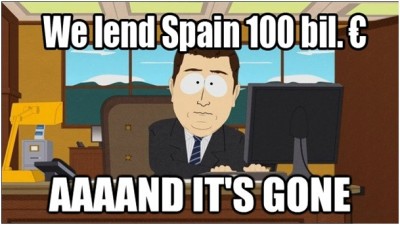

Apart from flexible purchasing of bonds of the problematic countries by EFSF/ESM (ESM is supposed to do what until now was done by ECB – manipulate prices of the loans for problematic countries) and abolishing superior status of ESM’s loans it was agreed that after establishing single European banking supervision, which will strengthen ECB at the end of summer, it will be possible to recapitalize banks directly through ESM. For example rescuing Spanish banks won’t burden Spanish state debt within this plan. It was also agreed to relieve Ireland, whose bank rescue has been involved within their state (unsustainable) debt.

At 4 a.m. EU’s President Herman Van Rompuy said – commenting on the impending banking union – that it is a step that contributes to the fact that project euro becomes „irreversible“.

One can only agree. But it is not an advantage, but a threat, as this step will result in increasing costs and drama of possible collapse of the monetary union. Possibility of collapse is always there and won’t disappear just because European representatives ignore it.

Agreement to borrow from ESM, not through problematic countries, but directly to the banks in these countries, is a substantial step towards debt union. It also means that bad decisions of the local private banks and state regulatory sector won’t affect only citizens of these countries, but all the citizens of the Eurozone. Granting loans from ESM directly to insolvent banks instead of countries radically decreases quality and enforcement of claims of ESM. On the other hand, it increases possibility of high costs for Slovak public finances resulting from Slovak participation in this strange joint-stock company. Slovaks can be only sorry that such fund enabling transfer of lossess to other European countries didn’t exist in the year 2001, when we had to save our banks from our own pockets, which cost us over 10% of GDP.

But the banking union obviously won’t solve current problems, it’s only a strategic game how to allocate already existing losses in the system. And it seems we will get a nice share of them.

After the summit Angela Merkel is going to vote in Bundestag with the German parliament on ESM. Before that, budgetary commission of the German parliament wants to call a special meeting, as Merkel’s agreement to enable recapitalizing banks directly from ESM surprised Germans and spokesman from SPD Carsten Schneider said that „government will have to explain its turn by 180 degrees.“ Just before the summit Merkel said that there won’t be any sharing of commitments in Europe „as long as she lives.“ Due to surprising development for Germany, voting on ESM might be postponed. It would be funny if ESM was finally rejected in the German parliament. So much catering in Brussels for nothing.

Step towards banking union was suggested already before the summit by German Minister of Finance Schaeuble in an interview for Der Spiegel. In this interview he also hints that because integration processes in Europe are close to the limits which are allowed by the German constitutions, there is a serious possibility of carrying out referendum concerning changing it. This voting will have crucial implications for whole Europe, as it will define options of its currently strongest player.

Germany lost not only in semifinals of the European championships in football (against Italy 1:2), but also at the negotiations table (with Italy, Spain and France worth about one hundred billion euros) Spiegel: „How Italy and Spain defeated Merkel at the EU summit“.

Until today there were 12 015 complaints against ESM and fiscal compact filed in the constitutional court in Germany.

Slovenian Prime Minister Janes Jansa said in the interview that the next month his country will ask for financial help, if the parliament doesn’t manage to adopt laws reducing public spending. How great that we have the bailout mechanism! Politicians in whole Europe live under much less stress as there is an alternative to „inhuman“ austerity. Aid for Cyprus will reach 50% of their GDP. We are running out of our common money in the bailout mechanisms incredibly fast. Isn’t it time to give up on raising taxes and instead ask for help? Those who do so last will risk paying whole bill.

Rating agency Moody’s reduced the ratings of 28 Spanish banks, 21 of them have now only “junk” status. Cash transactions over EUR 2500 were banned in Spain.

In Slovakia a discussion burst out about who reads The Economist and who doesn’t. The more stripes, the more Adidas, the more news from The Economist read, the bigger expert? To be IN, I will offer give one link as well. Given closer integration and centralization of the Union, which is wrongly presented as the only solution of the current problems of the Eurozone, the writer of the Economist’s Badgehot editorial thinks that „the chances of Britain leaving the EU in the next few years are higher than they have ever been.“

For the end of this week here comes another hilarious propaganda video made by the European Commission, this time about „women in science“. Tubes, smoke and high heels. Magical.

http://news.sciencemag.org/scienceinsider/2012/06/harsh-reviews-for-european-commi.html

Have a little bit more fun this weekend

Juraj Karpiš

No comments

Be the first one to leave a comment.