News releases about the end of the crisis – as regular as sunrise. Greece has a surplus. Brussels has a whole lot of new ideas for spending money.

Have you heard the one about the crisis being over? News about economic growth is beginning to sound like old jokes told in a new way. In the second quarter of 2013, the euro zone grew by 0.3% of the GDP in contrast to the expected 0.2%, which motivated the Commissioner Olli Rehn to claim that “the data supported the EU’s response to the eurozone crisis!” For several years, we’ve been in a situation where a GDP growth of even a few tenths of a percent is celebrated almost like landing on the moon. Let our politicians enjoy themselves and let’s look at the rest of this week’s news from Europe.

Seemingly positive news arrived from Greece. The country has managed to achieve a primary budget surplus, meaning a surplus before paying interests. However, the problem is that the sum of interest payment is gigantic, since the debt is gigantic too. A primary surplus would be good news if the country decided to go bankrupt and thus get rid of the interest payments. We, the creditors, wouldn’t be very pleased though. It is interesting that while in 2005, the public sector in Greece constituted 40% of the country’s economy, today it’s 46%. The tax burden of 39% GDP in 2005 increased to 45% of the GDP. A nice illustration of how much effort was put into increasing taxes and how much to cutting spending.

The Slovaks are helping to save the Greek budget too: also two Slovak investment groups engaged in the privatisation of a 33% share – worth 652 million – of the state lottery company OPAP. It’s one of the greatest successes in privatisation of Greek state assets, but this profit will only cover 0.2% of Greece’s debt worth 300 billion.

In Spain, real estate prices are continuously going downhill. The craziness caused by cheap credit is beautifully symbolised by the construction of the highest residential building in Europe. The skyscraper in Alicante was heightened from original 20 storeys by another 27. Amid enthusiasm, builders forgot about one fundamental thing: to include sufficient capacity for elevators. The top apartments are thus currently suitable only for athletes.

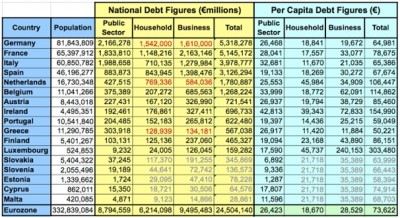

In contrast to Spain, the Irish started to demolish unsuccessful property development projects some time ago. The country is successful at lowering the financial leverage in economy, meaning the overall level of indebtedness. The latter, however, remains huge – per capita the second highest in the EU after Luxembourg and by a large margin ahead of others.

The crisis is not only a privilege of the eurozone, it also manifests its presence in all countries. Britain has suffered an extensive bank crisis and a less extensive real estate bubble, which was reflected in a 5.5% decline in real wages, the fourth highest decline in Europe after Greece, Portugal, and the Netherlands. Those who want to protect themselves from a decline in real wage should get employment as a public servant, at least in Britain. According to the Institute for Fiscal Studies, the average hourly salary in the private sector decreased from £15.1 to £13.6 between 2009 and 2011, while in the public sector it only went from £16.6 to £15.8. After all, the public sector doesn’t have to worry about problems with customers or sales.

It is interesting to watch the development of the European bank sector. To fulfil the conditions of the Basel III agreement, banks have to get rid of €3.2 trillion of assets. Not to mention that they have already got rid of €2.9 trillion of assets in the last 15 months. They also have to raise new capital and thus they make cuts where they can; for example, by lowering the number of branches. From 2008 until the end of 2012, 20,000 of them have been closed in Europe. Don’t worry about the danger of an exhausting walk for a consumer loan or a credit card getting longer though, there are still 218,687 of them.

Brussels is the only place with no problems inventing new expenditures. Billions of public funds went into construction of renewable sources of energy, while the profitability of these investments is rather a metaphysical question. Instead of a top-down re-evaluation of expenditures, it is becoming common to talk about a necessity to subsidise nuclear energy with EU funds as well.

Another sum of money will go into real estate. The news about the real estate bubbles causing a crisis in several countries apparently haven’t arrived to Brussels yet. With a modest €2 billion, the European Investment Bank wants to finance real estate projects in cities “that private lenders view as too risky”. And imagine that private investors can dive into pretty risky projects when equipped with cheap money!

Emancipation has to be subsidised too. Brussels’ astrologists have calculated from the planetary positions of Venus and Mars that there are too few female professors for the humanity to be happy. Fortunately, this problem has a solution too, and its estimated cost is €6 million.

The question of Brussels’ accumulating competencies at the expense of member states has been opened, after Britain and the Netherlands, also in Germany by Angela Merkel, even though carefully for now. The question is whether anyone will listen to her after elections. The campaign is already underway and brave ideas and motions can often be heard. For example, the Eurosceptic mini-party, Alternative Für Deutschland, says in the campaign that France should leave the eurozone. I dare to estimate that no one will listen to them after elections either.

But you should be all ears!

Translated by Tomáš Herda

No comments

Be the first one to leave a comment.