Crisis on Cyprus brought new tailwinds in the sails of the crisis in Europe and fully opened the question which had only been cautiously considered behind the scenes until now – how to deal with European banks? But first things first.

Nearly two weeks ago ECB announced that it would cease providing help for the Cypriot banks via a pump machine called ELA. The country badly hit by the crisis and also by the losses in Greece had to act promptly to avert the imminent fall of the local banking sector. Due to a combination of various official and unofficial reasons, Troika decided that, unlike Spain, the losses from Cypriot banks shall be born not only by the European taxpayers via the ESM but, at least partially, also by the depositors in the Cypriot banks.

The first agreement, according to which all deposits in the banks would be taxed, created a massive storm of anger and did not get the parliamentary vote. After a week of intense negotiations during which all banks remained closed, people queued in front of ATMs and the economy froze. A new deal finally came. This time supposedly a definite one and without Parliament approval requirements.

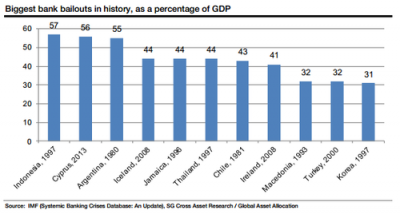

The ESM shall secure 10 billion EUR for Cyprus. Banks, however, will see nothing of it. The second largest bank Laki shall be liquidated. Accounts with deposits below 100,000 EUR shall be transferred to Bank of Cyprus. Amounts above 100,000 EUR shall not be taxed, but shall be decreased by the amount of loss of the liquidated bank. The losses of the bank are not yet officially known, nor is the information how much money flowed from the country before, therefore, we will have to wait a bit more for the exact percentage loss of the depositors. Some grim tongues whisper that this figure can be as high as 80%. Even the savers in the Bank of Cyprus do not sleep in a bed of roses. They will lose around 20-40% out of their deposits above 100,000 EUR. Instead of their money, they will receive some worthless shares of the bank. They won’t even receive the remainder immediately but only over several years. The rescue of the Cypriot banking system is thus the second most expensive one in history – in relative numbers as compared to the size of the economy.

The stock exchange still remains closed, banks opened last Thursday for the first time, although providing only limited maximum withdrawals of 300 EUR. There are some very tough times ahead of Cyprus. The loan of 10 billion EUR from the ESM means that the debt of the country will reach 140% GDP – unless there is no recession. Since the finance industry, the largest source of Cypriot fortune, just collapsed and business is limited due to the imposed capital controls, the recession will come and it will be a nasty one. When the GDP falls, the debt to GDP ratio will grow even further. That is the ugly trick of relative debt measurements as compared to absolute figures. In a second, the debt to GDP ratio can easily show 180%. This only means the country will default, in the same way as we saw in Greece.

A country-wide investigation has just started. Despite restricted withdrawals and out of country transfer restrictions, a surprisingly high volume of money disappeared from Cyprus. The suspicion goes to the Central Bank and the government, which could be responsible for the fact that many Russians saved part of their fortunes by transferring money to foreign branches of Cypriot banks, or withdrawing them in the branches of Russian banks on Cyprus.

Currently, three big questions keep floating around Europe. Firstly, how will the situation in Cyprus be resolved? By introducing the capital controls, one of the three founding pillars of the European Union was broken. The Euro as a currency was torn into two different currencies. One million euro in Cyprus is not worth the same as one million euro in Germany, because you cannot buy as much with the Cypriot euro as with the German one.

The second big question: what the hell did the Eurogroup head, Jeroen Dijsselbloem, mean? He said that Cyprus is a template which shall be applied to problems of banks in other countries as well. The fact that banks shall not be saved by taxpayers but losses would be paid by the shareholders and depositors caused quite a panic. Eurogroup rushed to publish probably the shortest announcement ever, in which they firmly denied all such considerations.

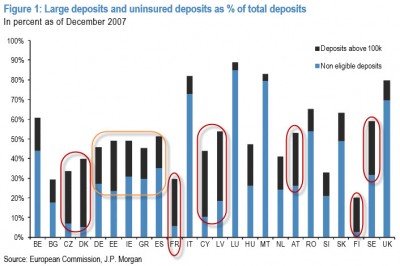

The third question is the most important one – who is next? The ratio of deposits over 100,000 EUR varies in the EU countries; a hot candidate for panic is for example France, since there is a lot of uninsured cash in the banks. The following chart is from 2007, the latest date we found.

Spain should be the most alerted one. Its banking sector is already drawing funds from the ESM, but because the recession for 2013 is predicted to be even deeper than the one in 2012, hard times are not over yet. Or Italy? The country with a huge debt is not able to form new government after the elections and reforms continuation is questionable. A few more billions already fled from Monte dei Paschi, the infamous oldest Italian bank, although its executives try to put the blame on some old derivative problems.

How about the ECB? The European Central Bank accepted 9 billion EUR of Cypriot bonds as collateral. If Cyprus defaults (announces inability to pay), this will wipe out big part of ECB’s own equity capital. Although the ECB can bear even negative equity and, due to its finger on the PRINT button, it cannot effectively go bankrupt anyway, this would, however, mean a big hit for its credibility.

The crisis is simply not over yet. Jens Wedmen, Bundesbank’s boss, explained this in a very honest interview, in which he also philosophised over the diminishing competitiveness of France or over the meaningfulness of the ECB’s help to Italy.

The only one who keeps ignoring the crisis is the European Commission, which is asking additional 11.3 billion EUR more for its projects in 2013.

If you want to increase your optimism levels during Easter, you are free to use “it can be even worse” reasoning. For instance, inflation in Argentina is currently reaching 33% (although if you are a local economist, you will go to jail if you say so) and the country’s prospects are set for another default after 12 years since the last one.

We wish you a basket full of untaxed eggs! (Translated by Jakub Pivoluska)

No comments

Be the first one to leave a comment.