Bouncer Ottmar Issing. ECB once again kept Greece in the game. Will the next five-year plan be merrier?

Briefly today. Pandas are on holidays and without Angela Merkel who is having a rest and German Minister of Finance, Wolfgang Schauble, not much is going on in Europe.

Mario Monti, Italian Prime Minister, informed Germans that he needs their help, not financial, but moral one. Spanish Prime Minister Mariano Rajoy considers asking Europe for help. Not moral, but financial one. But first he must figure out what conditions are associated with providing these funds. He probably expected more from Draghi and ECB and at home he is lacking creativity and ideas after introducing tax hikes and fees. British-Dutch company Royal Dutch Shell is transferring its money from European to American banks and assets fearing for its safety.

Former ECB chief economist and one of the Eurozone’s architects Ottmar Issing says that „Germany’s guilt over the WWII doesn’t oblige it to write blank cheques to euro zone countries that fail to reform their economies.“ At the same time he suggests kicking some members out of the monetary union in order to survive and stabilize euro. He didn’t say which ones but we all have the clue.

Speaking of Greece, it is becoming short of money again. ECB rescued Greece from the acute problem again. Pay attention for a moment: in order to pay off the bonds held by ECB itself, Greek central bank was allowed to print new euros increasing the maximum amount of government bills accepted as collateral within the programme emergency liquidity assistance (ELA) from EUR 3 billion to EUR 7 billion. Economic miracle enabled by fiat money. In theory, these additional EUR 4 billion are supposed to be enough for Greece to survive until another tranche from Troika in September.

International Monetary Fund is also willing to help Greece. Probably as a result of American incentive it appeals to euro zone’s members (yes, Slovakia as well) to write off a part of the Greek debt to enable it to fall down to „sustainable level“. Liar, Prime Minister of Luxembourg and Mr. Euro Jean-Claude Juncker said that euro zone could handle potential Grexit.

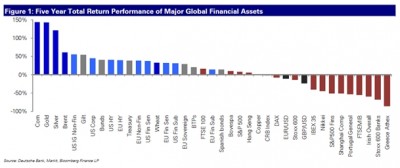

As the regular readers of Fiat Euro know, last week the crisis celebrated its 5th birthday. Since its beginning central banks are the main „fighters against the crisis“. They reacted to the crisis caused by the flood of new money with creating another flood of new money.

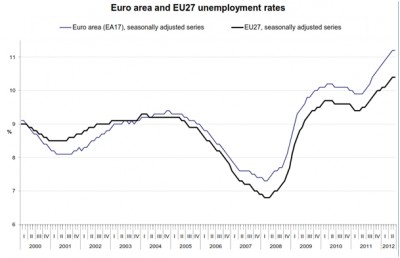

With this fiat money they postponed liquidating unreasonable investments based on artificially low interest rates and clearing overgrown financial sector from insolvent subjects. This way they avoided more significant decline, but on the other hand they have stretched the economic agony for half a decade already. Today it surely doesn’t seem that there is healthy economic growth and decrease in unemployment waiting on the doorstep.

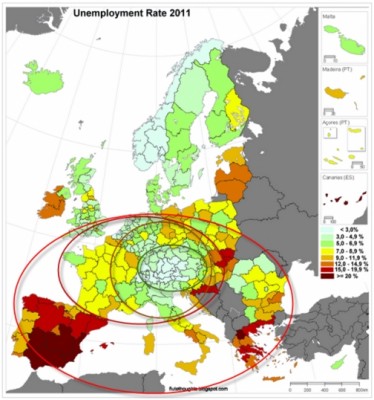

European regions according to the unemployment rates – Slovakia plays with all the colors.

On the contrary, economic situation keeps deteriorating. Not only banks, but also the states that saved them before, are insolvent now. A glance at the most successful financial assets during last five years, when politicians have been trying to solve all the problems with counterfeiting, is not surprising: corn, gold, silver and oil.

If there is too little tension, panic, scandals and intrigues in this issue you should know that you can look forward to them next month. Europe will have extremely interesting September. Euro zone’s Ministers of Finance meet on September 3, ECB on September 6, September 11 is the day when the proposal of the banking union will be presented, on September 12 German Constitutional court will make decision about ESM and there will be elections held in Netherlands, who still haven’t adopted the fiscal compact. Ratification of the fiscal compact in France was given a green light from the French Constitutional court.

Until then, at least some fun from the Olympics:

Have a happy weekend!

Juraj Karpiš

No comments

Be the first one to leave a comment.