Will the savers in PIIGS be naive and lazy enough so that the Eurozone won’t fall apart? – FiatEuro! 21/2012

Another unnecessary summit, politicians know how to focus and agree only when they are under pressure from the bond markets. Who is ready for Grexit? A feast on German money is postponed. Irish want ESM for banks and a second aid package. Has EU lost all hopes for Greece? The Euro Bill reached EUR 588. Slovaks are waking up: „EU as a Superstate? So what! We want security!“

We have another useless summit behind us. We learnt thanks to the summit, that „The condition for further aid for Greece is to fulfil the agreed conditions!“. In media there was news that working group Eurogroup called for all the member states to prepare individual plans what to do in case when Greece leaves EMU. Good morning! Such possibility has been on table for two years already and could be ignored only by professional optimists, paid from taxes. European representatives were vehemently denying that such call for preparing the plans for possible Grexit exists.. Only Italy, Sweden and Finland are going to prepare such plan. Another a bit more specific conclusion was a homework for the European Investment Bank, which is supposed to prepare proposals how to support the economic growth for the next summit in June. Maybe there will be another nicely overpriced highway or unnecessary bridge built.

We have another useless summit behind us. We learnt thanks to the summit, that „The condition for further aid for Greece is to fulfil the agreed conditions!“. In media there was news that working group Eurogroup called for all the member states to prepare individual plans what to do in case when Greece leaves EMU. Good morning! Such possibility has been on table for two years already and could be ignored only by professional optimists, paid from taxes. European representatives were vehemently denying that such call for preparing the plans for possible Grexit exists.. Only Italy, Sweden and Finland are going to prepare such plan. Another a bit more specific conclusion was a homework for the European Investment Bank, which is supposed to prepare proposals how to support the economic growth for the next summit in June. Maybe there will be another nicely overpriced highway or unnecessary bridge built.

That’s all when it comes to a bit more specific conclusions. Growing cries from countries suffering from fiscal problems (Greece, Belgium, Italy) and especially those from France for European bonds were not heard. Apart from the fact that the European bonds would probably be against German constitution, it is obvious for everyone that it is de facto about starting a European feast on German account. And this is something Germans don’t want (German Commissioner for Energy considers issuing European bonds to be just a matter of time). German Chancellor uses Lisbon Treaty as an argument. Common bonds wouldn’t be compatible with this agreement either. Moreover, according to her „the almost identical interest rates member countries paid lead to the chaotic development of the recent years. “ German refusal was also supported by Austrian Minister of Finance Maria Fekter, who described the „pro-growth“ arguments supporting common bonds presented by French President Hollande as a nonsense. „Financing growth with debts is a prescription from the day before yesterday“. Netherlands joined the oppositions; Finns also think that states should be responsible for their own debt.

Discussion about the „fiscal compact“, which was a cornerstone of Francois Hollande’s presidential campaign, wasn’t initiated either. At least in France, a quick ratification is not awaiting the fiscal pact. It will wait until the compromises will be agreed on. Pan-European insurance of bank deposits, which would help preventing massive runs (current process of withdrawing money from these countries can be called jogging) on the banks in these problematic countries, was discussed and assigned as a subject for review to the European Commission. Commission is supposed to analyze the issue further and then discuss it at the following summit, in June it will be only a „preliminary discussions“. Let’s remind us a witty statement from the USA. „Europe’s stability now rests on the sloth and stupidity of European savers,“ Says professor of International Relations and editor of The American Interest Walter Russel Mead. If people in the problematic countries stopped believing fairy tales their politicians tell that everything will be fine and rationally moved their savings collectively to Germany, Switzerland or Netherlands, euro story would end in need to suspend freedom of capital movement.

„preliminary discussions“. Let’s remind us a witty statement from the USA. „Europe’s stability now rests on the sloth and stupidity of European savers,“ Says professor of International Relations and editor of The American Interest Walter Russel Mead. If people in the problematic countries stopped believing fairy tales their politicians tell that everything will be fine and rationally moved their savings collectively to Germany, Switzerland or Netherlands, euro story would end in need to suspend freedom of capital movement.

It isn’t any clearer if the newly created European Stabilization Mechanism can lend money directly to banks. Irish, speaking through the Prime Minister Enda Kenny, are vehemently for. Considering the huge losses of Irish commercial banks it doesn’t come as a surprise to anyone (by the way, Ireland, which is often presented as an example of successful EU’s rescue operations, will need another aid package). You can guess who is against it. Yes, Angela again.

Deutsche Bank estimates that in order for ESM to effectively protect Spain, Belgium and also Italy against consequences of potential Grexit and at the same time to extend programs for Portugal and Ireland by three years it would have to have capacity of EUR 1 trillion- twice its current capacity.

German „Nein, nein, nein!“ didn’t fluster Spanish Prime Minister Mario Rajoy, who toughly declared that „Spanish government is not interested and does not want to use aid resources from the EU or other institutions.“ Quite brave statement from the Prime Minister of the country, which for the third time recalculated (obviously upwards) the deficit of public finances for the year 2011 from 8.51% up to 8.9%. Experts from Eurostat won’t be fooled by „Greek statistical jokes“ and will go to Madrid to check the deficit themselves. Moreover, a new hole of a size of 28 billion has just been revealed in Spain. Itwas hidden in the regions.

A bit later the same Prime Minister suggested at the summit that ECB should again start buying state bonds in order to calm down the situation on the bond markets. Lower interest rates on the debt would surely help Spain. European politicians keep believing the theory that money in ECB are free lunch. ECB denies that, it „doesn’t want to give the impression of helping the countries with refinancing“. Unwillingly it admits then that purchases until now (213 billion) were actually help for the members of the monetary union. ECB was treated as the tool of the last resort to postpone painful steps also by Hollande, who calls for a next round of cheaper loans from ECB to the commercial banks. Trillion euro (EUR 3 000 per capita in the Eurozone) at one percent rate for three years is still not enough?

Greek exit from the monetary union according to the information of Deutsche Wirtschafts Nachrichten is already a sure thing. Troika allegedly lost all hopes about Greece not because of the chaotic elections, but because of the lack of willingness of the other side to fulfil any agreed conditions. Let’s see if such information is valid and if a prepared Grexit won’t be replaced by an uncontrolled and chaotic Hellexit. Representatives of the Russian central bank claim that Greece has already prepared a plan for introduction of a parallel currency. If Troika really wants Greece to leave, it would be cheaper if it was done last weekend, because the next Monday Greece received EUR 18 billion from the EU for recapitalization of the banks there.

„If Greece leaves the Eurozone, it will cost every Slovak EUR 450, according to the calculations by Nomura bank.“ These estimations are always magical. It’s a pity that they didn’t calculate how much Nomura would gain. What we can calculate quickly are our guarantees that we have already provided so that we can keep the illusion that insolvent European countries won’t go bankrupt for a couple of months more. We updated the Euro Bill – current guaranteed loan programmes and ECB’s purchases reached EUR 588 per capita in Slovakia.

Germans, afraid of Greek anger, cancel their holidays in Greece. Compared to last year bookings decreased by 30%. On the other hand Vicky Voulboukeli, a good-looking right-wing populist MP from the Independent Greeks party, called for Germany to pay EUR 70 billion debt for distress caused to Greece during the World War II. So much more data for testing the hypothesis that euro will improve integration and peaceful coexistence of nations in Europe.

Germans, afraid of Greek anger, cancel their holidays in Greece. Compared to last year bookings decreased by 30%. On the other hand Vicky Voulboukeli, a good-looking right-wing populist MP from the Independent Greeks party, called for Germany to pay EUR 70 billion debt for distress caused to Greece during the World War II. So much more data for testing the hypothesis that euro will improve integration and peaceful coexistence of nations in Europe.

Crisis has positive influence on migration. Now I’m not talking only about the rich escaping France in fear of Hollande-Robin Hood. Far more numerous are Greeks and Spaniards fleeing to Germany. According to the German Office for Statistics, the number of Greeks who settled down in Germany in 2011 increased by 90% up to 24 000 and Spaniards by 52% up to 52 000.

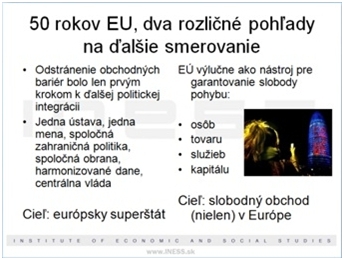

Finally, also people in Slovakia start to realize that euro is doing wonders with the European Union. „Union is heading towards a superstate“ thinks Michal Horvath, the former and the current advisor in Slovak Ministry of Finance. Who could have thought that?

Slide 4 from my presentation „€urostory – a story with happy end?“ from May 2008

(Bottom left:”Aim: European superstate”)

I wish all of us a beautiful weekend and above all, happy end

Juraj Karpiš

No comments

Be the first one to leave a comment.