Work is taxed with the highest percentage in Poland. Effective tax rate for work exceeds 40% – the rate similar to the taxation of vodka. But the main problem is not the fact that it is not worth employing for such rates but the fact that, taking into consideration the present tax wedge, it is not worth working for such rates.

The idea that social insurance civil-law contracts contributions should be paid to the Social Insurance Institution (ZUS) is another example of the fiscal solutions of the government. It is easy to predict the results. The number of contracts will decrease and the average pay will be getting smaller. Some people will lose their occupations, other will start being active in the shadow economy. The poorest, the worst educated and the young will suffer the most. The scope of the shadow economy and the takings to ZUS will be getting bigger. But it is difficult to estimate net benefits for the budget. Takings from contributions will have to be reduced by the decrease of takings from Personal Income Tax and additional expenses on social help, training courses and retraining.

Firms will not suffer so much, actually their situation may get better. Their advantage over employees will increase more. The situation will look worse in the case of non-governmental organisations, which cannot benefit from the shadow economy so easily. However, in many cases they will just increase certain amounts in the motions for subsidies in the right way.

All these things are obvious. Many articles have been written on this subject. But it is worth looking at this situation from two different points of view. Firstly, the issue of financing the national budget. Putting aside the effectiveness of spending public money, we should think where to take them from. Many things can be taxed: property, consumption, turnovers, capital, work. It is an important decision to specify, which of these elements will be the main source of income and which of them has serious political repercussions. High taxation of any of these areas is unfavourable.

In Poland, the taxation of property is relatively small. Real estate tax is nominal and inheritances and endowments are not taxed at all. Other property fees exist solely as anecdotes – I mean broadcast receiving licence or dog tax. Such an attitude causes the increase of property disproportions, but in our country these disproportions (measured with the Gini index) are surprisingly decreasing. The increase of fiscal stringency in this direction – even by an ad valorem tax – is the matter of time.

The taxation of capital is also relatively low. Low and simple taxes, both corporate income taxes and capital gains taxes, are favourable to the accumulation of capital. Supposedly, this is a right attitude because the decrease of capital in the economy is the most long-lasting and harmful result of taxation.

Taxes on consumption are very high. VAT and excise level is severely noticeable. In a country which is working its way up and wants to focus on investments it is not necessarily a bad approach.

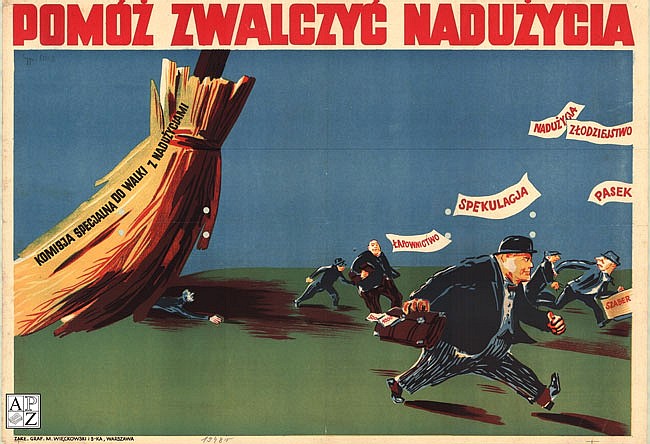

Help us fight abuses. Special committee for fighting abuses. Bribery, Speculation, Abuses, Theft, Looting A poster from the times of social realism – the fight against abuses, 1950s. State Archive in Zamość.

However, taxes on work are the highest. Effective tax rate for work exceeds 40% – the rate similar to the taxation of vodka. The results are seismic. Huge unemployment rate, people who cannot find work for a long period of time, social harms and all these things happen in a still developing country, where everybody should build our future. It is hard to deny that this is

a great mistake. Of course, as a counterargument it can be stated that the labour costs in Poland are low in comparison to the rest of Europe. It is true, but we have to take the work efficiency into consideration. But the main problem is not the fact that it is not worth employing for such rates but the fact that, taking into consideration the present tax wedge, it is not worth working for such rates. The system of social care often guarantees nearly the same money for no work at all.

Paying social insurance contributions derived from other employment contracts to ZUS is another example of this incomprehensible trend. Huge liabilities, when more increased, will result in further wastage of work, which could be beneficial for everybody, and consequently in further emigration from our country. It will only deepen our demographic problems and the deficit of the Social Insurance Institution. Present modest additional takings to the Social Insurance Fund (FUS) will result in great deficit in the future.

There is one more perspective worth considering. The latest front of social fight will not be

a traditional Marxist dichotomy of capitalists against employees. It will be the fight of the old against the young. Huge pension needs have to be financed by working people. According to demographic perspectives even the present retirement age of 67 will be an unattainable luxury. Depending on economic growth, the pension rates have to decrease from 75% to 50%. Of course, pensioners and people who are about to retire will be against such a scenario and their strength will give them political advantage. On the other hand, the young will vote with their feet (and they are already doing so). As long as it does not come to the closure of borders, pensioners have to lose despite their strength. And even if the borders are closed, it is difficult to make anybody work for free.

For now, tensions between these groups are not so visible. According to studies, the majority of people with civil-law contracts are looking forward to contributions deducted from payments. But it will change soon, when the results are noticeable in the terms of money in their pockets. Especially because political tendency to maintaining the status quo will force further increase of liabilities. Supposedly, entrepreneurs are next in line.

Nonetheless, the present decision is another little encounter in the main social conflict which will shape our reality through the next decades. Today, pensioners are still winning. However, the longer they triumph, the more painful their final defeat will be.

Translation: Anita Stradomska

No comments

Be the first one to leave a comment.