Up to two thirds of Slovaks do not know the real value of their work.

Press Release, Bratislava, 8 December 2021. The Minister of Finance has submitted a proposal for amendments to simplify the payment of levies and taxes on labor income. However, two more steps are needed before we can say after the reform that the system is simple and that employees understand the taxes and levies they pay: the abolition of the semi gross wage and the misleading title of ’employer’s levy’.

According to a representative survey commissioned by the economic think-tank INESS, very few Slovaks know what employer levies are paid today, or what their actual amount is.

This ignorance creates an information asymmetry between employers and employees, who do not know the real value of work. They therefore underestimate its tax burden and at the same time overestimate the average profit margin of entrepreneurs.

This ignorance contributes significantly to the fact that employees are not interested in how their money is managed by the state. It also allows the high tax burden in Slovakia to be maintained.

In 2020, the share of taxes and levies in total wage costs (super gross wages) in Slovakia was 43.7%, while the average for OECD countries is only 37.8%.

Few People Know the Level of Levies

The seriousness of the situation is underlined by a representative survey* by the Institute of Economic and Social Analysis (INESS) on super gross and gross wages. It shows that the vast majority of the Slovaks do not know the real costs which employers spend on employee remuneration.

We asked about the gross wage of 1,000 euros, and in total up to 71% of respondents either significantly underestimate or significantly overestimate the employer’s costs.

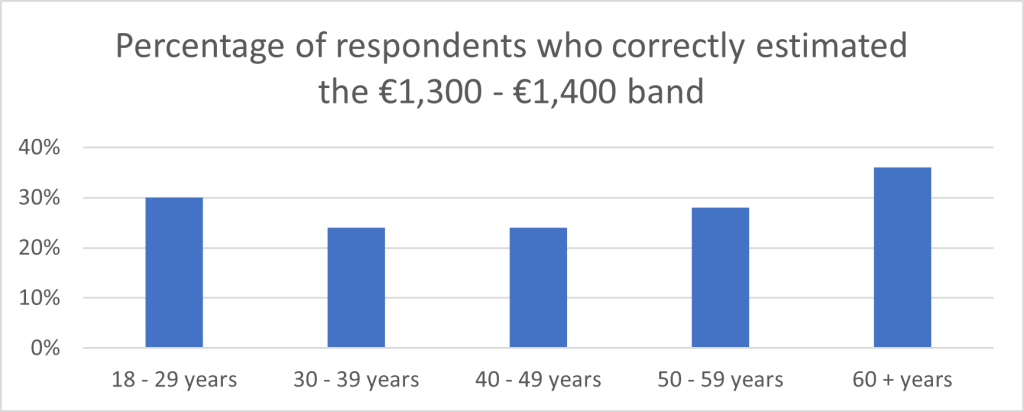

“College-educated people had only a slightly higher response rate of 38%. A similar proportion was achieved by a third of the highest income households. Respondents with higher education and income are better informed about the costs of their work, but this difference is not significant,” says Róbert Chovanculiak from the economic think-tank INESS.

The existence of employer contributions is an accounting fiction that has no economic substance. The employer, i.e. the company, cannot be insured for health or social insurance. The exception is accident and guarantee insurance, which should not be linked to wages, but to the employer’s potential accident costs.

Employees are not only unaware of the levies paid by the employer, but also do not have a good overview of the levies deducted from their gross wages. Employees pay a levy of 13.4% of gross wages, but only 36% of respondents reported a correct range of 10%-20%. More than half of respondents (55%) think that employees pay significantly higher levies, with a fifth estimating rates of more than 30% above the actual total levy burden.

The survey confirms what employers face every day when hiring new employees or talking about wage increases. “Discussions are being held about a variable that neither side cares about. For the employee, it is the net income that is key, for the employer it is the total cost of the work.

For example, due to ignorance of the amount of levies, employees often demand a (gross) wage that does not correspond to their expectations in net terms,” said Ján Solík from the Association of Slovak Entrepreneurs.

The Slovaks Don’t Even Know the Amount of Health Insurance

When asked how much an employee and employer pay for health insurance on a gross monthly salary of €1,000, only about a quarter of respondents (26%) answered correctly. More than half of the respondents (57%) estimated significantly lower contributions than the legislation stipulates.

“Ignorance of the actual levy burden means that employees do not know the true cost of public services that are not directly funded, including free healthcare. Raising awareness of how much of Slovaks’ wages goes to the state coffers would help increase interest in how the state uses these funds,” explains Róbert Chovanculiak.

Therefore, the system should be simplified into two levies – the social levy and the employee’s health levy. Since the tax burden on labor in Slovakia is relatively high, it would be advisable that such a reform should not lead to its increase, but rather the opposite.

Gross Wages Are Misleading

The survey also showed that a third of respondents even consider the gross wage to be the total wage cost of an employee. The results of the survey can thus be summarized by stating that employees in Slovakia do not know the real cost of their work and have the weakest information about the levies that employers pay to insurance companies on their behalf.

Ignorance of wage costs is not a surprising result, on the contrary, it is understandable. It is an undesirable consequence of the existence of the so-called gross wage, which is a fictitious, accounting value. The gross wage does not reflect the total cost of labor (it does not include the employer’s levy costs); in fact, it should be called the ‘semi-gross wage’.

If we consider it right for employees to know the true tax and levy burden of their work, their actual payment for public services, we need to initiate a change in the way levies are calculated. The best way to increase workers’ awareness is to abolish the use of the current gross wage calculation and replace it with the total wage cost (super gross wage).

The following figure presents what the current tax and levy design might look like if we abolished the old – semi-gross – wage and used the term gross wage to refer to the total remuneration for work – the employer’s wage bill. Income tax would be calculated on a higher base, so the rate would be lower, so that the amount paid would not change.

| Finance minister’s proposal of semi-gross wage | True gross wage | ||

| Total Labour Cost | € 2,000 | Gross Wage | € 2,000 |

| Contributions paidby employer | € 561 | Contributions paid by employee |

€ 561 |

| Semi-Gross Wage | € 1438 | ||

| Income Tax | € 273 | Income Tax | € 273 |

| Net Wage | € 1165 | Net Wage | € 1165 |

For more information on the initiative to abolish the semi-gross wage, visit www.polohrubamzda.sk