Georgia, after regainig its independence, became a place of many experiments. The nation made certain state-craft steps to obtain legitimacy and capacity to run social institutions. Including the process of restoration of private property.

This article is dedicated to the man. To the freedom and capabilities to protect oneself from a government, and, more specifically, from the abuse of power by the majority.

There are various ways used by nations to limit their governments, counterbalance three branches of power, protect the rights and freedoms of individuals.

The contemporary world created new challenges; abilities of individuals to limit the intervention of the government in their life have become less powerful. Governments created several new functions, which, on the one hand, created deep dependence of their citizens through huge welfare liabilities, and on the other hand, dramatically shrank the economic capacities and choices of said individuals.

The trend is supported by the politicians, who are looking for more votes, and by the voters, who look for opportunities to free-ride. These phenomena slowed down the economies, but, more importantly, limited freedoms of individuals. Even more alarming is the fact that there is no visibility of how this trend may be turned back.

In this challenging environment Georgia, since 2004, has attempted to conduct a set of free-market-oriented reforms, which enabled the improvement of the business climate and resulted in economic growth and reducing the government intervention.

In 2011, the country adopted a special amendment to the Constitution: Economic Liberal Act (ELA), which restricted the economic and fiscal powers of the government. Particularly, the Georgian government cannot:

-

spend more than 30% of the country’s annual GDP;

-

have a rate of the public debt of more than 60% when compared to GDP;

-

create more than 3% of the GDP of public budget deficit;

-

increase the tax rates or implement a new tax without a public referendum.

The ELA came to force in 2013 and created strong limitation mechanisms to the central government. Its efficiency became clear in terms of its impact on public finance policy.

On the other hand, there were several attacks and efforts to discredit the ELA in order to create more opportunities for the government to expand. In 2017, the government conducted a major reconstruction of the Constitution, which allowed the government to limit the period of the constitutional restriction on the tax changes by 12 years.

Apart from the negative economic outcomes of this change, it can also threaten the freedom of an individual.

Yet, the ELA helps an individual defend oneself against the government and the majority in the country. Should the ELF be abolished, such a turn of events would be extremely harmful for the citizens.

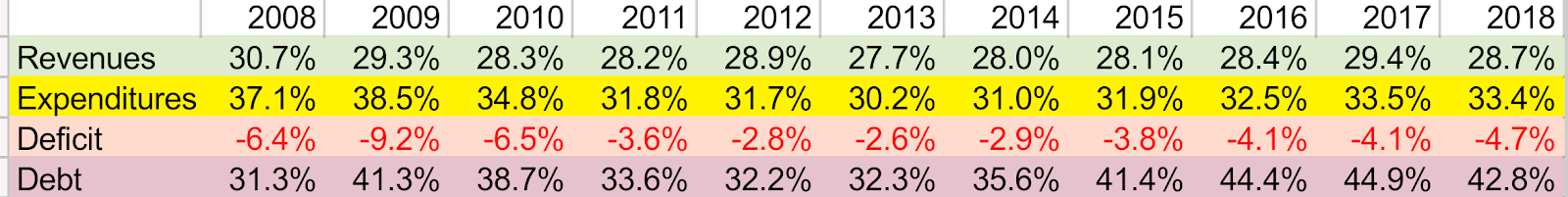

This is particularly visible when one observes the government fiscal statistics of the years before and after adopting the ELA. The table below is prepared according to the IMF and World Bank data (ELA has been in force since 2013):

Interestingly, both the IMF and the World Bank simply neglect the fact that the current Georgian government directly violates the rules described by the ELA in terms of government spending and deficit rates to the GDP. Moreover, they never announced their position on the ELA. It therefore seems that they have no high motivation in improving Georgia’s fiscal and economic situation.

Ongoing discussions about the 94th article of the Georgian Constitution (the Economic Liberty Act of Georgia) brought to the surface some very important problems of the contemporary world.

First of all, many people have somehow already decided that individual rights connected to the taxation powers of a government are not human rights. Or, differently put – there are some human rights and every person can demand execution of them but not in the case of taxation.

For instance, it would take the police a lot of effort and require going through very complex procedures to take possession of one’s property (letters, emails, etc). In the case of taxation, the government does notneed to follow any similar procedures.

Noteworthy, abuse of tax power (though for different reasons) can occur in the new democracies like Georgia, but also in any old democracy (like the US – remember the IRS stories?; or Germany? – more precisely, Germans hiding their tax money in Switzerland). Alhough it may take different forms, the taxpayers suffer anyway.

Value Added Tax – the most popular among the governmental taxes – is yet another example that illustrates the abuse of governmental power. It forces its payers not only to cooperate and collect their own taxes, but also to help the government collect this tax from other taxpayers.

This is not an innovation, governments have been obliging the businesses to collect the income taxes from their employees, and in both cases to do this extra work at their expense and for free for the governments.

Many constitutions may have openly opposing articles also when it comes to the property rights.

One article might, for instance, state that private property is inviolable but another may allow employees to strike, – thus directly attacking the private property, or demanding strict hiring or firing procedures, limiting the maximum amount of working hours per week or the number of paid holiday days, etc. It is easy to prove they all violate property rights.

Counting the governmental abuse and anti-individual rights powers may take us to a long distance. There are two issues related to Economic Liberty Act that are debatable:

-

restriction on the government spending – municipal, regional or central authorities combined together cannot spend more than 30% of the GDP;

-

Georgian government needs public consent obtained through nationwide referendum in order to implementat any new tax or increasing a tax rate .

Here, Georgian so-called constitutionalists became immediately one voice. Constitution must not include such kind of articles and voters must have the opportunity to support a political party that lobbies for more spending, they argue.

In fact, what they claim is that such a kind of restriction limits not only the government’s power to abuse, but also the “creative” opportunities of such constitutionalists.

First of all, such restrictions may be really unique. The Swiss constitution demands to organize referendums on any issue important for the people, including taxes. Several states in the US are also known for some spending restrictions.

Such constitutional requirements can be unique and strange for European lawyers but they can also claim that the US constitution itself is unique, as it was not written in the same legal language as the European ones – it also restricts the actions of federal government that could be aimed at the people.

Such an approach is not visible in European tradition.

The US Constitution is also clearly based on the system of checks and balances of the three branches of power – which has been completely ignored in parliamentary systems of many European countries. If one wants to see barriers to abuse of power, one must insist that due to less competition of powers European systems need much stricter limitations of political powers and guarantees for protecting individual freedoms. Unfortunately, we see mostly quite the opposite trends.

It is obvious also that with less checks and balanced of political powers, a democratic system could fail. Some people can talk much that the communist system is also good if used properly and kindly. But we cannot continue with such utopian experiments as they destroy our lives.

We have to risk less and have more guarantees that democratic power will not destroy our freedoms.

I was one of the few people who always openly argued that democratic system can work more or less normally if it is combined with limited powers of a government. I believe a taxpayer is also an individual who needs protection from the majority. Either we agree that an individual – a taxpayer – is still an individual or we have to admit that the democracy is not a value but a tool in the hands of the majority to oppress an individual or a small group.

But if we still keep arguing that an individual is valuable, then constitution has to restrict the actions of the majority from it abusing power, including when it relates to the taxation and fiscal rules.

The contemporary Georgian welfare programs became a very huge abuse of power. Let’s take the example of state pensions.

People are required to pay taxes to the state pension funds without their consent. The money contributed to the pension funds go through inflation spirals, political and economic crises. And the taxpayers have zero influence on this process, consequently they get only what the government at that moment can afford.

The argument that restrictions of government spending and taxing are limiting the voters’ choice is, certainly, worth to think about. Some people can also claim that if this is a club and we need to follow its rules.

Sorry, but since the membership in the club is not voluntary, the restrictions must be on the club president’s side, not of the members. As members often do not have the right to opt out (at least easily and cheaply), they do, however, have the right to demand very strict rules to be set by the club leadership.

Any rules written in the constitution could be questioned in the same way. What if voters wanted to support a party which is against racial, religious, or ethnic equality? Would we consider giving anybody such an opportunity and choice?

The answer is: not really, because we have decided that there are some principles that are not open for a debate. But private property, taxation, and spending choices are all about individual choices.

Moreover, tax and property relations between an individual and a government are the core philosophical issues – either I trust the system, or I feel like an outsider.

No Taxation Without Representation

Many people may think that the Tea Party slogan is outdated and has nothing to do with the contemporary realities. Some people can say that in the current world almost everybody has a right to vote. But I think that this slogan is about something more than just voting or knowing who is representing your city in the Parliament.

It is also about an ability of an individual to really influence the political processes and guarantee his/her personal freedoms against the majority.

The larger a community becomes, the more difficult it gets to influence the majority to protect your personal freedoms.

The larger the public spending becomes, the more impossible it becomes to monitor it. So, one might claim that by means of having voting rights, one has the power to represent oneself, but in reality this power is very weak.

This tells us one thing – democracy cannot guarantee individual freedoms against the majority. And constitution must provide such kind of guarantees of protection of individual freedoms against the majority.

Therefore, this slogan reveals, in fact, the real meaning of democracy. Either constitution insures such guarantees, or it becomes a powerful tool in the hands of the majority.

Is Democracy Like a Joint Stock Company?

Let’s compare democracy to a joint stock company. In both cases we have voters. But the biggest difference is that in the case of the former one has no chance to escape the costs of the week influence one has as an individual voter, no chance to avoid future costs.

But in the second system, anybody who feels his/her weak position can just leave and get rid of the future costs. In fact, the right to leave is more important than the power to enter.

I remember the last years of the Soviet Union, when Georgia and some other small republics decided to leave. The Soviet constitution featured a special provision that actually allowed for such a decision. But when we analyzed the then current political situation in the Soviet Union, we decided to put guarantees in our Georgian constitution.

The special amendment of the Georgian constitution added in 1989 stated that Georgia had the right to secede. If the Soviet authorities attempted to restrict this right, Georgia would be automatically free.

I strongly believe that this was the last strongest signal to the Moscow authorities that artificially keeping the “union” was not possible any more.

I believe this is what we need – rules that work authomatically, which can immediately respond to government’s efforts to restrict individual freedoms using power of majority of voters.

The Economic Liberty Act of Georgia gives Georgians a very good tool to protect themselves from the abuse of power by the majority.

The government cannot spend more than 30% of the GDP, which means not only less money wasted, but also less bureaucracy, less corruption, and less abuse of power – and in turn more protected individuals.

The power to vote on whether or not to have more taxes or to increase tax rates is another mechanism in the hands of individuals that enables them to try and protect themselves from the government and from the majority.