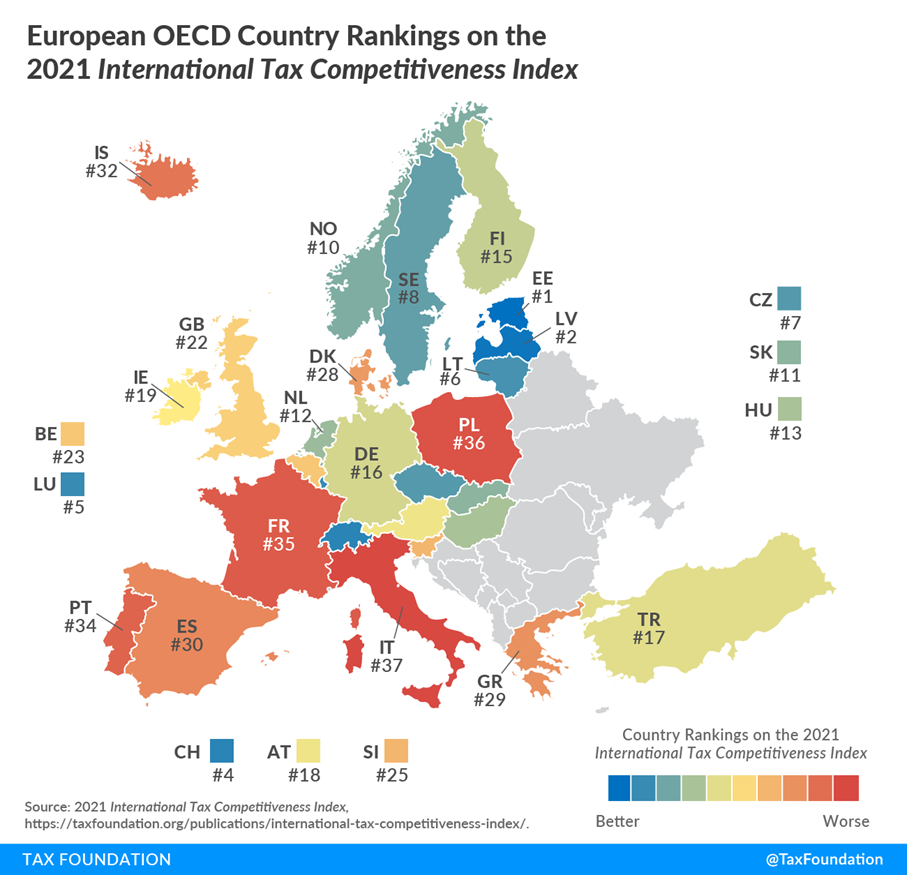

In the latest edition of the International Tax Competitiveness Index, Poland was placed 36th out of 37th OECD countries. In the international ranking of tax systems’ competitiveness prepared by the American Tax Foundation, only Italy scored worse. Poland maintained its position from last year and is three positions lower than two years ago.

The index measures the quality of the tax system in five areas: corporate taxation, personal taxation, consumption taxation, wealth taxation and rules for taxing cross-border activities. It takes into account not only the rates themselves (competitiveness) but also the complexity associated with numerous preferences and exceptions (neutrality).

The most significant problem of the Polish tax system turns out to be its complexity. Poland also performs poorly in terms of the tax base for consumption taxation, which is associated with the existence of a wide range of reduced VAT rates.

The index does not take into account an aspect which is particularly painful for Polish taxpayers, i.e. the volatility of regulations and uncertainty related to their enactment. Tax regulations in Poland are modified every now and then, which officially is often intended to “patch” loopholes.

What is worse, in recent years, it has become an infamous tradition to work at the end of the calendar year on tax and contribution changes which are to be effective as of January 1 of the following year.

This uncertainty is further increased by the work on the tax reform, the so-called Polish Deal, which does not respond at all to the problem of excessive complexity of the Polish tax system identified by the Tax Foundation.

Continue exploring:

Cheap Chicken Meat Equals Cheap Election Victory in Hungary?

Competition Is Like Adidas Stripes, More Is Not Always Better