Last week’s events give some hope that the deep crisis which has gripped Venezuela’s economy in the past few years could end, or at least that the country may head towards economic recovery soon.

It is, however, worthwhile to review the dimensions and the causes of the crisis again. A crisis that brought the country, just a decade ago paraded as an example of successful implementation of a socialist system and a viable alternative of the Western combination of liberal democracy and capitalism, to the very brink.

The detail frequently left out from the rosy narrative of the so-called “Bolivarian socialism” was its extreme dependence on the export of crude oil and petroleum products, which make up more than half of the economy of the country. It is no mystery why Venezuela’s economic cycle is tightly connected to the dynamics of the international oil markets, and the country’s economic crises coincide with their sharper slumps.

Similarly, the crisis that has overtaken the country in the past few years is a consequence of the sharp drop in the price of oil in the beginning of the decade and the shrinking of Venezuelan exports.

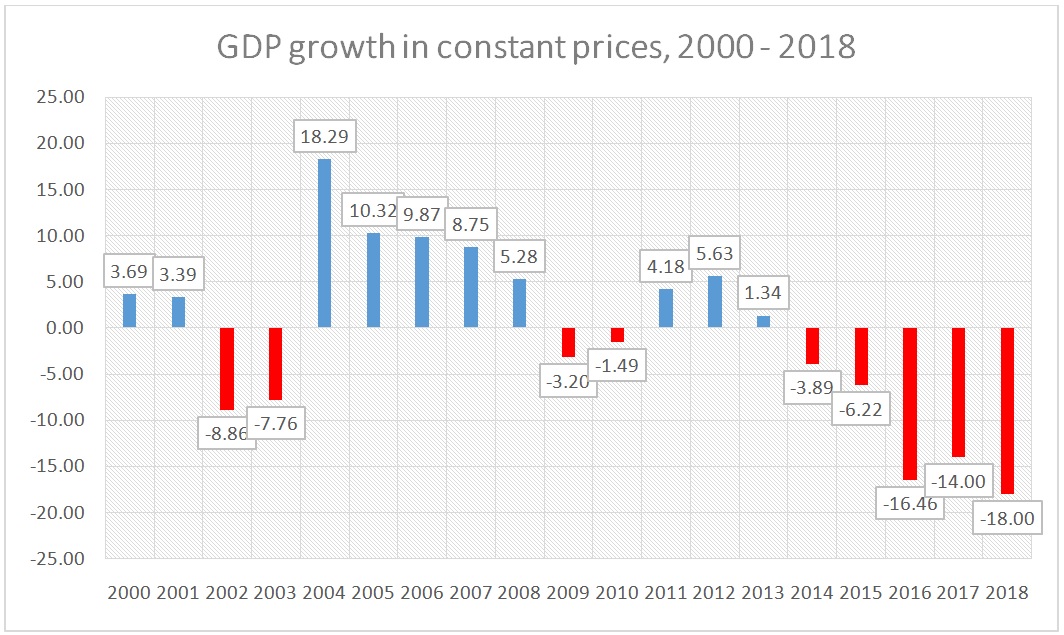

Figure 1: GDP growth

The dynamics of Venezuela’s gross domestic product clearly demonstrates the severity of the crisis that the country has been in the past five years – a period of recovery and economic growth for most of the rest of world. The fact that in the past three years Venezuela has been losing about a sixth of its economy annually mostly explains its population’s rapid impoverishment and the disappearance of essential products from the shops.

The dynamics of the country’s GDP in the beginning of the century is also quite curious, as this was yet another period of economic growth for the rest of the world, but also one with relatively low oil and petroleum product prices, which, as expected, produced the previous grave economic crisis in Venezuela.

If there are any causes for optimism, they can be found in the IMF’s midterm prognosis, according to which Venezuela will stay in recession in the next five years, but its economy will shrink in a much slower rate compared to the current one.

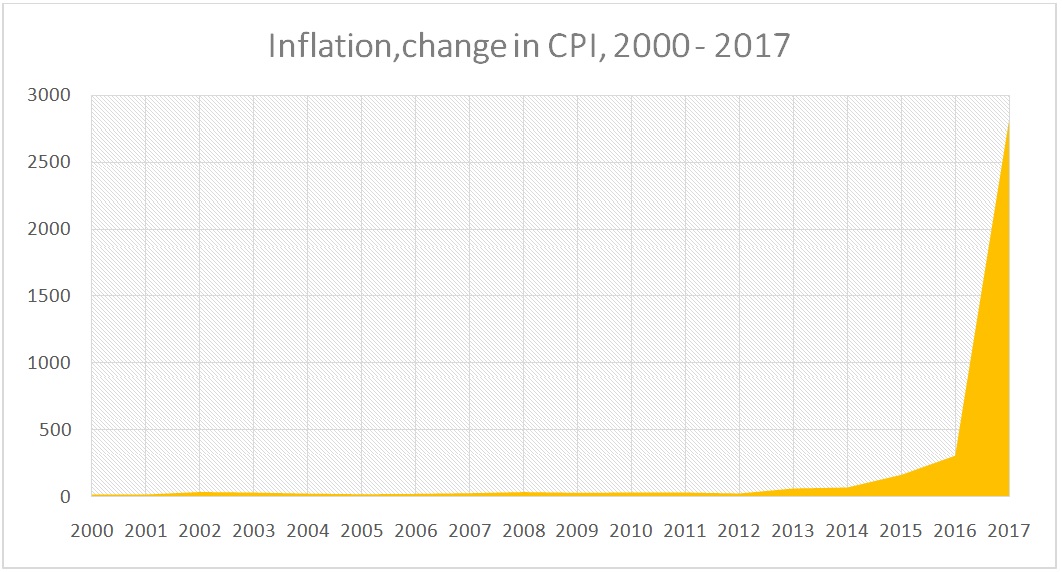

Figure 2: Inflation

Inflation is likely the best illustration of the crisis’s impact on the life of the average Venezuelan. Even back in 2015 the country led the world in the annual increase of the consumer price index, and in 2017 it reached almost 3000% (last year is not included in the graph since the IMF prognosis shows a growth of about 2.5 million per cent).

In practice, for several years inflation has completely wiped the purchasing power and the savings of Venezuelans, and the subsequent increases in the minimum wage did nothing to alleviate this. The same issue can be seen in the real-world exchange rate of the Bolivar, which has practically lost its value relative to the global currencies.

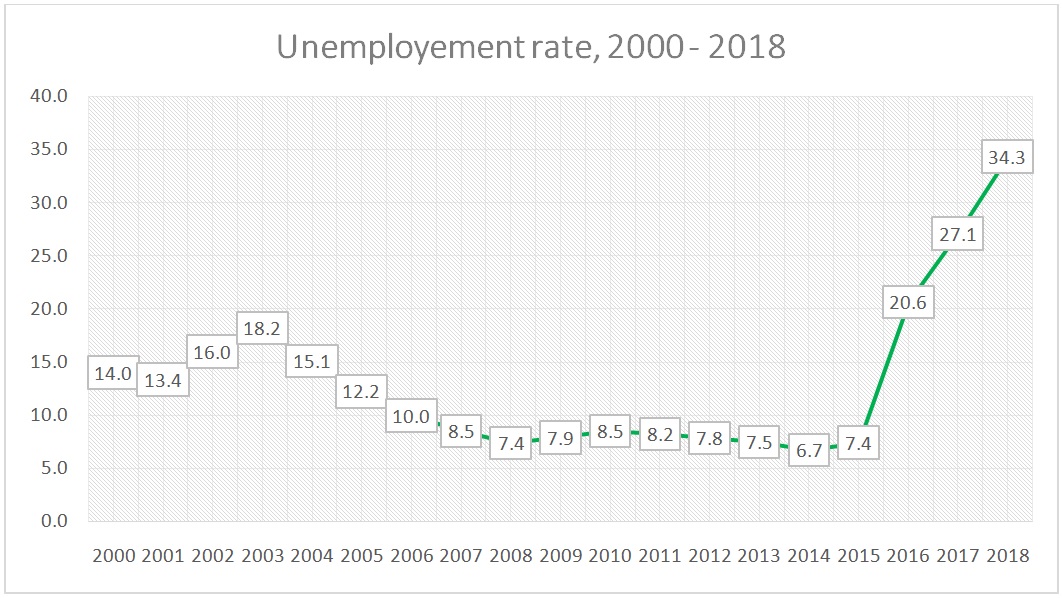

Figure 3: Unemployment

The crisis has also not left out the labor market. While in the first two years of crisis unemployment was relatively low, today it covers more than a third of the labor force; in this instance we also need to remember that a significant part of the population seeks employment in the surrounding countries, where they also find better access to consumer goods, in addition to much better wages.

The labor market recovery will likely be among the hardest challenges on the road towards economic recovery of Venezuela

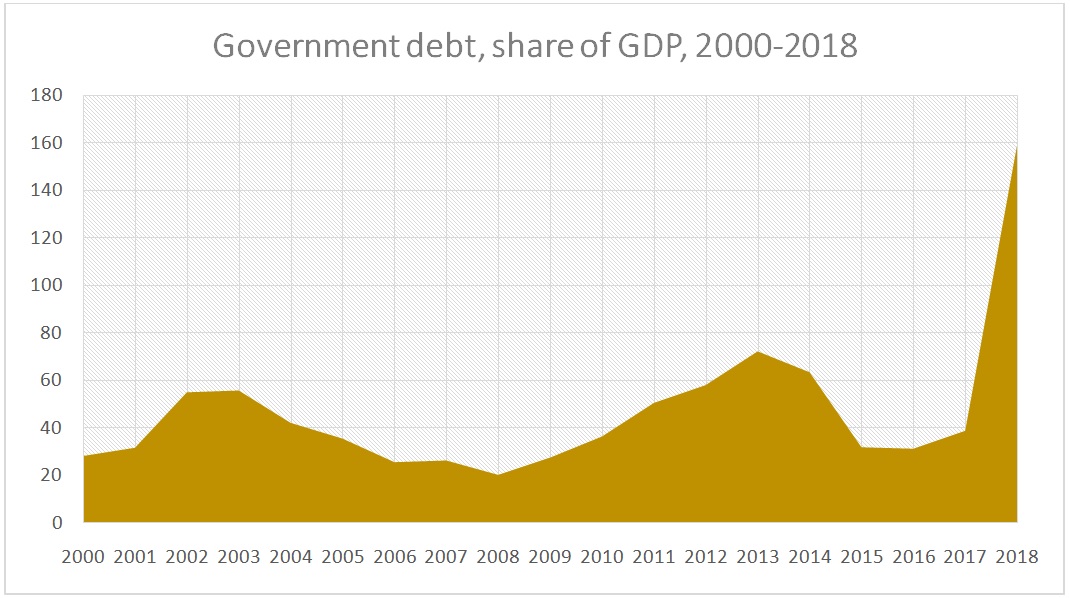

Figure 4: Government debt

If there even was a macroeconomic indicator that provided some grounds for optimism regarding the future of the economy of Venezuela, that was its relatively low government debt.

According to the IMF prognosis for 2018 (and the following years), however, Venezuela’s debt has increased drastically and as a result its payment will provide an additional obstruction to economic recovery.

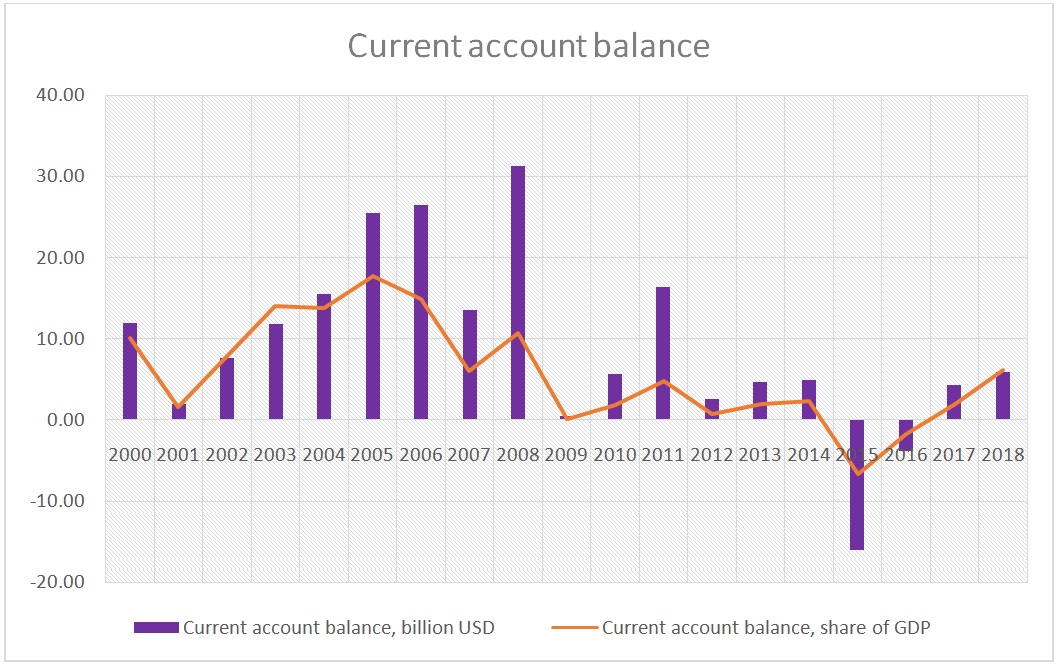

Figure 5: Current account balance

Given the high dependence of Venezuela’s economy on exports, the current account balance is quite telling for its overall condition. While in 2015-16 the typical significant surpluses (mostly a consequence of oil trade) quickly turned into deficits, in the past two years it seems that the trade balance has somewhat normalized.

It has to be noted, however, that the new equilibrium is not a result of a pickup in oil trade, but rather of the shrinking of imports.

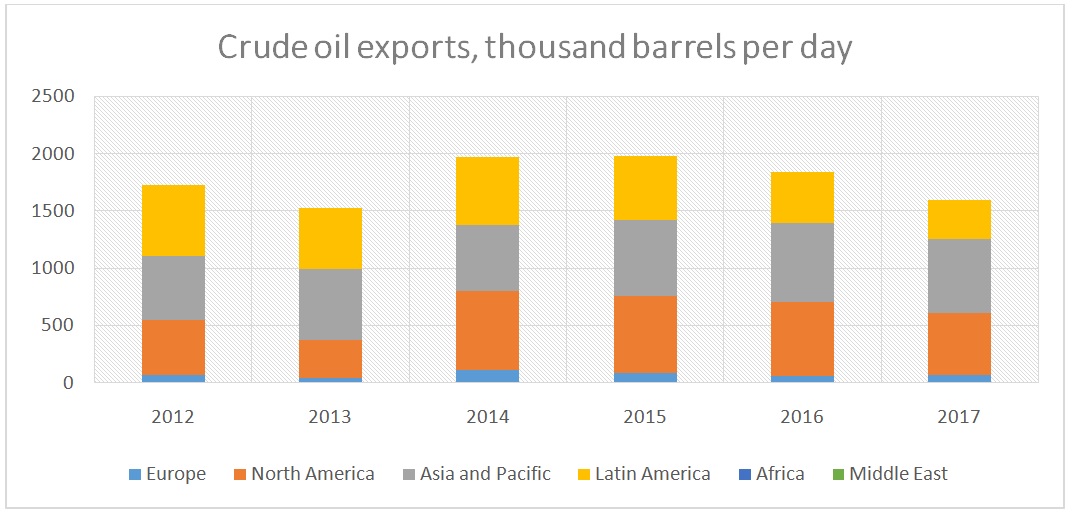

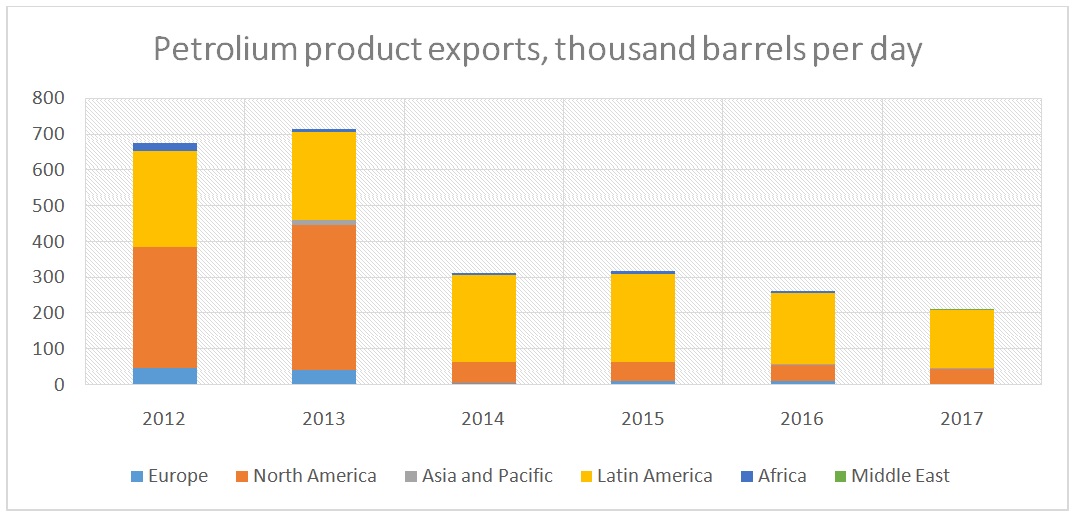

Figures 6 and 7: Oil trade

It is also worthwhile to trace the most direct cause of the Venezuelan crisis – the collapse of oil trade. While until recently the crude oil exports of Karakas seemed relatively stable, in the past few years its presence in all key markets has declined significantly.

The export of refined petroleum products, however leaves little room for optimism – Venezuelan fuels have basically disappeared from all markets other than the surrounding countries. In other words, the recovery of the Venezuelan economy will also require a restructuring, aimed at decreasing the dependency on oil and petroleum products.

In Conclusion

Even though the breakup of the Nikolas Maduro regime will likely pave the way of economic reforms and put an end to “Bolivarian socialism”, the events of the past few years are a cautionary tale for countries tempted to combine their dependence on resource export and the resulting quick and easy wealth with a centralized economy, high levels of redistribution, and lack of economic freedom.

Time and again, this model has proven its fragility and susceptibility both to external shocks and internal tensions, and Venezuela is no exception.