Is the last fortification falling down? Spain used backup. American debt can ask for a driving license. And Bulgarians are ungrateful.

Silly season ended in a big style. ECB decided on its meeting last week to resurrect the program of purchasing bonds of the problematic states under a new label. Forget SMP, here comes new and better OMT – Outright Monetary Transactions! Apart from bubbles of active oxygen, it also offers lack of limits, sterilization and consolidation. It means that ECB will be buying bonds according to needs, but at the same time each country which is involved has to commit to a program of reforms. There are already programs of reforms imposed by MMF, EFSF, EFSM and more to come. Let’s hope there is still enough space on the shelves. Short-term bonds up to three years will be purchased, and purchases will be sterilized, so that money for it would be withdrawn from the circulation somewhere else.

Silly season ended in a big style. ECB decided on its meeting last week to resurrect the program of purchasing bonds of the problematic states under a new label. Forget SMP, here comes new and better OMT – Outright Monetary Transactions! Apart from bubbles of active oxygen, it also offers lack of limits, sterilization and consolidation. It means that ECB will be buying bonds according to needs, but at the same time each country which is involved has to commit to a program of reforms. There are already programs of reforms imposed by MMF, EFSF, EFSM and more to come. Let’s hope there is still enough space on the shelves. Short-term bonds up to three years will be purchased, and purchases will be sterilized, so that money for it would be withdrawn from the circulation somewhere else.

This program obviously doesn’t mean anything else than that through ECB the core countries will take over the risk from the problematic countries. Germans didn’t like it, but they weren’t helped by either Fins or Dutch, not to mention Slovaks. Bundesbank suffered another defeat, euro ceased to remind Deutsche Mark a long time ago and we are waiting in tension when it will start reminding the bad old Italian lira.

Yields on Spanish and Italian bonds reacted by dramatic fall and European stock markets with not that dramatic rise. Two years of debt crisis taught us that every moment of happiness is temporary and as the effect of SMP faded away quickly, the same will happen to the effect of OMT. ECB announced at the same press conference lowering expectations concerning economic growth of the Eurozone from -0.1 to -0.4%. This week Moody’s for the first time added a minus to AAA rating of the EU. This is just a tip of an iceberg of bad news.

Their source is mainly Spain. Regions which have already asked central government for help were joined by the fourth one – the most populous, Andalusia. It requested decent one billion euros. However, this is the last worry on the government’s mind. Spanish banks are losing deposits of frightened citizens on a big scale and to balance them, they have to sell assets, which means mainly Spanish bonds. It’s unpleasant not only because this way their supply and thus yield on the secondary market increases, but also because until recently Spanish banks by purchasing state bonds had government on a liege. Between December and March they bought (for the money borrowed from ECB) EUR 87 billion of the domestic debt. This year Spaniards need to refinance at least 30 billion. Several Spanish banks have run out of loan sources from ECB, from which they borrowed already EUR 410 billion, and now they don’t have more assets (collateral) that they could offer. But here comes a patch for a patch – program ELA, known already from Ireland, Portugal and Greece, in which banks borrow money from a national central bank for virtually any collateral, and a central bank borrows money from ECB. Financial system falling apart is reflected in a situation of Spanish economy, where record number of 2272 companies went bankrupt in the second quarter of the year. Catastrophic unemployment reaching 24.6% still has a potential for further increase. Does it seem unsustainable? Little birds on Internet are saying that Spanish government will ask for help already this week.

When it comes to unemployment Spain can be matched only by Greece, which after two years of receiving aid of billions of also our money reached unemployment rate of 24.4%. In one month it increased by 1%. One of the solutions is supposed to be six day work week, at least according to Troika. According to OECD Greeks work after Mexicans and Chileans the highest number of hours in the world. Well, for example Greek shipmakers buy right away ships from their bankrupt German colleagues. They borrow money for that without any problems from German banks. However, it is difficult to create welfare, when the majority of what you work for goes to maintaining inefficient state. Riot police already has to deal with their demonstrating colleagues, but they are not very eager to do so. Maybe they will find comfort in one more thing. New euros are supposed to bear pictures from Greek mythology. According to fortune tellers, it might mean that in the future Eurozone counts on with Greece.

In the noise of bankrupting Spain and Greece the news from other countries may not be heard. The second biggest mortgage specialist in France, Crédit Immobilier de France, announced problems and the government came to help right away holding money from taxpayers in its hand. CIF has to find 1.7 billion until October. With progressing problems in Spain there will be more cases like this in France, as the periphery exposition of the French financial sector is more than significant.

Problems of Slovenia haven’t disappeared either. In October this country will need money and a chance to find it on the market is very slim. Their finger on the doorbell of the EFSF or ESM is ready. As we say „The eye sees!“, and the Bulgarian eye sees that for now it will leave the euro alone. September 12 is already marked in your calendars for the German Constitutional Court‘s meeting concerning bailout mechanism and the draft of the European banking supervision, you should add to this date also the elections in the Netherlands. Eurosceptic Wilders calls it a referendum on euro and the EU.

But the opposite side knows how to speak in strong voice as well. President of the Commission Barosso considers it to be necessary to strengthen the European institutions at the cost of individual states power: „We need to consolidate a transnational order that through shared sovereignty guarantees the protection of our citizens.” Everything for our own good. The bureaucratic band on Titanic keeps playing, as if nothing was happening. The newest song is called “State enterprises have to hire more women in their supervisory boards!” and the lyrics are about a popular theme that it’s not the employer who should decide with whom he wants to work, but the EU.

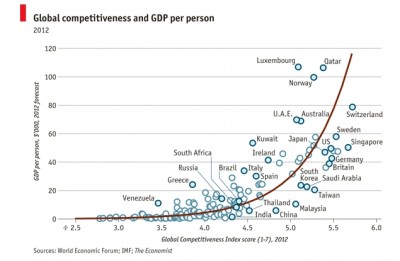

And what about Slovakia? We have dropped in the competitiveness rankings and our position was quite bad already in 2010. Competitiveness doesn’t matter? For mainstream economists, who love GDP and correlations, we have the answer here.

All quiet on the Western front, Americans are getting ready for the elections, which will decide about everything nothing. Their debt has already reached 16 (not years, trillions), so it can ask for a driving licence to race up even faster. Well, it seems that there will be definite break of events soon. Ron Paul’s warnings didn’t help, but now a thundering voice comes, which prompts everyone to be on guard. Days of socialism are counted.

Have a peaceful weekend on barricades

Martin Vlachynský