ECB trade unions protest, Barclays collects all the prizes both at home and abroad, Sarkozy packed toothbrush and pajamas – just in case, Finns and Dutch are disobedient, Klaus witty about the Europe as always. And you know who rules the EU? Communists.

Ongoing crisis has profound social implications. So significant that they were noticed even by the trade unions in ECB. In a survey carried out among employees it turned out that the years of hard fight against the crisis required from them a cruel payback in a form of increasing unsustainable workload. Problem is mainly the small number of ECB employees, judge yourself, 1200 people employed in the headquarters simply can’t manage all the crisis. For example this week they had to reduce the interest rate from 1% to 0.75%, which is a new record. Let’s hope this time it will help. If not, then we will reduce it again.

You ask how it will be done, when the 0% level is already slowly approaching? Ask the Danes. They reduced interest rate to 0.2% and deposit interest rate (which a commercial banks receive when they deposit Danish krones in the Danish central bank) to -0.2%. Yes, you got it right; banks are paying for the possibility to deposit money on the central bank’s accounts. Scared capital from other countries is escaping to relatively safe Denmark. Jacob Graven, chief economist of Sydbank A/S commented: „It is a sign of strong Danish economy…We have a problem of luxury.“

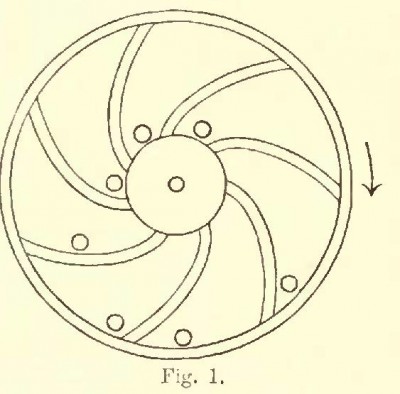

We do not want to underestimate ECB, they do more than this. For example, this week they &sid=1" target="_blank">reduced the collateral requirements that banks have to meet to receive money from ECB. ECB gradually creates a perfect financial perpetuum mobile. Commercial bank creates and subsequently sells any product, for example leasing for cars. The bank sells it and then provides ECB with the leasing agreement as a collateral, in exchange ECB prints new money and gives it to the bank for its collateral. That bank will borrow the money through another product, for example cheap mortgages for garages in Bratislava and all repeats from the beginning. It’s possible that at the end of the year ECB will accept pawn tickets as a collateral.

example leasing for cars. The bank sells it and then provides ECB with the leasing agreement as a collateral, in exchange ECB prints new money and gives it to the bank for its collateral. That bank will borrow the money through another product, for example cheap mortgages for garages in Bratislava and all repeats from the beginning. It’s possible that at the end of the year ECB will accept pawn tickets as a collateral.

As some say, “couples who fight have better marriages”. Even though governments and banks are swashbuckling often, in reality they are cooperating nicely. Magazine Euromoney announced bank excellence awards (more awards than there were on Brezhnev’s chest). In the category Best Global Debt House, Best Investment Bank and Best Global Flow House of The Year the winner was…Barclays! Yes, the bank which is currently facing the biggest financial scandal since the time of Lehman Brothers, because it manipulated LIBOR, interest rate, for which banks were lending money to each other in London. Barclays’ representatives don’t want to give up without a fight. They pointed to the former British government and the Bank of England, from whom they reportedly received informal instructions in the year 2008 to push down the LIBOR rates and calm down British economy this way. Simply, banks and state are in the same bed.

As some say, “couples who fight have better marriages”. Even though governments and banks are swashbuckling often, in reality they are cooperating nicely. Magazine Euromoney announced bank excellence awards (more awards than there were on Brezhnev’s chest). In the category Best Global Debt House, Best Investment Bank and Best Global Flow House of The Year the winner was…Barclays! Yes, the bank which is currently facing the biggest financial scandal since the time of Lehman Brothers, because it manipulated LIBOR, interest rate, for which banks were lending money to each other in London. Barclays’ representatives don’t want to give up without a fight. They pointed to the former British government and the Bank of England, from whom they reportedly received informal instructions in the year 2008 to push down the LIBOR rates and calm down British economy this way. Simply, banks and state are in the same bed.

Let’s move a bit closer to a sea, for example to the French Riviera. The still fresh President Hollande will impose new tax up to 75% on the rich. Check out the reaction of Will Smith to the idea that if he was French, he would have to give ¾ of his income to the government. Even more telling was the reaction of David Cameron, who welcomed the French rich with the words „Roll out the red carpet!“ Politicians are joking while unemployment in the Eurozone reaches new records.

The male half of the once famous duo Merkozi has totally different worries. Police searched Sarkozy’s house and offices in connection with suspicious financing of his presidential campaign in the year 2007.

Here at home we are especially interested in the ESM bailout mechanism. After Spain, Cyprus – a country currently holding presidency in the EU – will be the next member state needing bailout. Cyprus first asked Russia for a loan, then asked Eurozone for ten billion and in the end it seems it will get help from both. Cyprus, with rich gas resources, can negotiate better (translate as ”none”) conditions of the loan. But taxpayers don’t have to worry about their money.  Charming President Demetris Christofias from the ruling Communist party (no, it’s not a joke, EU is really led by a country ruled by a Communist party) said that „if the government didn’t feel capable of paying back the loans it wouldn’t ask for them, because it doesn’t lie in the government’s interest to burden future generations of Cypriots.“

Charming President Demetris Christofias from the ruling Communist party (no, it’s not a joke, EU is really led by a country ruled by a Communist party) said that „if the government didn’t feel capable of paying back the loans it wouldn’t ask for them, because it doesn’t lie in the government’s interest to burden future generations of Cypriots.“

Slovenia still says it doesn’t need any loan, even though there are rumors saying something different. Slovenian banking sector recorded loss of EUR 436 million in the year 2011, it survives only thanks to ECB, which has already provided over EUR 2 billion, more than a half of which went to the most problematic bank NLB. Majority of NLB is owned by the state, which can’t afford bailing it out. In 2007 the „Balkanian Austria“ had balanced budget, in the year 2011, thanks to the expenditure growth it jumped to -5.5% of GDP, and since Slovenians refused to carry out reforms, much improvements can’t be expected. It should be a memento for Slovakia that the situation can deteriorate faster than we can say “fiat euro!”.

The savior of NLB and thus of the whole Slovenian banking system was supposed to be the Belgian KBC, which wanted to buy NLB shares and provide the necessary capital injection. KCB finally stepped back as there are concerns that the Commission would not accept this move. KCB itself received significant help not long time ago and part of the plan was to get rid of part of KBC portfolio, including NLB. Commission decided that KBC can invest in Slovenia but has to get rid of other assets. Tempting.

Let’s not forget the last June weekend. Eurozone’s representatives agreed that ESM will be able to directly finance also banking sector. Member states that are shareholders of ESM will borrow money to insolvent banks practically without any conditions; in exchange they will receive their shares. At the same time they would like to enable ESM to directly purchase bonds of the problematic states. Fortunately Finland and Netherlands are brave enough to oppose that idea and said that they would block such attempts. Question remains if they will manage to do that. Agreement on ESM is as flexible as a chewing gum and when it was once signed, it can be changed according to current needs.

To bring also some positive attitude, there is also good news coming from Ireland. As one of the few they tried to carry out reforms keeping relatively low taxes at the same time. The result is decreasing interest rate on bonds, which fell from almost 15% to the same level what Spain has to pay today.

It became a good tradition that we end in a funny way. This time let’s go to Malaysia, which was visited by slowly retiring Czech President Klaus. Local EU ambassador carelessly asked him if he thinks that the project of the EU is wrong from the beginning. Klaus in line with his reputation answered right away that cooperation is good but centralization isn’t. „Speaking openly, I don‘t agree with having ambassador of the European Union in Malaysia. I have ambassador of Czech Republic here with me. He, not you, represents me…I think that ambassadors of the EU are a bit like a plaything – not needed, and unnecessary“

Have a peaceful weekend

Martin Vlachynský