“It’s the economy, stupid!” – this slogan led Bill Clinton to presidential victory in 1992 in the United States. If we were to paraphrase this statement, we could say that the last few days of the 2015 presidential campaign in Poland were almost vibrating with slogans urging to lower the retirement age in Poland. One may want to shout: “Demography, stupid!”. Why? Let’s invite the ghosts of our past, present and future to answer this question.

First, the past. In 2004, Poland was a state in which opportunities to exit labour market earlier resulted in a situation when only a handful of people were working until the statutory retirement age. Over 1.6 million Poles were eligible for early retirement or pre-retirement benefits and allowances, and the employment rate among people aged 55-64 amounted to 26,1%. Does it mean than back then the youth had jobs? Not necessarily, as the unemployment rate among people aged under 25 amounted to 39,6% (!). We even envied the Spanish – only 22% of the youth were unemployed. Economists speculated why the unemployment is at such a high level despite the economic growth. One of the reasons for such a state of affairs was the need to provide the benefits for an extremely numerous group – people who were potentially still able to work. It was a bitter pill to swallow which proved that allowing some people to retire earlier does not go hand in hand with creating new jobs for the youth – it’s a myth that politicians keep believing in, but the falsehood of which has been proven many times before.

Now, the present. Reforms initiated by the so-called “Hausner Plan” have restricted the availability of the pre-retirement benefits. “The Bridging Retirement Act”, passed in 2008, redefined the terms of performing work in hazardous conditions and of hazardous nature, and limited the number of workers with long service eligible for earlier retirement. How the situation is shaping today? In 2013, almost 700.000 people received pre-retirement benefits. In 2014 the employment rate among people aged 55-64 amounted to 42,5%. The unemployment rate among the youth reached 23,9%. Of course, it’s not a low number. Nevertheless, it is lower that ten years ago. To put things in perspective: now, in Spain, 53,2% of young people are unemployed.

Today, demography gives us a warning – now in Poland there are less than 400.000 newborns each year (according to the Eurostat forecasts, in the year 2040, only 300.000 children will be born in Poland). This means that already today fewer people enter the labour market than exit.

Looking into the future, let’s be frank – changing the retirement age will not reverse the negative effects of the aging of the population on the labour market and the pension system. According to the Eurostat forecast from 2013, in 2040 in Poland, there will be about 3.6 million people aged 60-66, about 18.2 million people between 20-59 years old and 8.1 million Poles aged over 67 (in comparison, in 2015, there is 3.6 million people aged 60-66, 22.1 million aged 20-59 and less than 5 million of people over 67). In other words: up to the year 2040, the group aged 20-64 will shrink by 3.9 million, and up to 2060 by 8.5 million. Changing the retirement age was therefore a necessary step. However, it may not have been enough in terms of maintaining the generational balance on the labour market.

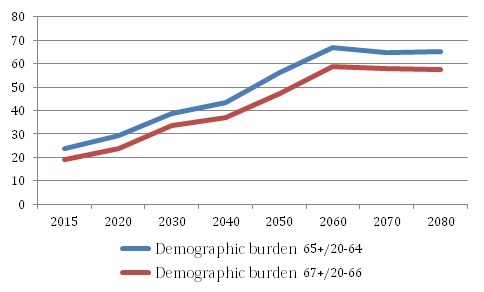

The demographic dependency ratio shows the challenges that pension system has to face in the future by illustrating how many people in the retirement-age group occur in a hundred (Fig.1). It becomes clear that increasing the retirement age will help balance the number of people in the retirement-age group and the youth. It will not, however, reverse the developing trend that will continue until 2060.

Fig.1. Demographic dependency ratio in Poland: Forecast.

Source: Own calculations based on Eurostat data.

A significant and favourable consequence of the forthcoming demographic changes is an increased longevity – now a 60-year-old woman has about 24 more years ahead of her, in 2040 this number will increase to 27 years, and in 2050 – to 29,5. A 67-year-old woman will have 18,3 more years ahead, and in 2060 – 23,1 years. Those positive changes mean that there is a need to raise the retirement age in order to maintain the proper balance of the years spent as an active worker and the years spent as a pensioner. It also suggests that the financial stability and an adequate amount of benefits received by each individual from the pension system should be secured.

Polish pension system needs a reform. In the recent years, in the light of the deteriorating condition of public finances, a series of modifications has been introduced – they have, however, blurred the rules governing the pension system and evoked distrust in the society. And so, in view of the already observable demographic changes, instead of promising castles in the air, we should stop to think how can this trust in the future of the pension system be rebuilt. How should we do it? First of all, by simplifying the current system, integrating some pension pots (why does the Polish Social Insurance Institution, ZUS, hold now two separate accounts?). Secondly, by simplifying the set of information provided for the future retirees so each of them would easily understand what amount of money can they expect to receive from the public system. Thirdly, by searching for the ways of further integration of the system for different professional groups (farmers, miners or uniformed services), so the different structure does not discourage them from labour market mobility.

Demographic change is not a tsunami. It proceeds gradually but steadily, just as the ocean’s tide. It can be foreseen if we simply choose to open our eyes and look at facts.

The article was originally published in Polish: http://liberte.pl/demografia-glupcze-czyli-opowiesc-wigilijna-na-dzisiejsze-czasy/

Translation: Olga Łabendowicz