Prime Minister Donald Tusk’s and Minister Andrzej Domański’s speech at the Warsaw Stock Exchange (WSE) has generated significant attention in the media. Using bold historical comparisons, the Prime Minister presented a bright vision of Poland surpassing Western countries in living standards. The key to achieving this goal, he argued, lies in investment.

Fundamentally, this is true — well-designed investments, particularly private ones, drive economic growth. The Prime Minister also quoted a figure: PLN 650 billion — the total projected value of public and private investment in Poland in 2025. In nominal terms, this would be a record. However, when we look at the most common measure of investment — its share of gross domestic product — it turns out that the investment rate in 2025 is not only projected to fall short of a record, but actually to decline compared to previous years.

Investment: Is 2025 Really a Breakthrough Year?

“It’s investment, investment, investment.” – Donald Tusk, 10 February 2025, speech at the WSE

The Prime Minister announced that investment in Poland would amount to 650 billion PLN in 2025, noting that the figure could rise to 700 billion PLN. While this would be a nominal record — investment in 2024 reached 637 billion PLN — it represented approximately 17.5% of GDP.

In contrast, the projected PLN 650 billion for 2025 would imply an investment rate of around 16.5% of GDP. That would mark a year-on-year decline of over 1 percentage point. The European Commission projects a higher investment level in Poland —702 billion PLN, equivalent to approximately 17.8% of GDP.

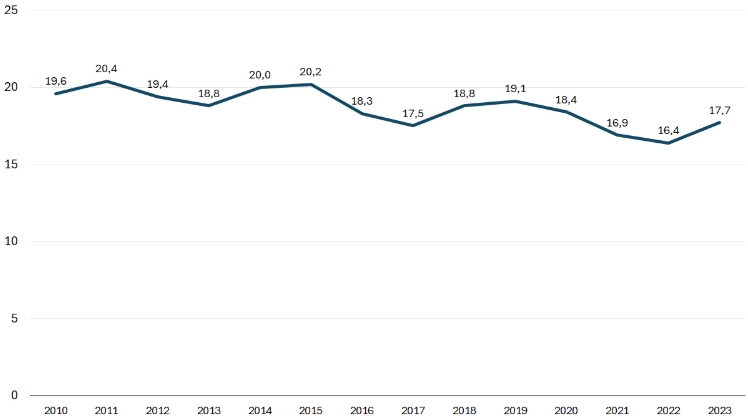

By comparison, the average investment rate in Poland between 2010 and 2023 stood at 18.7% of GDP.

Figure 1. Investment rate in Poland, 2010–2023

It is worth emphasizing that an investment rate at the level of 16–17% of GDP places Poland at the bottom of all international comparisons. In 2023, Poland ranked second to last in the European Union in terms of investment as a share of GDP—just ahead of Greece.

Real Deregulation Requires Legislation

“Of course, I’m somewhat tired of hearing these rather bold calls for deregulation, both in the European Union and occasionally in Poland. We must move from slogans to very concrete decisions.” – Donald Tusk, February 10, 2025, Warsaw Stock Exchange

Another component expected to positively impact future economic growth is the deregulation initiative announced by Prime Minister Tusk. Excessive regulations constrain growth and create unnecessary costs for businesses, which in turn leads to higher prices for goods and services for consumers. The Prime Minister entrusted Rafał Brzoska with the task of leading deregulation, emphasizing that the changes are to be limited solely to measures that can be implemented via government regulations rather than acts of parliament.

In principle, however, only statutes (acts of law) can impose binding obligations on citizens. Therefore, the stated goal of deregulation—namely, reducing the number of obligations imposed on individuals and businesses, and lifting restrictions on their rights—cannot be achieved solely through executive regulations. Regulations serve an auxiliary role: they define how statutory duties are to be implemented. Of course, minor liberalizations of such regulations are possible, but their practical impact on citizens’ lives and business activity is likely to be marginal. Examples might include simplified administrative forms, streamlined documentation requirements, or minor adjustments to inspection procedures.

While deregulation is undoubtedly necessary, limiting it solely to executive regulations is insufficient. Legislative amendments are indispensable. Potential resistance from the president should not be a deterrent to legislative efforts aimed at reducing regulatory burdens—especially in a political climate where even opposition parties have responded favorably to the idea of deregulation. Moreover, identifying areas in need of change and moving forward with the legislative process will likely take several months. Meanwhile, President Andrzej Duda’s term concludes in less than six months.

Authentic, deep deregulation is needed and would undoubtedly have a positive impact on both investment levels and economic growth. It is essential not to restrict reform efforts to executive regulations alone. Furthermore, beyond deregulation itself, a broader shift in legislative philosophy is warranted. In this context, one concept worth considering is the widespread use of sunset clauses—provisions that set an automatic expiration date for new laws that impose restrictions. This approach is particularly relevant in cases where the real costs and effects of regulation are difficult to estimate in advance. By including a fixed-term clause (e.g., three years), lawmakers gain empirical data to evaluate the regulation’s actual impact. If the intended outcomes are achieved, the law can be extended (through further legislation); if the regulation proves overly burdensome or fails to deliver the expected results, it expires automatically.

Finance Minister Announces Spending

“We are also working on a dedicated Deep Tech fund worth 300 million PLN, which will invest in areas such as cybersecurity, space technologies, satellites, artificial intelligence, and so-called dual-use technologies. Together with the Polish Development Fund (PFR), we aim to accelerate financing in these sectors so that more breakthrough technologies can be developed right here in Poland.” – Andrzej Domański, February 10, 2025, Warsaw Stock Exchange

Finance Minister Andrzej Domański focused less on deregulation and more on state-driven investment. Unfortunately, he placed significant emphasis on public investments, without presenting any concrete strategy for boosting private investment rates. State-owned enterprises are expected to drive infrastructure investments, particularly in the energy sector. Neither Prime Minister Donald Tusk nor Minister Domański presented any proposals for the privatization of state-controlled assets, even though the level of state ownership in Poland’s economy remains unusually high by international standards. In this respect, the KO–TD–PSL–NL coalition government is following the footsteps of its predecessors from the PiS administration.

Instead, the finance minister outlined plans for funding new and costly initiatives via public funds. Yet such ventures should ideally be financed by private capital, which operates based on expected returns while accounting for the inherent risks of these types of projects. Given that Poland currently holds the second-highest public finance deficit in the European Union and is subject to an EU excessive deficit procedure, these kinds of expenditures should be kept to an absolute minimum.

What Needs to Be Done?

Despite the extensive emphasis on investment, neither the Prime Minister nor the Finance Minister addressed Poland’s high deficit, growing public debt, or the disproportionately large role of the state in the economy. Deregulation and steps to increase investment—especially private investment—are moves in the right direction. But these measures must be complemented by deficit reduction, privatization, and the dismantling of state monopolies.

References

[1] „Polska. Rok przełomu” – Premier przedstawił plan gospodarczy na 2025 rok, Prime Minister’s Office, February 10, 2025, https://www.gov.pl/web/premier/polska-rok-przelomu–premier-przedstawil-plan-gospodarczy-na-2025-rok.

[2] Ameco

[3] Own calculations based on Ameco data.

[4] Eurostat

[5] Article 7 in conjunction with Article 31(3) and Article 92 of the Constitution of the Republic of Poland.

[6] Mateusz Morawiecki on X, https://x.com/MorawieckiM/status/1888948534650577281

[7] B. Jabrzyk, Własność państwowa – nowy rząd idzie w ślady PiS, FOR Communication 9/2024, Civil Development Forum, March 18 2024, https://for.org.pl/wp-content/uploads/2024/05/8263_komunikat-92024-wlasnosc-panstwowa-nowy-rzad-idzie-w-slady-pis.pdf.

[8] M. Zieliński, M. Michnik, Budżet na 2025 rok – deficyt (nie)odpowiedzialności, FOR Communication 23/2024, Civil Development Forum, October 16 2024, https://for.org.pl/wp-content/uploads/2024/10/Komunikat-23_2024-Budzet-na-2025-rok_deficyt-nieodpowiedzialnosci.pdf.

Continue exploring:

Digital Tax. Consumers Will Pay for Political War

Myth of Capitalism’s Guilt for Unfair Market Interference by Entrepreneurs