Gloom approaching Italian banks. Portugal wants to decrease income tax. Obama’s hard drive is small.

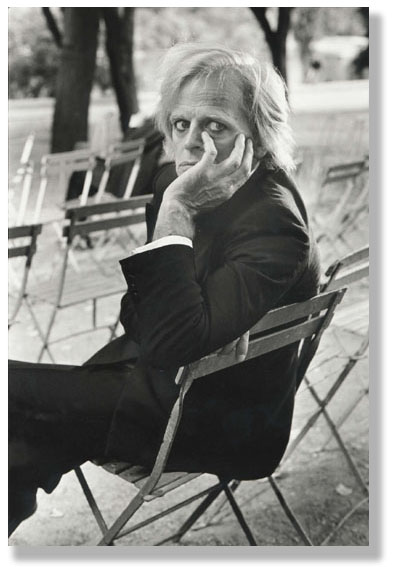

“The Great Silence” is an excellent Italian western with the demonic Klaus Kinski playing the villain. It also happens to be a good wording to describe the economic situation in Italy. The third largest economy of the eurozone has been swimming through the crisis rather quietly. The country hasn’t experienced a large real estate bubble, like Ireland or Spain, its banking system has handled the collapse of derivatives, and it has asked for help “only” in the form of the ECB buying Italian state bonds and LTRO lending programme. Although this aid amounts to several hundred billion euros, much more than was given to Greece, it hasn’t managed to outperform Berlusconi’s escapades in the media coverage of Italy. However, a look at the numbers suggests even to a non-expert that something is very wrong around here. For the last 20 years, the country’s economy has been operating with an anaemic growth rarely exceeding 2%. We can hardly attribute this to the favourite culprit of choice – austerity. Italians haven’t been saving by any means; on the contrary, they have “saved up” a gigantic debt equal to 130% of the GDP. Lowering the debt won’t get on the agenda any time soon, as there is no foreseeable period of growth for Italy’s economy. The yield of Italian state bonds stays in a safe range only thanks to the ECB’s promise to intervene if necessary. The Italian government decided to postpone payments to the private sector because of the public finance drought, which will strangle job creation even more.

Due to the ongoing bankruptcies of Italian enterprises, banks have been accumulating bad loans more than a little. The situation has been worsening for more than 27 months already. At the end of March, bad loans totalled €249 billion, i.e. 14.2% of all loans. Italy’s central bank has intensified loan quality inspection and ordered the banks to create additional accounting provisions of €3.4 billion. This could be far from sufficient, which is also the reason why the Standard and Poor’s rating agency lowered the rating of 18 Italian banks last week.

The Commission allowed France to guarantee a 7-billion loan to the seriously troubled car manufacturer PSA. This guarantee is in fact equivalent to a direct subsidy of 0.5 billion, with PSA getting additional 86 million of tax money to develop a new hybrid engine. This situation just goes to show that we haven’t learned anything in the 6 years of the crisis, and that we keep repeating the same mistakes. The French government strives to impede PSA’s restructuring and offers it taxpayers’ money instead. The problem won’t be solved this way, it will just be postponed. Other entrepreneurs will have less money due to higher taxes and in the meantime the state will fall deeper into debt.

With smaller or greater variations, we can see a similar conduct across the whole EU, not to mention that the automotive industry problem was already postponed in the same manner in 2009 (do you remember the cash-for-clunkers scheme?).

More bad steps have been made in fighting the crisis than at a first dancing lesson. And we’re still out of rhythm. The controversial financial transaction tax to be introduced by 11 eurozone countries, including Slovakia, is going to kill 640,000 jobs in Europe according to the newest study. In Slovakia alone, it should be around 7,000.

Spain has been in recession for 8 quarters in a row, and it was in recession in 13 out of the last 18 quarters. In the second quarter of this year, it has marked a quarterly variation of -0.1% and an annual variation of -1.7%.

In Cyprus, the final conditions for restructuring the Bank of Cyprus have been agreed upon. From the deposits above €100,000, as much as 47.5% will turn into the Bank’s (almost worthless) stocks, not 37.5% as intended before. The rest won’t be available for depositors either. It will remain in a monetary form but frozen on term deposit accounts for at least 6 to 12 months terms for now. Despite the ongoing capital control (whereby Cyprus was virtually cut off from the rest of the eurozone and the Cypriot euro became a separate currency), Cypriot banks lose deposits amounting to billions every month.

In the most affected states, the first serious ideas have been appearing in the form of proposals for lowering taxes. Greece wants to decrease VAT for restaurants. Portugal confirmed previous speculations and openly considers lowering corporate tax to 19%. The Wall Street Journal Article mentions that Portugal will thus be able to compete with Eastern European countries like the Czech Republic or Poland. Unfortunately, after rising corporate tax to 23%, Slovakia doesn’t get mentioned in such comparisons anymore…

A tiny change seems to arise also from within the ECB. Several members of the Executive Board as well as the boss Mario Draghi admitted that they’ll make minutes public. These were hitherto secret, even though this public institution personified by a few men makes decisions about key monetary policy instruments in these meetings, instruments which affect lives of all citizens of the eurozone and often also outside of it.

Business negotiations between countries of geopolitical blocs are a chess game of many players. The EU and China have started one in the form of an import tariff on solar panels from China. The panels are not welcome to the European panel manufacturers who convinced Brussels how necessary the tariff is. China responded by threatening with an import tariff on European products. It was joined by the European solar power plant constructors who, on the contrary, want to buy them for the cheapest price. Even though the EU and China have reached an agreement in the form of import tariffs and quotas, not all lobby groups are satisfied, so the chessboard is not set aside yet.

There is an interesting page on president Obama’s campaign website. The subsection contained a document from Obama’s presidential campaign in which the future president wrote about the importance of whistleblowers. A whistleblower is an informant who discloses information about illegal conduct of public institutions or politicians. According to what Obama said in 2008, such people are an example of patriotism and courage and, as a future president, he would commit himself to protecting them.

Well, I hope you don’t get stuck somewhere in the terminal on your way on holiday.

(Translated by Tomáš Herda)