Republikon Institute invited experts and analysts from the field of economy for its conference ‘The Hungarian Economy Is Doing Better – Arguments and Counter-Arguments’ to discuss and debate where does the economic policy of Fidesz stand in the half time running up to the 2018 elections and what did it accomplish so far. The following article is a report on some of the main issues discussed during the conference. While it might be too harsh to say that Hungary was near bankrupcy in 2010, or when it was put in the junk category in 2014 we could argue that it was only an overreaction of the market. Still, it would be wrong to say that ’Hungary is doing better’, especially on the regional level. In almost all areas Hungary is listed last.

Hungary has the highest EU transfers in Europe thus it plays an essential part in its economy

EU transfers made up 4.3% of the annual GDP between 2010-2015. So while it is true that government investments have increased, the base for this is mainly coming from the EU transactions – hence from the money of the European tax payers. While the economic growth of the country is around 2.5%, which in itself could be regarded as strong growth, we shouldn’t ley ourselves be convinced that it is good news. The reason for this is that the growth is highly dependent on the pace in which EU funds can be pulled.

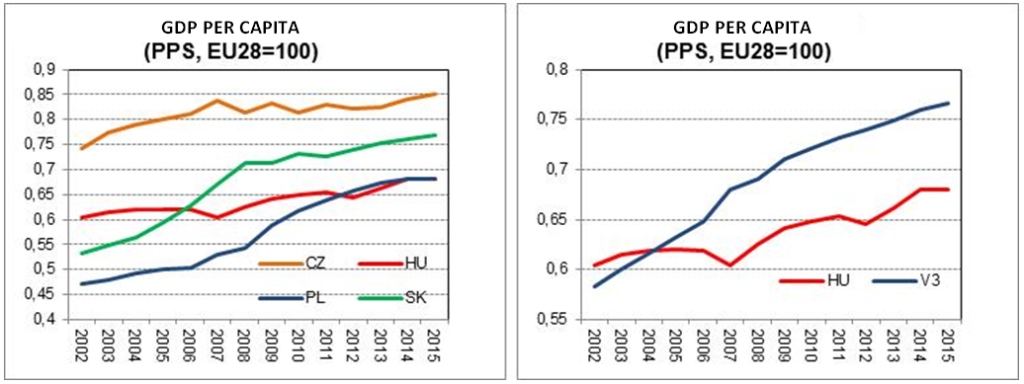

This year, when the funds were coming much slower, the growth (according to estimates) will only be around 2%. This slowing down can be explained by the fact that while in 2014-2015 funds were coming at a fast pace, this year is the opposite. The 2.5% rate cannot be considered as strong growth, especially if we consider the fact that our EU transfers are the highest within the EU. In the medium term, only 2% growth is sustainable – however, this is not enough to bridge the gap between Hungary and the West, as argued Dr Surányi György.

We should consider how this growth rate would change if there were no EU transfers. According to Dr György, the difference would be significant. The growth could only reach the two-thirds of the present rate. Still, in the regional context, Hungary’s growth rate is the slowest. This, again, contradicts the claims of the government that we are constantly catching up with our V4 neighbours.

We can experience the constant lagging effect of the government’s economic policies. It is highly visible if we look at the investment patterns. Hungary’s investment rate is the lowest in the region. The explanation for that can be found in the fact that neither domestic, nor international investors have trust in the future state of the Hungarian economy. This is clearly shown in the low intensity of FDI to the country. Unlike the necessary 23-24%, it is only 20%.

Moreover, we could experience a fall back in this regard this year. We should be critical of the fact that while it is true that we could see a 20% growth in real wages since 2013, which can be regarded as a strong movement, we only reached the 2007-2008 level in this regard. On the contrary, it should be noted that private investments did not increase, the country has been unable to gain back its credibility and we can rather experience an investment outflow.

Furthermore, our external debt is still above the regional average. EU financial flows made an increasing contribution to the improvement in the net external financing as well. This is extremely telling if one would like to consider the success or failure of the Hungarian economy. Therefore, keeping in mind the context should be our primary aim.

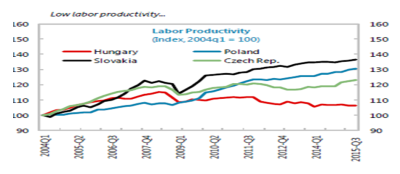

The government is keen to state that unemployment rates are falling, however, the country is still behind in terms of labor productivity. We can generally say that among those in the workforce the ratio of vocational workers is especially high, while the productivity is especially low.

Internal tensions. Source: IMF

Internal tensions. Source: IMF

Fundamental problems of the Hungarian economy are coming from internal tensions, such as the disastrous state of the health system or education. The current educational system does not encourage innovation. Similarly to government policies, it does not support the establishment of SMEs. Not only investors but common citizens are afraid to establish an enterprise on their own due to the lack of support from the government and its ambiguous decisions. The fact that the state is intervening in areas where it should not results in enterprises with lower productivity having no time to adapt to certain policies. It could be worrisome if we think about how the Hungarian SMEs would create a larger market niche for themselves should the EU transfers slow down – as their international competitiveness is especially low even now.

What Should Be Done?

All in all, the biggest problem is that most of these decisions are made by politicians with their own political objectives, among which the main one is the re-election of the governing party in 2018. Due to the inconsistent economic policies and ad-hoc measures introduced by the government, the conditions for a fast and lasting growth are not provided. In order to change this government should implement measures to (first and foremost) gain back the trust of the market. There needs to be safety in terms of private property and taxation. Then, both the educational system and the state should encourage innovation and SMEs. Studies have shown that three out of four Hungarian citizens would experience significant change in their lives if their net salary would grow by 50%. Hence, the growth of the macro indicators is not enough – the government should aim for policies which impact the lives of common citizens.