What A. Smith Teaches Us About Taxpayers’ Rights?

BY

LFMI / July 25, 2023

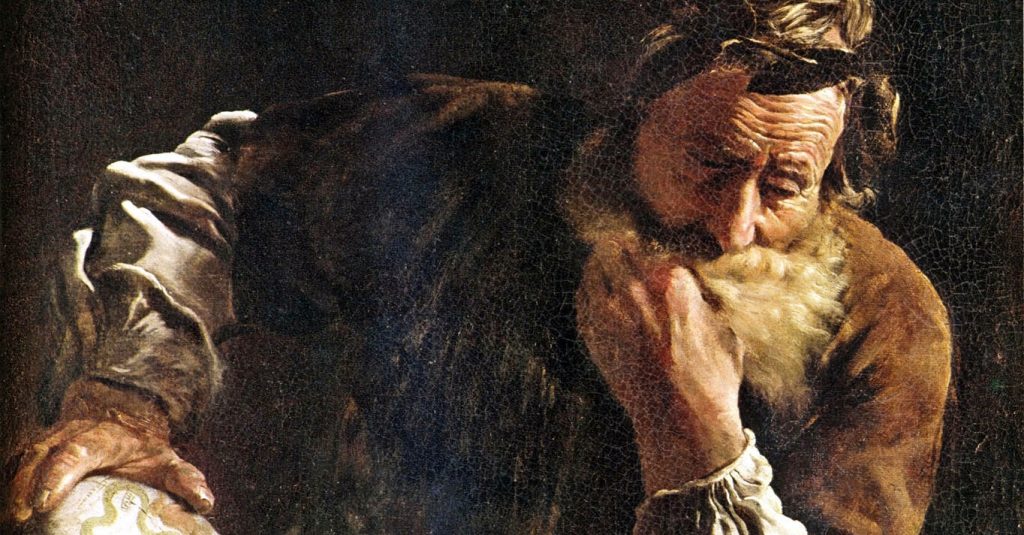

Who should be taxed, how should they be taxed and what purpose should it serve? These questions are as old as the world. To help answer them, in his 1776 work \"The Wealth of Nations\" the Scottish economist and philosopher Adam Smith formulated four principles of taxation. According to him, taxes should be proportional to the benefits that a person derives from belonging to society.