The metallurgical and metalworking industry has been one of the pillars of the Ukraine’s economy, but the war and the sea blockade are driving it into a deep crisis. In the industry, enterprises pessimistically assess their business activity and business climate; they continue to reduce production and exports. These are the main results of the sixth New Monthly Enterprises Survey conducted by the Institute for Economic Research and Policy Consulting (IER) in October 2022.

Russia’s military aggression put Ukrainian metallurgy and metalworking on the verge of survival. The industry suffered irreparable losses in Mariupol, where two leading iron and steel works were located. Furthermore, the enterprises experience difficulties with the supply of raw materials, a decrease in demand, and blocking of export routes. Companies that produce metals or metal products have mostly found themselves in a deep crisis, regardless of size and geographical location.

Russian missile strikes in October only worsened the condition and expectations of metallurgy. Power, water and heating outages have become an obstacle to work for 70% of enterprises in the industry. For 40%, low security level was an obstacle (only 16% in September). Therefore, the new missile attacks in November only increased concerns about the crisis in metallurgy, which remains critical to the country’s economic recovery and reconstruction.

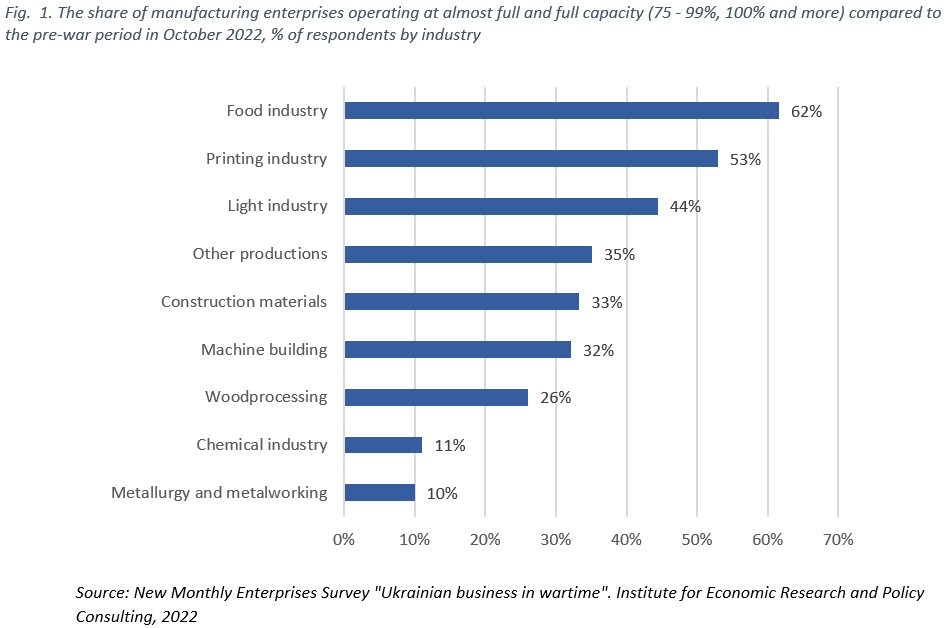

In October, only 10% of metallurgical and metalworking enterprises operated at near-full (75-99%) or full capacity compared to the pre-war period. This is the lowest indicator among all industrial sectors. In July-August, the indicator was 26%, and in September it was 20%. In industry, the companies are rapidly reducing declining operations.

Pessimism about Today and Tomorrow

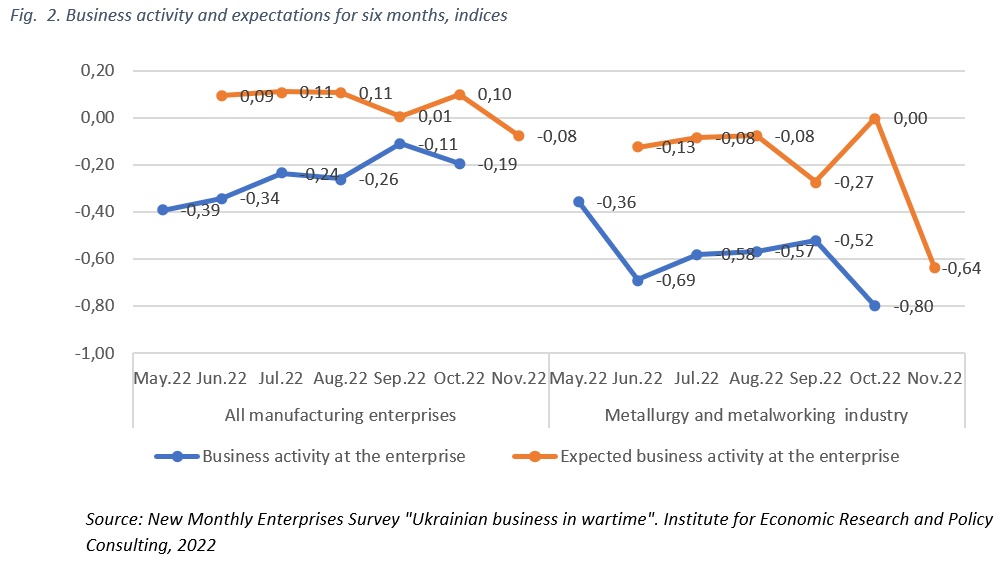

Since the beginning of the war, representatives of the metallurgy and metal industry rated their current business activity as the worst compared to other industries. In summer, the industry demonstrated a slight positive trend, but negative assessments still prevailed. In October, the assessment of the business activity reached a record low of -0.80 (-0.19 for the entire manufacturing sector).

For example, 80% of the industry’s companies rated their operations as bad, 20% as satisfactory, and none gave a positive rating. Expectations in metallurgy also remained pessimistic. It is the only industry in which positive responses never outweighed negative ones. In October, the index of expected changes in business activity fell to a record low of -0.64 (-0.08 for all manufacturing enterprises).

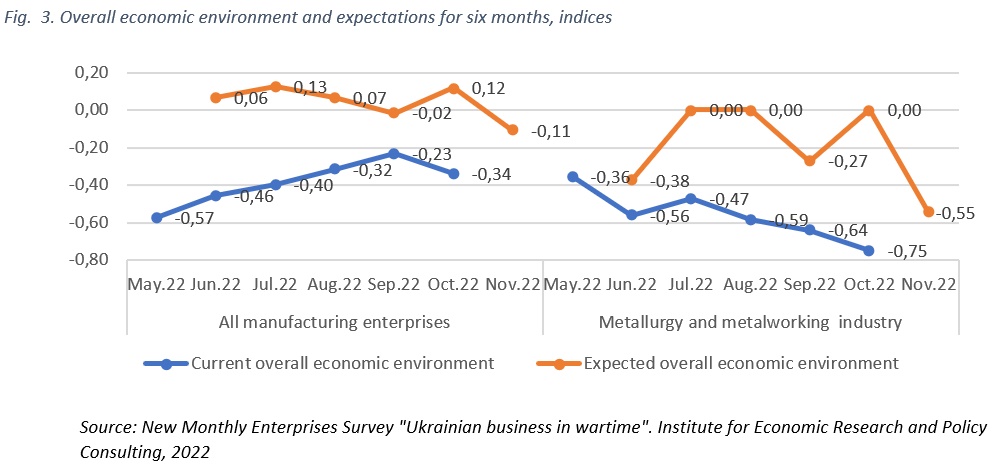

Metallurgy is also the most pessimistic regarding the overall economic environment. Before October, there was a tendency for the metal and metalworking industry to regain optimism. And after that, the situation in the industry became the opposite. In October, business climate assessment fell in metallurgy to a record low of -0.75. Only 5% of respondents assess the industry’s business environment as good, while 80% rate it as bad. The industry also has the most negative expectations, reflecting a whole range of unresolved challenges (logistics, infrastructure, etc.).

Metallurgical and Metalworking Production Is Falling into Abyss

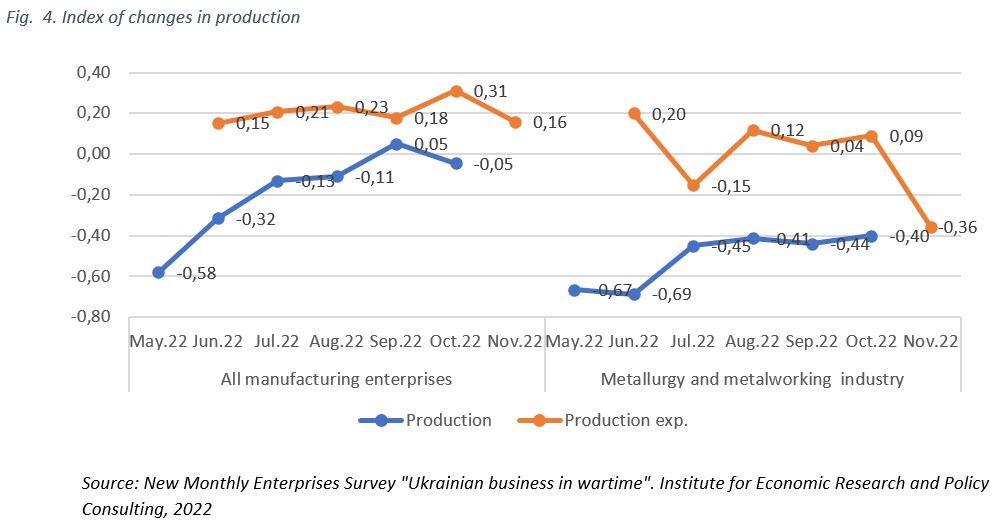

Production indicators only confirm the crisis in the industry. At the beginning of the war, metallurgy lost ground, as did other industries.

However, while there was a general trend toward business recovery, metallurgical enterprises mainly were decreasing production. In October, 45% of surveyed enterprises in the industry decreased production, and only 5% increased it. Thus, metallurgy again demonstrated the worst index of changes in production (–0.40 vs –0.05 for all manufacturing enterprises). This illustrates the trend toward the decline of the industry.

Metallurgy is also one of the two industries (along with construction materials production) where negative expectations prevailed in October. The index of expected changes in production is –0.36 vs +0.16 for all manufacturing enterprises. Only 7% of enterprises in the industry expect an increase in production. The significant deterioration of expectations happened precisely after terrorist attacks on the Ukraine’s energy infrastructure.

Other manufacturing indicators also reflect deep problems in metallurgy and metallurgy. In the industry, companies are more likely to report a reduction in raw material inventories (40% of respondents). The number of new orders is also decreasing (40% of respondents). In addition, 24% of enterprises increased the number of employees on forced leave, which is the highest indicator among the entire manufacturing sector.

Industry Loses Its Role as Exporter – “Breadwinner”

Before the war, the metallurgical and metalworking industry was one of the “breadwinners” of the Ukraine’s economy. Russian aggression not only caused irreparable damage to production, but also blocked traditional export routes. Most of the industry’s products went abroad through seaports, which currently are only available for Ukrainian grain.

In September, 67% of the industry’s enterprises indicated that the sea blockade is a big obstacle to exports. It is the highest indicator among all manufacturing industries. This confirms that the metallurgy is not able to substitute sea trade routes.

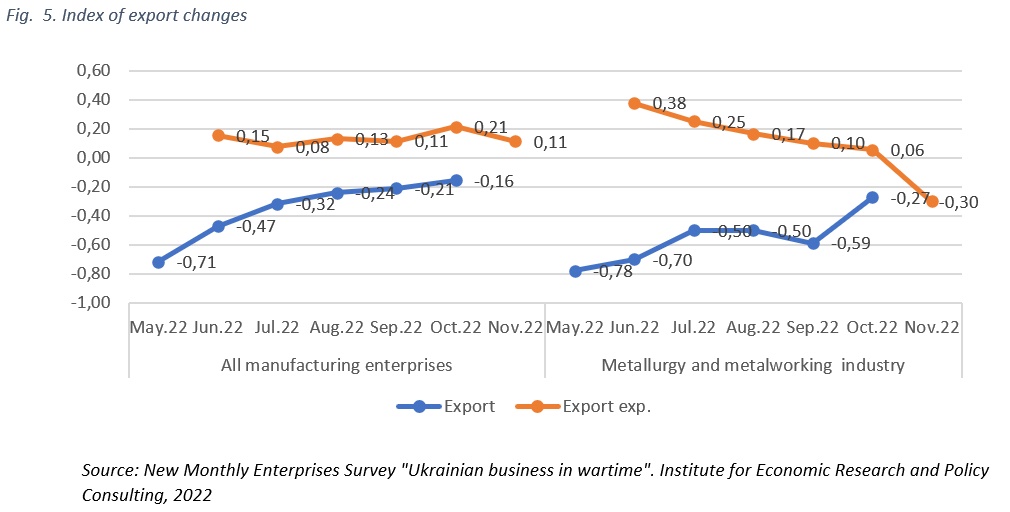

As of October, every third company in the industry (33% of respondents) did not resume exporting. In the same month, 36% of enterprises reduced export volume and 55% did not change it. Only 9% were able to increase the export volume compared to September. Moreover, metallurgy representatives are skeptical about the recovery of exports volume in the near future. Until September, the share of optimists prevailed over pessimists, but the situation changed radically in October. 40% of enterprises expect a decrease in export volume and only 10% expect an increase.

Trade statistics fully confirm the export crisis in the metallurgy and metalworking. In nine months of 2022, exports of base metals and base metal products reached $5.1 billion, which is more than two times less than in the corresponding period of the previous year. At the same time, the industry provided 15% of the total export volume (it was 23.5% according to the results of the entire 2021).

However, almost half of the volume was reached in the pre-war January-February. Application of the “grain corridor” mechanism to other “sea-dependent” industries (for example, metallurgy) is critically important for preserving their potential.

About the survey

The Institute for Economic Research and Policy Consulting conducts a monthly enterprise survey using the Business Tendency Survey approach to quickly collect information on the current economic state at the enterprise level.

The methodology was developed to assess the situation from the “basic level”, on the judgments and expectations of the main economic agents – entrepreneurs and enterprise managers. The field stage of the 6th monthly survey took place from October 17 to October 28, 2022.

The article was prepared within the project “For Fair and Transparent Customs,” financed by the European Union and co-financed by the International Renaissance Foundation and the ATLAS Network.