During 1995–2015, Slovenia saw substantial improvements in overall economic freedom. Progress, however, was far from uniform and even laced with outright reversals. Measured with the Economic Freedom of the World ratings framework, Slovenia’s situation in 2015 was inferior, relative to 1995, in several areas. Notably, regarding government consumption, private sector credit, the legal system, and property rights – even though problems in the latter area are to be found in several former socialist economies, as emphasized by Gwartney and Montesinos in this issue1.

This paper aims at situating Slovenia in a wider context. Section 1 discusses the partial “backsliding” of Slovenia along several dimensions of economic freedom. Section 2 compares the Slovene experience with that of other former Yugoslav countries. Section 3 finally reviews the major explanations put forward for the worsening performance of the Slovene legal system.

1. The Travails of Slovene Transitioning

Economic transition is a loaded term. At its most broadly conceived, it describes economic regime change (either a gradual or a revolutionary/‘shock-therapy’ process) whereby an economy moves from one type of economic system, say “A”, to a new one, say “B”. Note the metaphorical dimension of space – the economic transition is usually conceptualised as a unidirectional movement from one distinct point of departure to another point of destination. In the specific case of Central and Eastern Europe, “A” clearly refers to a centrally-planned socialist system and “B” to an economy of the free-market type (See Figure 1).

Figure 1: Transition in Central and Eastern Europe2

Moreover, the economic transition is usually dated to the early 1990s and is supposed to have concluded, at least in broad strides and in most of the countries throughout the region, by the early twenty-first century. But this is subject to uncertainty. Differently put, economic transition properly belongs to the realm of ‘unfinished history’. It is as much a thing of the recent past as it is of the present, despite a plethora of potential historical signposts. In the case of Slovenia, economic transition has been repeatedly declared accomplished with the country’s entry into the European Union (in 2004),3 or the European Monetary Union (in 2007)4.

But has Slovenia indeed transitioned? A simple metric (by no means conclusive) is to compare the country’s performance on a multi-dimensional ranking (i.e. along several dimensions of economic change) between the 1990s and today. Using the Economic Freedom of the World framework, two conclusions stand out. Firstly, Slovenia did indeed experience significant progress on its way towards a free market economy. The overall summary ranking improved from 5.31 in 1995 (87th place) to 7.00 in 2015 (73rd place) – unfortunately, data availability issues prevent us from examining the crucial first years in the transition in the early 1990s.5 Secondly, the transition has been far from unidirectional. Table 1 lists the dimensions where Slovenia’s performance in 2015 was markedly worse than twenty years earlier (it excludes the likely insignificant drop – of a mere 0,5 % – associated with the military interference in rule of law and politics).

Table 1: Components of Economic Freedom where Slovenia Markedly Deteriorated

|

1995 |

2015 |

1995-2015 |

|

|

1 A. Government consumption |

4.17 |

4.01 |

-3.8% |

|

2. Legal System & Property Rights |

8.42 |

6.32 |

-24.9% |

|

B. Impartial courts |

7.02 |

3.57 |

-49.1% |

|

E. Integrity of the legal system |

10 |

7.5 |

-25.0% |

|

D. (ii) Capital controls |

5 |

3.08 |

-38.4% |

|

5. A. (ii) Private sector credit regulations |

9.94 |

8.78 |

-11.7% |

Source: Gwartney, Lawson, and Hall, Economic Freedom of the World: 2017 Annual Report: EFW 2017 data by countries tables.

Except for government consumption, all areas of Slovene reversal – private sector credit regulation, as well as the legal system and property rights – can be subsumed under a wider heading, that of the “Rule of Law”.

This is worrying since the long-run effects of Rule of Law are not easily picked-up by annual indices, even though there is a wide-ranging consensus among political economists that rule of law does matter. To cite an influential paper: “We find that democracy and the rule of law are both good for economic performance, but the latter has a much stronger impact on incomes. […] Rule of law and democracy tend to be mutually reinforcing.”6

Moreover, the finding of Slovenia’s deterioration in rule of law appears robust to the instrument used to measure it. It has been noted by several scholars, using a variety of methods, in various fields of inquiry. The legal scholars Bojan Bugarič and Alenka Kuhelj, for instance, “argue that the Slovenian case represents a very subtle form of democratic regression where competitive political elites control democracy in an opaque and non-transparent manner. Since the rule of law and political competition still exist, although in a quite rudimentary form, Slovenia is better described as a diminished form of democracy rather than a diminished version of authoritarianism.”

The political scientist Béla Greskovits differentiates between two types of reversals in the transition process of ten East- and Central European EU member states. “The first of these refers to the general European problem of declining popular involvement in politics, termed hollowing of democracy,” while the second challenge is “captured by the term backsliding, which suggests destabilization or even a reversal in the direction of democratic development. Backsliding is usually traced to the radicalization of sizeable groups within the remaining active citizenry, and the weakening loyalty of political elites to democratic principles.”7

As Greskovits clarifies, both types of reversals can be dated. The hollowing of East Central European refers to the period 2000–2007, while their backsliding is dated to 2009–2013/14.8 Like Hungary, Slovenia has been characterized as a case of “low hollowing/high backsliding”. In other words, in Slovenia, the destination point “B” of economic transition turned out to include many aspects of the departure point “A”.

2. Slovenian Exceptionalism or Yugoslav Heritage?

What is at fault, the transition process as such, or the actual point “A” – the path-dependent institutional heritage the transition process was meant to transform? Indeed, before 1991, Slovenia was part of Yugoslavia, a socialist state that experimented with elements of market economics and encouraged mass consumption among its citizens – and which therefore developed unique institutions among the communist regimes of that time.9

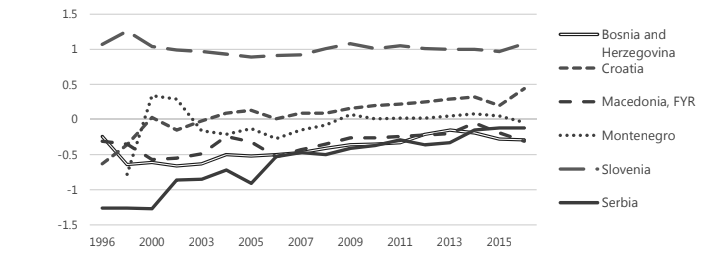

Unfortunately, the point “A” is unobservable within the Economic Freedom of the World framework which currently covers only two of the six former Yugoslav republics, Slovenia and Croatia, in sufficient detail.10 World Bank’s Worldwide Governance Indicators project, in contrast, has the geographic reach but falls short on the temporal front – it starts with 1996 (in the case of Montenegro, with 1998). This means that we can only compare the former Yugoslav institutions during the economic transition, not at its starting point.

Still, the great variety of initial values and trend lines in Figure 2 argue against common Yugoslav heritage as a coherent explanation of Slovenia’s backsliding. Of all the former Yugoslav countries, Slovenia has persistently enjoyed the highest levels of rule of law and comparatively low volatility. But Slovene performance has been far from satisfactory. The estimates for 2015 represent a decline of 23.0% from the peak in the 1990s. Despite an improvement from the previous year, the 2016 levels were still 14.3% below 1998 values.

Figure 2: Rule of Law, Former Yugoslav Republics, 1996–2015

Source: World Bank, The Worldwide Governance Indicators 2017.

Source: World Bank, The Worldwide Governance Indicators 2017.

3. The Softening of the Budget Constraints

If Yugoslav heritage falls short as an explanation for Slovenia’s multidirectional economic transition, where else can we look?

In literature, the search for explanations has been mostly carried out by legal scholars. Bugarič and Kuhelj suggest there are two principal reasons for the “apparent decline of the Slovenian model.” First, they blame the “relatively privileged position vis-a-vis other East-Central European countries” for Slovenia being “a reluctant reformer, doing very little to actually change its institutional setup from the communist past.” Put differently, Slovenia had not actually aspired to move from “A” to “B” but targeted a mixed system instead, say, “AB” (See Figure 3).

Figure 3: Transition in Slovenia

Second, Bugarič and Kuhelj point to reform implementation and accuse Slovenia of being “an uncritical model-taker” of Western policy models. “This mimicry was done in a fairly top-down, bureaucratic way, creating institutions without deep enough roots in society, and without necessary trial and error style usually needed for successful evaluation of proposed reforms.”11

These two hypotheses point towards “Slovenian exceptionalism” as an explanation for the defects in its transition. An alternative hypothesis blames the local manifestations of a universal phenomenon in political economy – the pernicious influence of rent-seeking:

The capture of the state by various political and informal groups has progressed to such a dramatic extent that it is undermining the independence and credibility of almost all rule-of-law institutions in the country, with the exception of the Constitutional Court. Formal democratic rules and institutions often operate in the shadow of informal networks and practices. A myriad of interest groups, political parties and individuals use these networks and practices to extract resources from the state. One of the most troubling aspects revealed by the economic crisis is the ease with which the politically installed managers of public enterprises, banks, insurance companies, public universities, and the national broadcaster distribute money and other non-pecuniary gains (jobs, privileges) to their political friends, relatives, etc. Quite often, this extraction of public resources was carried out to the letter of the law, but in sharp contrast to its spirit.12

But why was it precisely the economic crisis that had revealed the “troubling aspects” of Slovene transition? Why did it take years if not decades into the transition for the interest groups to finally capture the Slovene state? If, instead, Slovenia had been captured from the start, why did it become apparent only after 2009? Therefore, an economic explanation for Slovenia’s transition must not only account for practices on the intersection of State and the economy, but also for the link to economic crises and economic dynamics.

The theory of the soft budget constraint (SBC) seem to fit the bill. First proposed by János Kornai in 1979, the “theory of the SBC focuses on a special type of intervention designed to ensure the survival of an enterprise, or a whole industry, that would otherwise succumb to the processes of market selection and cease to exist.”13

The firms’ budget is not hard in the sense that all expenditure must be paid out of income and endowment, but soft in the sense that all financial shortfall will be covered by an external authority (rather than lead, as in a pure free-market system, to bankruptcy). Moreover, SBC refers to the economy at large, not an individual firm. “The decisive question in this respect is this: what was the regular experience of a larger number of firms over a longer period in the past? And can it be expected, that similar experiences will occur in the future?”14 In other words, public expectations (including voters’ expectations) are the key enablers of the SBC.

While the SBC can be found in a capitalist economy as well, Kornai maintains “that the phenomenon is far more common and far more damaging in a socialist or post-socialist economy than in a consolidated market economy.”15 In the case of Slovenia, what has made the country especially vulnerable to the SBC syndrome is its extent of state ownership in the economy (See Table 2).

Table 2: Sectoral composition of state-owned enterprises in Slovenia on December 31, 2017

|

Sector |

Number of state-owned enterprises (SOE) in bankruptcy and/or liquidation |

Total number of companies with state ownership share within the sector |

Mean state participation in SOE share structure in % |

|

Manufacturing |

13 |

22 |

40.2 |

|

Energy |

0 |

12 |

71.0 |

|

Logistics, transport, infrastructure |

0 |

8 |

83.0 |

|

Financial holdings |

3 |

7 |

20.3 |

|

Business services |

2 |

7 |

41.8 |

|

Tourism |

3 |

6 |

47.4 |

|

Utilities |

0 |

5 |

40.0 |

|

Gambling |

1 |

5 |

22.1 |

|

Banking |

0 |

4 |

74.9 |

|

Private equity |

0 |

4 |

49.0 |

|

Disability employment companies |

1 |

3 |

62.8 |

|

Post and telecommunications |

0 |

2 |

83.4 |

|

Insurance |

0 |

2 |

45.2 |

|

Food processing |

0 |

1 |

0.0 |

|

Regional development |

0 |

1 |

5.9 |

|

Total |

23 |

89 |

49.2 |

Sources: Author’s calculations; Slovenian Sovereign Holding, Seznam neposrednih naložb RS in SDH na dan 31. 12. 2017.

Note that because of past privatization campaigns, the state is no longer the sole shareholder in most state-owned enterprises (SOE). But it still acts as the dominant shareholder, with the Slovene government of the day in effect appointing the firms’ management teams (even though, from a strict legal perspective, personnel decisions are taken by the notionally independent sovereign wealth fund).

International measures are taken in by such national idiosyncrasies that mask the true persistence of the SBC. In the relevant Economic Freedom of the World sub-rankings (1 C. Government enterprises and investment), for instance, Slovenia has achieved stellar improvement, from a score of 0.00 in 1995 to 6.00 in 2015.16

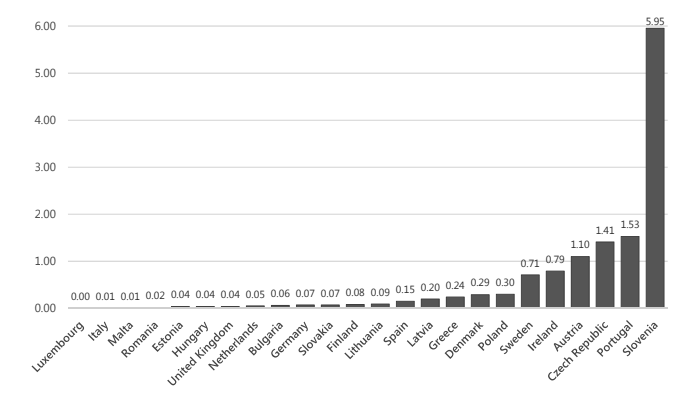

In 1980, Kornai described four major ways to soften budget constraints: (1) soft subsidies, (2) soft taxation, (3) soft credit, and (4) soft administrative prices (while discussing the case of then Yugoslavia, he also cited soft payment discipline).17 Which was the main softening channel in Slovenia in 2016? Figure 4 presents statistical data on the stock of non-performing loans provided by European governments. Normalized by gross domestic product (GDP), Slovenia’s figures stand out internationally, and are consistent with the soft credit channel (See Figure 4).

Figure 4: Stock of non-performing loans provided by government (% of GDP, 2016)

Source: Eurostat, Government finance statistics and EDP statistics: Contingent liabilities.

Source: Eurostat, Government finance statistics and EDP statistics: Contingent liabilities.

Note: Data not available for Belgium, France, Croatia, and Cyprus.

What does soft credit mean? “For example, loans may be offered to financially troubled firms that would not be eligible for credit were standard conservative lending criteria applied. Alternatively, firms that have already borrowed may have the servicing and repayment terms in their loan contracts relaxed. Of course, credit per se is consistent with an HBC [hard budget constraint]. But under the SBC syndrome, too much credit is extended from the standpoint of economic efficiency […].”18 It should be noted that the SBC implies discretion on the decision makers’ part that stands in stark contrast with the principles of rule of law.

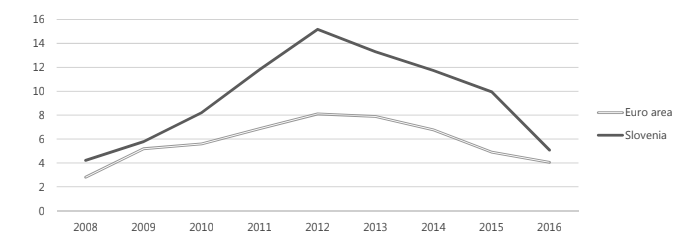

Soft credit is also consistent with the performance of the Slovene banking sector (See Figure 5). Before the financial crisis, the percentage of loans given out by Slovene banks that had turned sour (non-performing loans or NPL) was only slightly above Eurozone average. During the crisis, however, the percentage of non-performing bank loans in Slovenia increased to levels much higher than elsewhere. This implies that the SBC may not necessarily be discernible in NPL levels during the growth phases of the business cycle. Rather, the SBC manifests itself in recessions, when it acts as an amplifier to the shocks to the banking sector.

Figure 5: Bank non-performing loans to total gross loans (%)

Source: World Bank, World Development Indicators.

Source: World Bank, World Development Indicators.

Conclusion

Slovenia was a markedly freer country overall in 2015 than it was in 1995. But Slovenia’s performance deteriorated in a particularly dangerous area, namely that of the rule of law. While several explanations for this have been put forward, the old theory of the soft budget constraint offers new avenues of inquiry. It not only explains why it should have been the financial crisis that exposed backtracking in the transition process but also provides a link between policy outcomes and public expectations.

The paper was originally published in the Visio Journal No. 2.

1 Gwartney and Montesinos, “An Examination of the Former Socialist Economies 25 Years After the Fall of Communism,” 1-32.

2 Following the IMF, Central and Eastern Europe (CEE) is defined to include former communist states over five regions: Baltics (Estonia, Latvia, Lithuania), Central Europe (Czech Republic, Hungary, Poland, Slovak Republic, Slovenia), CIS (Belarus, Moldova, Russian Federation, Ukraine, Southeast Europe EU members (Bulgaria, Croatia, Romania), and Western Balkans (Albania, Bosnia and Herzegovina, Kosovo, FYR Macedonia, Montenegro, Serbia). See Roaf et al., 25 Years of Transition, vi.

3 Most explicitly in a Slovene government brochure: “membership of the Union is the ultimate proof that transition has been accomplished” (“Slovenia Entering the EU – April 2004,” Urad vlade za komuniciranje).

4 This milestone is implied, for instance, in Callado and Utrero, “Towards economic and monetary union.”

5 Gwartney, Lawson, and Hall, Economic Freedom of the World: 2017 Annual Report: EFW 2017 data by countries tables.

6 Rigobon and Rodrik, “Rule of law, democracy, openness, and income: Estimating the interrelationships,” 533.

7 Greskovits, “The Hollowing and Backsliding of Democracy in East Central Europe,” 28.

8 Greskovits, “The Hollowing and Backsliding of Democracy,” 32.

9 Patterson, Bought and Sold, xvii.

10 Gwartney, Lawson, and Hall, Economic Freedom of the World: 2017 Annual Report: EFW 2017 data by countries tables, accessed February 1, 2018, https://www.fraserinstitute.org/resource-file?nid=11606&fid=7542.

11 Bugarič and Kuhelj, “Slovenia in crisis,” 273.

12 Berend and Bugarič, “Unfinished Europe: Transition from Communism to Democracy in Central and Eastern Europe,” 778.

13 Kornai, “The Place of the Soft Budget Constraint Syndrome in Economic Theory,” 16.

14 Kornai, “The Soft Budget Constraint,”7.

15 Kornai, “The Place of the Soft Budget Constraint,” 12.

16 Gwartney, Lawson, and Hall, Economic Freedom of the World: 2017 Annual Report: EFW 2017 data by countries tables.

17 Kornai, “The Soft Budget Constraint,” 26.

18 Kornai, Maskin, and Roland, “Understanding the Soft Budget Constraint,” 1102.

References

Berend, Ivan T., and Bojan Bugarič. “Unfinished Europe: Transition from Communism to Democracy in Central and Eastern Europe.” Journal of Contemporary History 50, no. 4 (2015): 768–78.

Bugarič, Bojan, and Alenka Kuhelj. “Slovenia in crisis: A tale of unfinished democratization in East-Central Europe.” Communist and Post-Communist Studies 48 (2015): 273–9.

Callado, Francisco, and Natalia Utrero. “Towards economic and monetary union: changing trends in payment systems for new European members.” Journal of Financial Transformation 20 (2007): 168–174.

Eurostat. “Government finance statistics and EDP statistics: Contingent liabilities.” Accessed February 1, 2018. http://ec.europa.eu/eurostat/web/government-finance-statistics/contingent-liabilities.

Greskovits, Béla. “The Hollowing and Backsliding of Democracy in East Central Europe.” Global Policy 6, suppl. 1 (June 2015): 28–37.

Gwartney, James, and Hugo Montesinos. “An Examination of the Former Socialist Economies 25 Years After the Fall of Communism.” Visio Journal 2 (2018): 1-32.

Gwartney, James, Lawson, Robert, and Joshua Hall. “Economic Freedom of the World: 2017 Annual Report: EFW 2017 data by countries tables.” Accessed February 1, 2018. https://www.fraserinstitute.org/resource-file?nid=11606&fid=7542.

Kornai, János. “The Soft Budget Constraint.” Kyklos 39, fasc. 1 (1986): 3–30.

Kornai, János. “The Place of the Soft Budget Constraint Syndrome in Economic Theory.” Journal of Comparative Economics 26 (1998): 11–7.

Kornai, János, Eric Maskin, and Gérard Roland. “Understanding the Soft Budget Constraint.” Journal of Economic Literature 41 (December 2003): 1095–136.

Patterson, Patrick Hyder. Bought and Sold: Living and Losing the Good Life in Socialist Yugoslavia. Ithaca: Cornell University Press, 2011.

Roaf, James, Ruben Atoyan, Bikas Joshi, Krzysztof Krogulski, and an IMF staff team. 25 Years of Transition: Post-Communist Europe and the IMF. Washington, D.C.: International Monetary Fund, 2014.

Rigobon, Roberto, and Dani Rodrik. “Rule of law, democracy, openness, and income: Estimating the interrelationships.” Economics of Transition 13, no. 3 (2005): 533–64.

Slovenski državni holding (Slovenian Sovereign Holding). “Seznam neposrednih naložb RS in SDH na dan 31. 12. 2017.” Accessed February 1, 2018. https://sdh.si/sl-si/upravljanje-nalozb/seznam-nalozb.

Urad vlade za komuniciranje (The Government Public Relations and Media Office). “Slovenia Entering the EU – April 2004.” Accessed February 15, 2018. http://www.ukom.gov.si/fileadmin/ukom.gov.si/pageuploads/dokumenti/Publikacije/european-union.pdf.

World Bank. “World Development Indicators.” Accessed February 15, 2018. https://data.worldbank.org/indicator/FB.AST.NPER.ZS.

World Bank. “The Worldwide Governance Indicators 2017.” Accessed February 1, 2018. http://info.worldbank.org/governance/wgi/#reports.