Bitcoin is losing share in market capitalization. This is just one of many possible ways to describe recent events in cryptomarkets. The surging capitalization of Ethereum and the related ICO phenomenon are the main reasons behind such developments.

ICO stands for Initial Coin Offering, which has become particularly popular in the last few weeks. ICO serves as a useful tool predominantly applied by start-ups to acquire vital funds for their functioning. In simple terms, the equivalent of a bond paper is emitted (in this case a token) which creates and distributes voting rights in the process of decision making or gives a share in the profits of the company. It all depends on the set-up of specific projects. Investors pay for tokens by a currency called Ethereum. This activity is yet to encounter its own wave of regulation, therefore ICO funding has become largely adamant, raising questions in the crypto-community whether we are about to experience a bubble as in the case of the often compared Dotcom bubble.

On a personal note, I am rather wary of ICO´s rapidly inflating balloon and I am a bit worried about the consequences of investors becoming aware of the large number of risks associated with such financing. Not to mention developers and the politics of Ethereum, which are often considerably murky, as recent events have shown.

Current news surrounding Ethereum carry their own eyebrow-raising weight. ETH 96,000 were sold on the Coinbase exchange market, equal to roughly 30 million dollars. It resulted in the price plummeting to 13 dollars. However, we haven´t received any explanation whatsoever and those who had orders set in trades concerning ETH on this currency exchange probably regretted doing so.

Moreover, around ETH 30,000 (more than 12 million dollars) were sold from Genesis block in a similarly confusing manner. Genesis block is basically a founding block – i.e., the first block of Blockchain. In the case of Bitcoin, coins in this block cannot be sold.

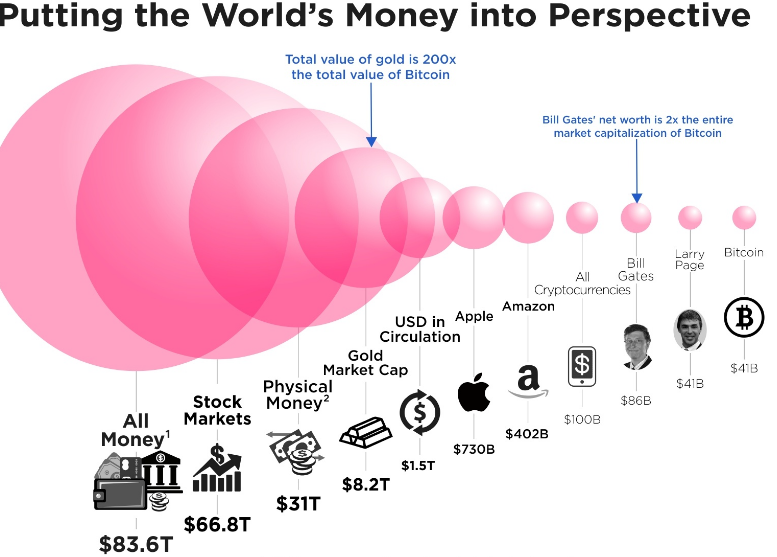

Speaking of cryptocurrency capitalization, the market capitalization of Bitcoin currently floats around 45 billion dollars – just over a half of Slovakia´s annual GDP. The total capitalization of cryptocurrencies currently stands around 114 billion dollars. This is more than Bill Gates´ net worth of almost 90 billion dollars but it´s still a mere drop in the ocean when compared to the capitalization of gold (USD 8 trillion) or stock markets (USD 70 trillion).

Meanwhile, cryptocurrencies continue to be the “boogeyman” of bankers as evidenced in a recent statement made by the President of the German Federal Bank, Jens Weidmann, who said that he sees a threat in digital currencies.

Mr Weidmann stated that he was specifically concerned about the theoretical possibility of banks starting to use such currencies as state-backed digital currencies, as it could have negative effects especially in times of crisis – i.e., a drain of deposits from a problematic bank. The problem is to imagine a state covered currency without centralization, as it would most likely not be decentralized anymore.

The idea of troubled banks allowing people to handle their deposits is just as dodgy. Remember, it has not been that long since banks in Cyprus had endured forced closure specifically for the problems of infected local banks.

When it comes to cryptocurrencies in Russia (always a rather contradictory, paradoxical matter) the tide is apparently turning. While the Central Bank has been reviewing the Blockchain, government representatives unleashed a heavy critique on it and wanted to see the chain banned.

However, a swift turnover is lurking just behind the corner. Vitalik Buterin, the main developer behind Ethereum, recently met with Mr Putin. It looks like a liaison encompassing mutual cooperation has appeared on the horizon. It would substantially boost the process of diversification of the economy which is currently primarily dependant on oil and gas. With an equal importance, it would lead to administration processes being noticeably simplified while transaction costs would be substantially lowered.

Kazakhstan, the southern neighbor of Russia, is similarly interested in the Blockchain as well. The country´s Central Bank has announced that short-term bonds will be sold via Blockchain, starting from the second half of this year. The system is designed to be easily accessible via a mobile app while investing in bonds will carry minimum fees.