Nowadays, decision-makers are driven to come up with solutions to the issue of rising obesity rate. In Slovakia, the obesity rate has doubled in last 35 years.

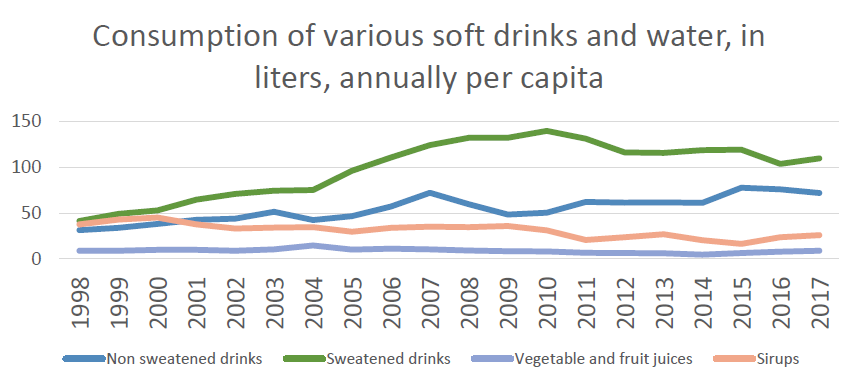

To begin with, the tax discussed does not focus on sugar as such, rather it focuses on sweetened drinks. In their paper, IFP claims that “High sugar consumption mainly reflects the amount of consumed sweetened drinks”. This statement is based on a study from the United States (the relevance for Slovak reality remains unclear) and a chart depicting the dynamics of sweetened drinks consumption in Slovakia.

The statistics show that there was indeed a considerable rise in sweetened drinks consumption per person in the beginning of the millennium. It subsequently culminated and then fell to less than 80% of the peak at the end of the decade.

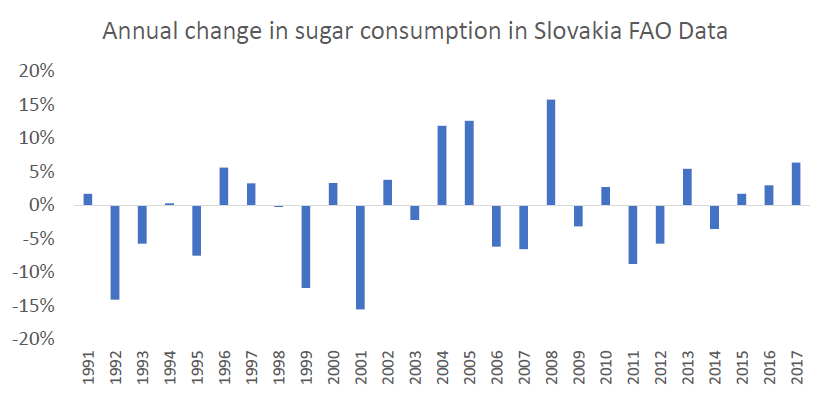

The assessment of the dynamics of “sugar” consumption in Slovakia is not entirely a trivial matter. The main issue is the definition of the term “sugar” (more precisely also the definition and monitoring of the consumption of sweeteners) with which the Statistical Office of the Slovak Republic (ŠÚ) works, as well as terms with which the UN’s Food and Agriculture Organization (FAO) operates.

In the period 2002-2009, statistics of FAO showed a dramatic increase of consumption of sweetened drinks in Slovakia. Suddenly, in the next two years, it fell by more than a third.

These rather wild year-on-year fluctuations in FAO and ŠÚ SR data suggest that the data is not that reliable with respect to final depiction of the consumption of sugar by citizens.

Table sugar consumption fell by 20% since 1990 per person.

Conversely, sugar and calorie consumption increased by up to 31%, with a slightly visible decline since 2010. Consumption of different types of sweetened drinks increased by 64% between 1998 and 2017 but decreased from 2010 onward. The average year-on-year decline in 2010–2017 is -2.8%.

This decline is accompanied with growing consumption of pure water.

Source: Slovak Statistics Office

Source: Slovak Statistics Office

According to our estimations, sweetened drinks played a significant role in sugar consumption, but this trend changed in 2007 and the share of drinks on sugar consumption is in decline.

In 2013, sugar from sweetened drinks represented 4% of average daily caloric intake of a Slovak. The decrease in consumption of sweetened drinks by 1% would imply a decrease of sugar consumption by 0,4 grams a day in Slovak circumstances.

The second part of the publication is dealing with the discussion on whether rise of obesity can be the causal effect of the increase in caloric intake, or whether sugar has a special place with respect to this trend. In this part, we discuss the impact of tax on sugar in other states as well.

For instance, in the U.S., daily calories consumption increased by 474 calories between 1970 and 2010, but scientists attribute more than 90% of this increase to flour, cereal products and added fat.

Empirical evidence on the effects of sugar tax indicates huge variability of potential impact (as well as disputable application of these results to other countries). For example a British study estimated the impact of a 20% tax to cause a reduction in obese adults by 1.3% in Britain, while this effect would be achieved by a 10% tax in Ireland.

Nonetheless, the above-mentioned studies are based on theory – the estimated elasticity of demand (change of demand in response to the price), they attribute decrease of calories to lower consumption and subsequently, they translate it into theoretical decrease of BMI. Nevertheless, this transfer does not occur automatically.

There are numerous real-life examples of such tax introduction. A study of consultancy company Ecorys1 conducted for the European Commission provides a systematic review of the change of price and the change of demand after introduction of different taxes on food in Europe. The results indicate huge variability and often contrary changes in prices.

A necessary part of this discussion is the question of actual costs of the obesity. One might say, not all obesity is equal. The 2011 German study concluded that the health costs of people on the edge of overweight and obesity were 15% higher, it was +64% for people with BMI 40, and up to +160% for people with an extremely high BMI of 50. The study concludes that “the value for money is hidden in targeting the most obese individuals”.

Due to unertain impact of the tax, there is a risk that tax on sugar will become another “item” pulling money out of the pockets of consumers without fulfilling its proclaimed purpose.

Impact of the Tax on Sweetened Drinks on Obesity

Introduction of a tax on an item of groceries ( sugar, fat, salt, alcohol…) will result in a combination of responses on the market, among which there are:

-

an increase of price of a product,

-

a decrease in manufacturer / seller margin,

-

a decrease of demand of consumers

-

an increase in expenditures of consumers,

-

a change of product composition (reduction of content / replacement of taxed component),

-

a substitution of a product by a cheaper one ( a switch to a different brand),

-

a substitution of product by similar products (e.g. juice instead of a taxed sweetened drink).

The major issue of tackling the obesity problem is the fact, that the existence of compulsory health insurance does not permit the transfer of risk behavior to the price of health insurance. This is how a direct externality is created, since morbidly obese citizens ( with over 40 BMI) are almost 100% more expensive than the healthy and these expenses are financed by the rest of the working population.2

Conclusion and Recommendations of INESS

The growing prevalence of obesity is a serious health problem in the world and in Slovakia. However, the rise in obesity is caused by complex social changes that have led to changes in the lifestyle and physical activity of modern man.

Sugar tax is a tool with a low impact on the amount of sugar consumed and a very low impact on BMI change. Change can only be achieved through a comprehensive approach. Looking at the current obesity prevention strategy and funding for this purpose, it is clear that the public administration has not done its job. Sugar tax is a convenient tool, but without meaningful involvement of health insurance companies, schools, employers, municipalities and producers, the tax will be a single shot with minimal impact on the nation’s weight.

For this reason, these ideas should be put in the drawer at least until the government presents a comprehensive package built on demonstrably effective measures to improve health – to reduce the prevalence of obesity.

Thus, INESS recommends not to start the discussion of fighting growing obesity rate by tax on sugar itself, but to start a discussion on obesity as such.

In addition, it is important to evaluate the last decade in terms of action plans against obesity through benchmarks directly connected to obesity until 2020. In case the results are dissatisfactory, it is recommended to introduce a thorough plan of fight against obesity with measurable goals.

Finally, externalities should be internalized by intensifying the involvement of health insurance companies. For example, it should be enabled to insurance companies to financially motivate those policyholders who are actively involved in improving/maintaining their health. However, without more competition allowed in insurance products, their options will be limited.

1 Ecorys – Food taxes and their impact on competitiveness in the agri-food sector: Final report Client: DG Enterprise and Industry Rotterdam, 12 July 2014 Ref. Ares(2014)2365745 – 16/07/2014

2 Impact of morbid obesity on medical expenditures in adults, https://www.ncbi.nlm.nih.gov/pubmed/15685247