The Ministry of Finance proposed to reform customs in Ukraine with the aim of better transparency and predictability. The model of the reform and changes in custom procedures is currently debated between the Ministry of Finance and the representatives of the Parliament and civil society. The reform will hopefully be implemented by the end of 2017.

The survey of exporters and importers conducted by the IER indicates that the custom reform is badly needed as custom regulation hampers trade growth.1 Only 13% of exporters and importers think that work of custom services is efficient, while 43% of companies state that a radical custom services reform is required. Importers demand the reform of custom services more often than exporters. Moreover, the problems with custom procedures seem to be greater for smaller companies.

The survey of exporters and importers conducted by the IER indicates that the custom reform is badly needed as custom regulation hampers trade growth.1 Only 13% of exporters and importers think that work of custom services is efficient, while 43% of companies state that a radical custom services reform is required. Importers demand the reform of custom services more often than exporters. Moreover, the problems with custom procedures seem to be greater for smaller companies.

Overall, imperfect custom legislation was named a problem by 56% of respondents. 30% of companies stated that one of the largest problems is low transparency and openness in the custom services operation. Deliberate overstatement of the customs value was a problem for 28% of companies. Nearly 25% of companies defined as essential also such problems as corruption, frequent changes in structure and governance, and old technical equipment at custom service (e.g. computers and software).

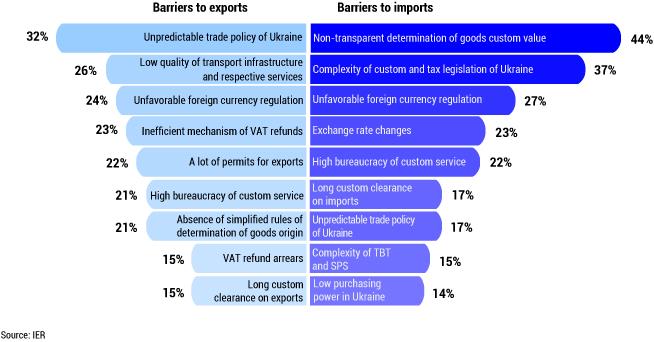

In particular, 27% of exporters and 35% of importers complained about facing barriers to trade. Main barriers to exports include unpredictable trade policy of Ukraine and low quality of transport infrastructure. VAT refund arrears are a bigger problem for smaller companies. The biggest barriers to imports include non-transparent determination of goods’ custom value and complexity of custom and tax legislation in Ukraine. These problems are important for companies of all sizes. Unfavorable foreign currency regulation was a barrier for both exporters and importers. Therefore, recent foreign currency liberalization is likely to facilitate external trade.

The business community also named key steps to reduce trade barriers. These steps include:

- the full automation of custom clearance procedures (68% of respondents);

- introduction of the possibility to amend the custom documentation (67%);

- unification of Ukrainian and international custom documents (66%);

- reduction in number of documents required for custom clearance (61%).

Other essential changes that would facilitate external trade include: increase in transparency of custom clearance procedures and decline in time needed for this. To solve a problem with the determination of custom value, business recommends to define it in accordance with provided supporting documents. Most of the issues important for business are tackled in the custom reform proposed by the Ministry of Finance.

1 Survey was conducted by the IER in the framework of the project: Trade Facilitation Dialogue. The report is available in Ukrainian at: https://goo.gl/XAWStR