Download the full mBank – CASE Seminar Proceedings No. 146/2017 report (in English) here

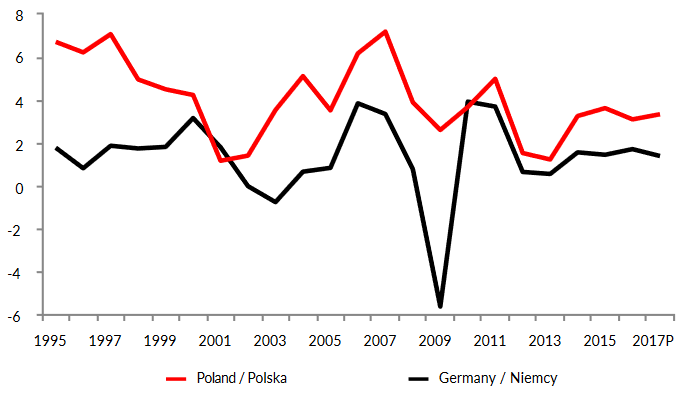

Polish economy is highly dependent on the situation in the global economy, which remains very uncertain. Even a simple comparison of the rate of Polish economic growth with the German rate, i.e. with the growth of our main economic partner, shows how strong the dependency is between our economies (Figure 1). These connections apply not only to simple demand for Polish export goods – they are also related to factors including inflows of foreign investment, on which Poland, as a country with a low savings rate, is particularly dependent.

Figure 1: GDP growth rates in Poland and Germany

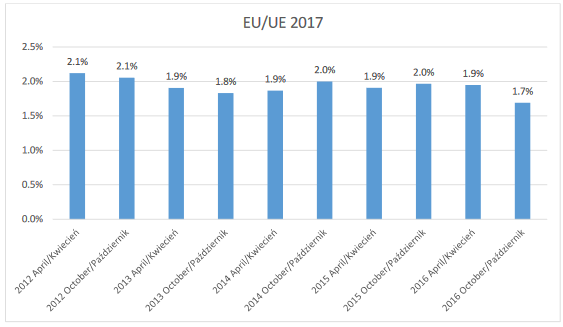

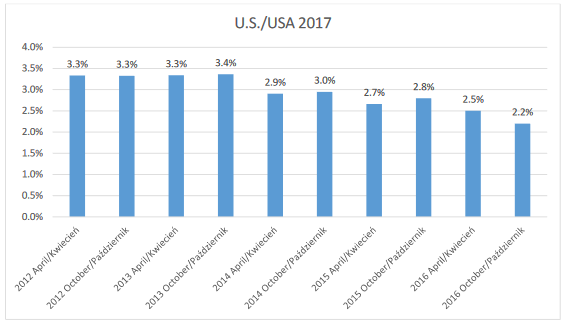

The growth of the world economy in recent years has been disappointing, and remains uncertain. Forecast after forecast for economic growth, both for the U.S. and for the European Union, is being revised downward (Figure 2). At the same time, in its newest round of forecasts from October 2016, IMF points out to significantly more factors that could cause growth to be below expectations than the factors that could contribute to a positive change. A continued source of concern is the risk of a collapse in the Chinese economy, where economic growth is slowing after a gigantic credit boom. Countries that export natural commodities are being forced to adjust to low prices. In the case of Poland’s closest economic partners – the countries of the European Union, and in particular the Eurozone – it is hard to describe the economic situation as stable and certain. Italy, France and to a smaller degree Spain have yet to implement the reforms necessary for EU to be able to look to the future without anxiety (see e.g. Rzońca et al 2016).

Figure 2: Forecasts for 2017 GDP growth in the EU and U.S. forecasts from successive editions of the IMF’s World Economic Outlook

Source: Own work based on IMF World Economic Outlook

Source: Own work based on IMF World Economic Outlook

The economic risks are additionally multiplied by political risks. Disappointing growth after the 2008 financial crisis was one of the factors supporting the rise in popularity of extreme populist groups, whose ascent to power can only deepen the economic problems. This is not a new phenomenon: already in the past, during periods of slowdowns, populists took power more easily. After having analyzied election results from 16 OECD countries over the course of 30 years, Brückner and Grüner (2010) confirmed that a slowdown in economic growth by 1 percentage point leads to 1 percentage point of growth in the extreme right’s popularity.

The most recent visible effects of the growth of populism are, i.a., the UK’s decision to leave the EU and the election of Donald Trump as the president of the U.S. Both Brexit and the policies of the new U.S. president may create barriers to international trade, which will negatively affect growth in the world economy. Another political risks are connected to growing populism in France and Italy, where crucial political reforms were blocked by populist parties and led to the change of governments.

In terms of a high risk of external shocks, Polish economic policy should aim to increase the country’s resilience and strengthen economic foundations. The safety margin, in the form of ensuring the appropriate fiscal space, must be maintained not only because of tensions in the world economy, but also in terms ofpossibly less sharp, cyclical slowdown. Greater resilience to shocks would also be enhanced by structural reforms encouraging growth of employment and investment, and faster productivity growth.

In the presented publication, the author evaluates the government’s current policy through the lens of the challenges that lie ahead of Polish economy, and its resilience to shocks. The first chapter discusses the structural challenges that negatively affect the development prospects of our economy: an aging population, a slowing rate of productivity growth and a low investment rate. Second chapter focuses on the state of public finances and their resilience to a potential economic slowdown. In Chapter 3, the current government’s actions are evaluated through the lens of their direct effect on public finances, as well as their influence on economic growth (and, indirectly, on public finances). The summary analyzes the resistance to shocks of Polish public finances.