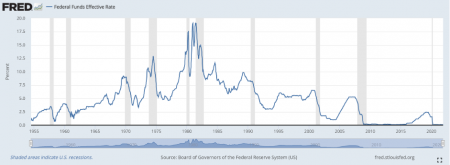

The US Federal Reserve System (Fed) has announced that it will raise interest rates. They have been at zero since the start of the pandemic and since the last recession in 2009, they hit their highest level in 2019. But even in 2019, they were very low, with an effective rate of about 2.5%.

Source: Board of Governors of the Federal Reserve System (US)

Source: Board of Governors of the Federal Reserve System (US)

We don’t yet know how much the Fed will raise interest rates, but we do know that it is doing so in response to inflationary pressures. While inflation has reliably stayed below three percent for the past decade, the Consumer Price Index has risen more than six percent in the past year.

The Fed’s stated policy is to keep the rate of price increases at 2%, so the Fed has no choice but to respond to increased inflation.

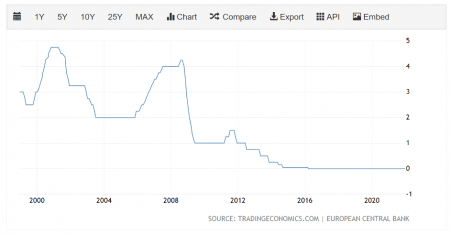

And the primary tool of central banks in today’s world is setting interest rates. Since the European Central Bank (ECB) and the Czech National Bank (CNB) are also facing a similar inflation situation, we can look at a comparison of responses.

Year-on-year inflation in the Czech Republic has also shot above 6%, forcing the CNB to raise its rate to almost 4% and signal that it will probably raise it further. Inflation in the Eurozone is a bit lower (around five per cent) and the ECB is sticking with the “pandemic” zero rates for now.

Central banks have other tools in their toolbox, so it is possible that the ECB will keep the rates but push inflation lower with other means. Or it could be that the ECB believes that the reasons for the current inflation in the Eurozone is not due to its monetary policy and is only short-term, so it is better to do nothing.

But given that inflation is also high in Germany (where the ECB is located) and that the Fed is also raising rates, the pressure on the ECB to do “something” about inflation is likely to grow.

CNB interest rates

Source: Tradingeconomics.com (CNB)

Source: Tradingeconomics.com (CNB)

ECB interest rates

Source: Tradingeconomics.com (ECB)

Source: Tradingeconomics.com (ECB)

Continue exploring:

Pandemic Has Plunged 100 million People into Poverty Globally